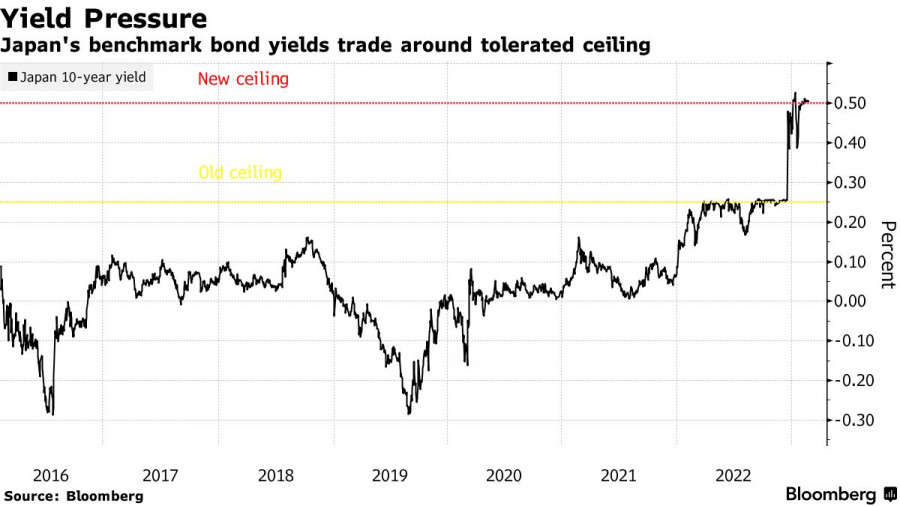

The U.S. dollar continues to rise against the Japanese yen on expectations that the Federal Reserve will continue its aggressive policy. In 2022, the yen rose after the Bank of Japan announced it was raising the yield ceiling to 0.5%, which triggered purchases of the yen against the U.S. dollar, but some of that fall has been recouped over time.

It is difficult for investors to determine what position the new BOJ governor will take and how the country's high inflation will be dealt with going forward.

As I mentioned, benchmark 10-year Japanese Government Bonds (JGB) have surpassed the central bank's ceiling again amid a global bond sell-off after traders focused on a key policy meeting scheduled for next week. The 10-year bond yield rose 0.5 basis points, to 0.505%, before a correction occurred. Even a relatively small amount of selling in a very low liquidity environment triggered yields above 0.5%. BOJ Governor Haruhiko Kuroda will announce his final policy decision on March 10.

Traders continue to bet on further policy adjustments from the BOJ, with many speculating that the bond yield cap will have to be lifted as it looks increasingly unsustainable amid rising inflation at home and abroad. Some economists note the external risk of a surprise move in December, when Kuroda again adjusted policy to smooth the transition for his likely successor, economist Kazuo Ueda.

Recall that late last year, Japan's central bank doubled its policy ceiling to 0.5% in a bid to improve market functioning, but just ended up buying more bonds to protect the ceiling. Clearly, as interest rates rise overseas, this step is clearly not enough to maintain a sustainable policy and attract foreign capital.

Thursday's auction of 10-year JGBs received the largest bids relative to the amount sold since 2005, indicating that investors were trying to buy bonds with yields above 0.5% in order to sell them to the central bank. Signals from the options market also suggest that yen traders are taking the risk of further policy corrections seriously.

The two-day hearing of Ueda ended on Monday. His statements to lawmakers were as expected, and contained nothing to change investors' perceptions of the BOJ's future policy. Some even saw a little bit of a dovish stance.

Data released on Friday showed that Tokyo's inflation decelerated for the first time in more than a year as ramped-up government subsidies masked a strengthening price trend. Whether policymakers will take this into account in determining future monetary policy is a topic for another discussion.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.