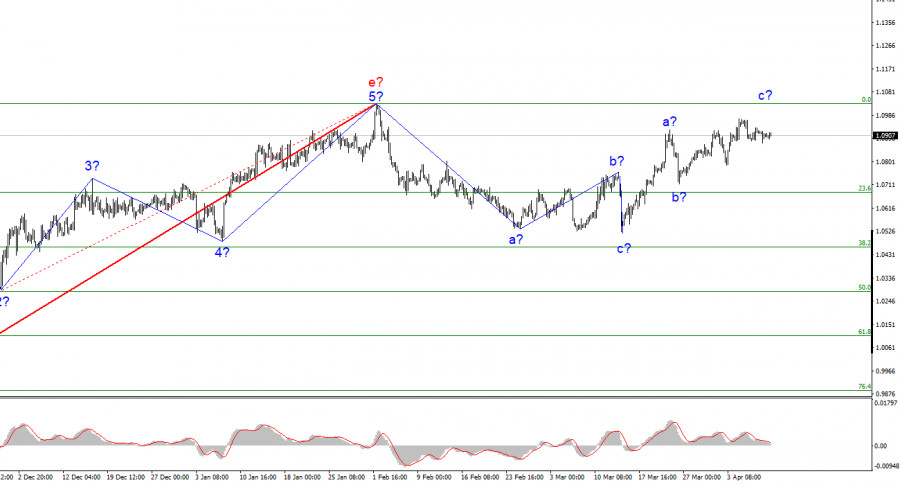

The wave markup of the 4-hour chart for the euro/dollar pair continues to get more confusing due to the recent upward waves. These waves are the beginning of a new upward trend segment (as the last downward one can be considered a three-wave and completed), but at the same time, this trend segment may end soon if it also takes a three-wave form. Thus, the wave pattern for the euro can become very complicated, and working with it is already very difficult. At the current positions, the formation of an upward wave set may end as the peak of the third wave goes beyond the peak of the first. We saw the same thing in the last downward formation. At the same time, there are other options for wave markup. It is appropriate to proceed from the scenario with an increase in the pair because the assumed wave c (of the descending wave set) was very weak. Consequently, buyers are stronger than sellers, and the upward wave c may be extended. The nearest target to consider is the peak of wave e, which corresponds to 1.1033.

Holidays continue

The euro/dollar pair on Monday did not decrease or increase. For the second day in a row, the amplitude of movements is minimal, and the market is simply resting. I want to remind you that Friday was Good Friday, and today is Easter Monday. Based on this, market activity has been reduced to its lowest levels, and improvements in the situation can be expected at the earliest tomorrow. Therefore, my readers can rest today, as no interesting events or movements are expected.

Due to the situation, the US labor market and unemployment reports, which came out on Friday, were very positive. It would certainly play them later if the market took a vacation on Friday and Monday. The wave markup of the pair fully admits the formation of a downward wave or even a set of waves. We have already seen two three-wave patterns, so the third one may start soon.

The market has no special reasons to increase demand for the euro. As before, it is based on the idea that the European regulator will raise the rate more strongly this year than the Fed. However, this understanding does not significantly increase demand for the EU currency. It has grown in recent weeks, but the current trend segment does not look impulsive, meaning it can end anytime. I advocate for the early completion of the increase in quotes (not higher than the 1.1030 mark) and constructing a new downward trend segment, quite possibly a three-wave one again. This week, there will again be a small number of events and reports in the European Union – there is practically nothing to note. Everything will depend on the background news from the US.

General conclusions

Based on the analysis conducted, the downward trend segment was formed. However, the upward trend segment, which can also take only a three-wave form, may also be completed. Therefore, now it is equally possible to advise both sales and purchases. The background information does not answer the question of which direction the pair will move with a higher probability. Wave analysis – also. In the current situation, I would advise cautious purchases with targets around the 1.1030 mark, but sales with a stop loss above 1.1030 can also be considered now.

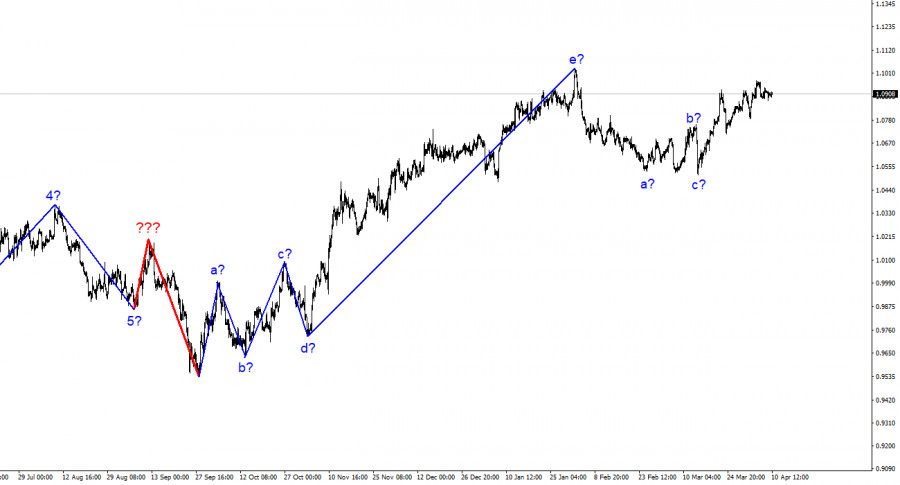

On the older wave scale, the wave markup of the ascending trend segment took an extended form but is likely complete. We saw five waves up, which are most likely the pattern of a-b-c-d-e. The formation of the downward trend segment may still need to be completed, and it can take any form in terms of structure and length.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.