Pound Sterling Fundamental Forecast: Bearish Northern Ireland Protocol Discussions Move in the Right Direction

Rishi Sunak has been hard at work attempting to come to an agreement over the flow of goods via the Northern Ireland border as the specifics around checks continued to draw division. However, if any deal is to be made it will need to satisfy the Democratic Unionist Party (DUP). Essentially, if there is to be an agreement next week, this ought to be positive for the pound but many headwinds still remain, such as: a pending recession and elevated inflation.

Britain Marks Anniversary of Ukraine Conflict with Import and Export Bans

Britain marked the anniversary of Russia’s invasion of Ukraine with bans on equipment Russia has used to conduct the war. The new wave of bans comes after numerous sanctions, the oil cap and Ukraine Zelensky’s latest meeting with world leaders, rallying for more support to increase the pressure on Russia.

The banned exports were followed by a ban on Russian iron and steel goods. The British government said it will target aircraft parts, radio equipment and electronic components.

A Pick up in Fundamental Data Insufficient in Reviving Sterling

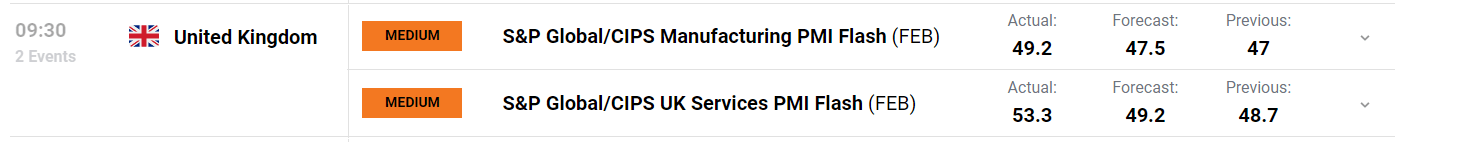

This week PMI data from S&P Global showed a return to expansionary territory for the UK services sector. The print actually printed well above the forecast but ultimately had a limited effect as hotter inflation prints in the US have overshadowed the slightly better UK news.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The manufacturing sector continues to lag but also had a better than forecast print. On Friday, Gfk consumer confidence data revealed that British consumers turned more optimistic about current finances and the outlook for the economy but overall, the mood remains somber.

The data revealed a 7 point improvement in the data, marking the largest improvement in the last 2 years. One worrying fining from the most recent survey suggests that nearly half of the respondents are using savings to help meet the higher cost of essentials and 10% are using their credit cards more frequently.

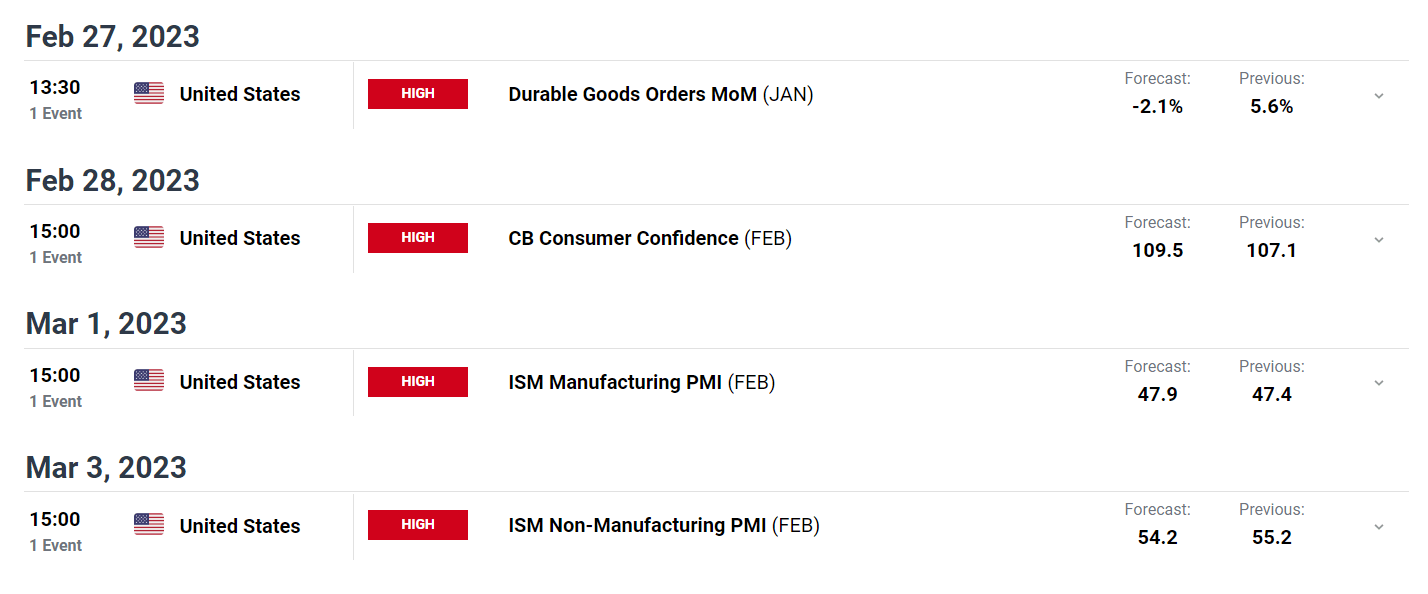

Next week sees a distinct lack of UK stimulus on the economic calendar, which favors a gradual decline in the currency, particularly as the dollar rises on higher interest rate expectations.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.