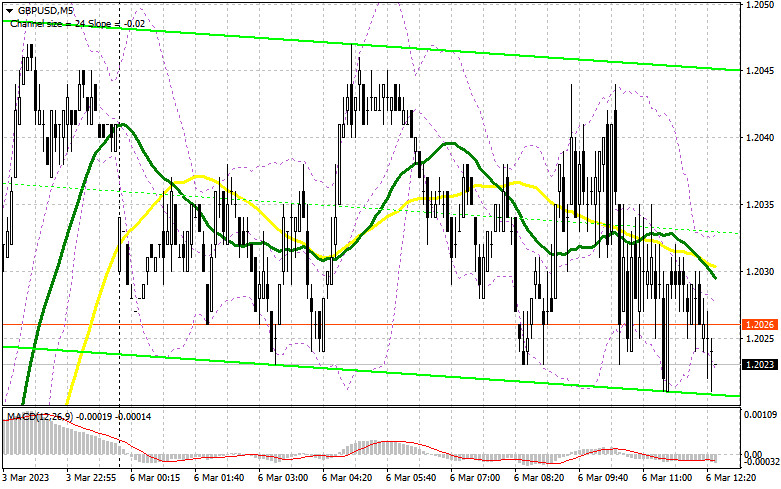

In my morning forecast, I focused on the level of 1.2019 and provided advice based on it for traders who were considering entering the market. Let's take a look at the 5-minute chart and see what happened. No indications were created in the first half of the day due to the extremely low volatility, which was only about 20 points. As a result, the technical picture for the American session was slightly revised.

You require the following to open long positions on the GBP/USD:

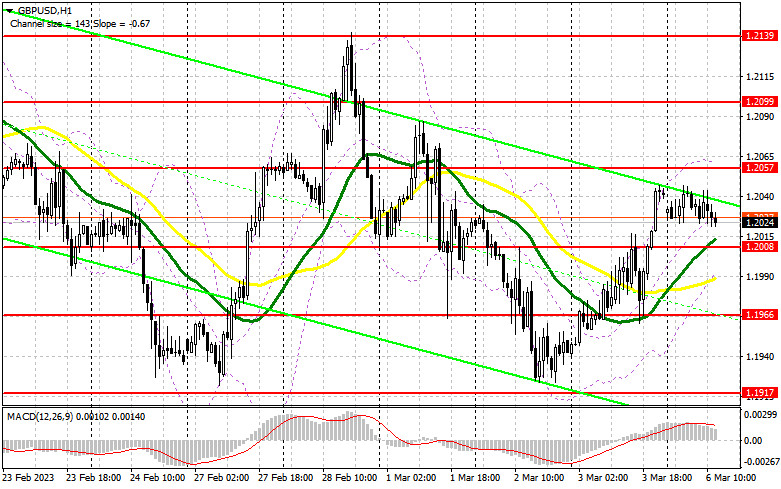

Although the news on the volume of US industrial orders is unlikely to have a significant impact on traders, particularly strong data could put pressure on the pound, which would result in a slight decline in the pair. As a result, I will now limit my purchases to the area around the new support of 1.2008, where the moving averages are on the bulls' side. The development of a false breakout there will provide a decent entry opportunity to purchase with the possibility of a breakthrough to the resistance of 1.2057, which has been updated by the outcomes of the European session. When fixing and testing from 1.2057 to 1.2099 against the backdrop of negative US data, I will bet on GBP/USD moving higher to 1.2099. A retreat above this level will also bring growth opportunities to 1.2139, where I've fixed profits. A test of this area will likewise show that the buyers' market has returned. Things will get worse if the bulls are unable to complete the tasks assigned and miss 1.2008, which is quite possible. In this situation, I suggest against making hasty purchases and only starting long positions around 1.1966 and only in the event of a false drop. To correct 30-35 points within a day, I will buy GBP/USD as soon as it rises from the month's low of 1.1917.

For opening short positions on the GBP/USD, you will need:

Sellers are also not showing up in any form, which is explained by the lack of crucial figures and the market positioning before important speeches by Federal Reserve System representatives, particularly Chairman Jerome Powell. Everything will begin tomorrow, so don't be surprised if the low volatility continues throughout the afternoon. Only the creation of a false breakout at the level of 1.2057 will provide a signal to enter the market with the expectation of a decrease in the area of new support on 1.2008 in the case of a sharp increase in the value of the pound. Buyers' expectations of a correction will be dashed by a sell signal and a decline to 1.1966 if the market exits at 1.2008 with a breakout and bottom-up test. The area around 1.1917 will be my farthest target, and that's where I'll set the profit. The situation will stabilize with the possibility of GBP/USD growth and the unlikely absence of bears at 1.2057, and the bulls will attempt to enter the market before Powell's speech tomorrow. In this scenario, the bears will retreat, and an entry point for short positions will only be formed by a false breakout at the next resistance level of 1.2099. In the absence of activity, I will sell GBP/USD immediately from the high of 1.2139, but only if the pair falls by 30-35 points within the day.

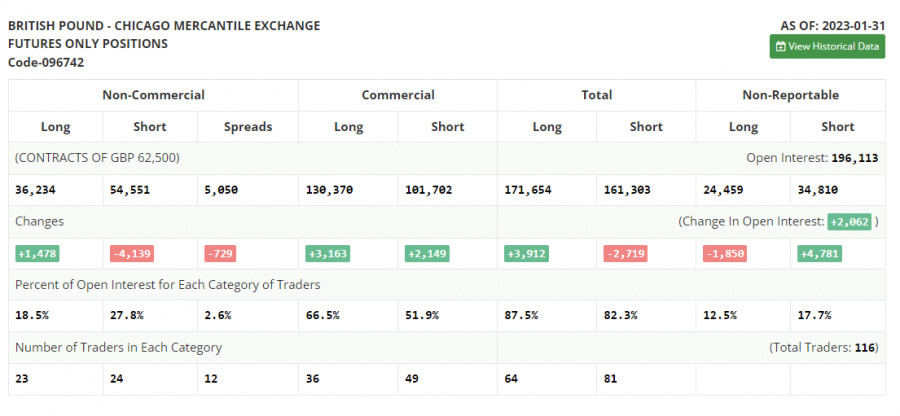

There were more long positions and fewer short ones in the COT report (Commitment of Traders) for January 31. Traders chose to leave the market before the meeting because they were betting on a future hike in interest rates from the Bank of England. However, it should be noted that these data are of no importance right now because statistics are only just starting to catch up following the cyberattack on the CFTC and the information from a month ago is not very pertinent right now. They'll hold off until new reports are out before turning to more recent data. Except for a few reports, there are no significant fundamental indicators on the US economy this week, so the pressure on risky assets may lessen slightly. In principle, this may increase the pound's value relative to the US dollar. According to the most recent COT data, short non-commercial positions fell by 4,139 to 54,551, while long non-commercial positions rose by 1,478 to 36,234. As a result, the non-commercial net position's negative value declined to -18,317 from -23,934 a week earlier. In comparison to 1.2350, the weekly ending price dropped to 1.2333.

Signals from indicators

Moving Averages

Trade is taking place between the 30 and 50-day moving averages, which may very likely result in the continuation of the pound's upward correction.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located at 1.1985, will serve as support in the event of a decline.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.