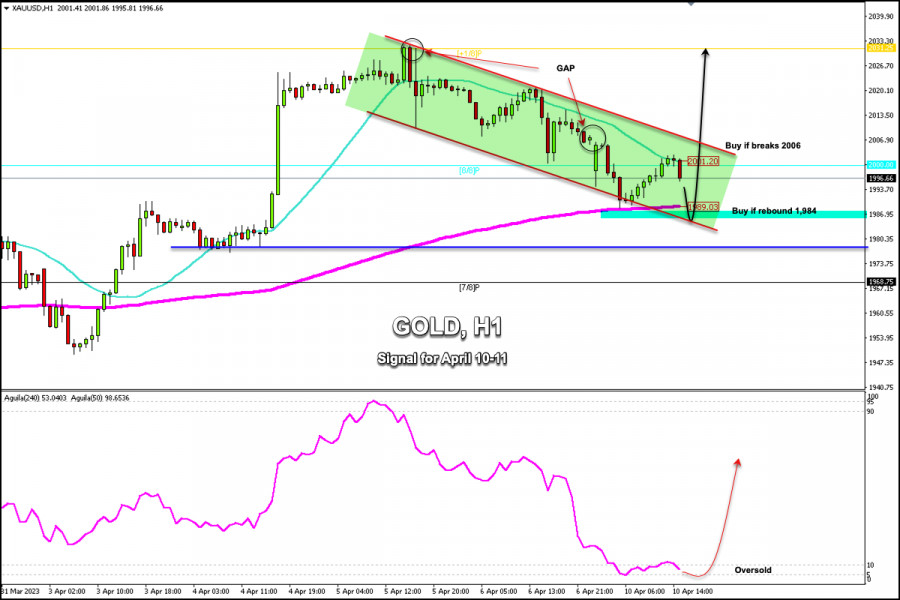

Early in the American session, Gold (XAU/USD) is trading around 1,996.66, retreating after the instrument reached the 21 SMA located at 2,001.20. We can see that the metal is under selling pressure and the instrument could continue its drop in the next few hours.

In the 1-hour chart, we can see that gold is trading within a downtrend channel formed since April 5. Gold is likely to attempt to reach the bottom of this channel around 1,984 in the next few hours. A technical bounce could occur at this level.

XAU/USD could find dynamic support around the 200 EMA located at 1,989. This level coincides with the bottom of the downtrend channel and could offer a technical bounce and reach push the price to the psychological level of $2,000.

In the chart, we can see that gold left a GAP at the opening of this week's negotiations, around 2,007.38. It is probable that in the next few days, gold could rise and cover this gap and finally reach +1/8 Murray around 2,031 where we can also observe a small gap left on April 5.

On the other hand, in case gold trades below 1,988, we could expect a downward acceleration and the price could reach 7/8 of Murray around 1,968.

Conversely, with a daily close and sharp break around the top of the downtrend channel around 2,006, we would expect gold to continue rising and the metal could reach the area between 2,018 and 2,031.

The Eagle indicator is showing oversold signs on the 1-hour chart. Any pullback should be seen as an opportunity to buy.

On Wednesday, the US inflation data will be released. The US CPI is expected to increase by 5.6%. In case this data is lower than expected, the markets could react against the US dollar, which could allow gold to gain strong upward momentum.

Our trading plan for the next few hours is to wait for gold to reach the support zone of 1,984-1,981 to buy with targets at 1,995 and 2,006. The eagle indicator is showing oversold signs which supports our bullish strategy.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.