GBP Fundamental Forecast: Bearish Fundamental Catalyst Remains Elusive for the Pound

Pound sterling has struggled against the euro and Swiss franc but made ground against the US dollar, Canadian dollar and Aussie dollar – a scenario all too similar. While the fundamental picture in Great Britain has improved lately, it appears to have improved the outlook from terrible to simply very bad.

Recent improvements include, a shallower recession than initially anticipated, a likely deal with the EU regarding the NI protocol, positive services PMI data, the early signs of disinflation and £30 billion available for treasury ahead of the Spring Statement.

However, none of these have been able to achieve any kind of sustained GBP rally. Inflation remains too high and the Bank of England continues to hike reluctantly.

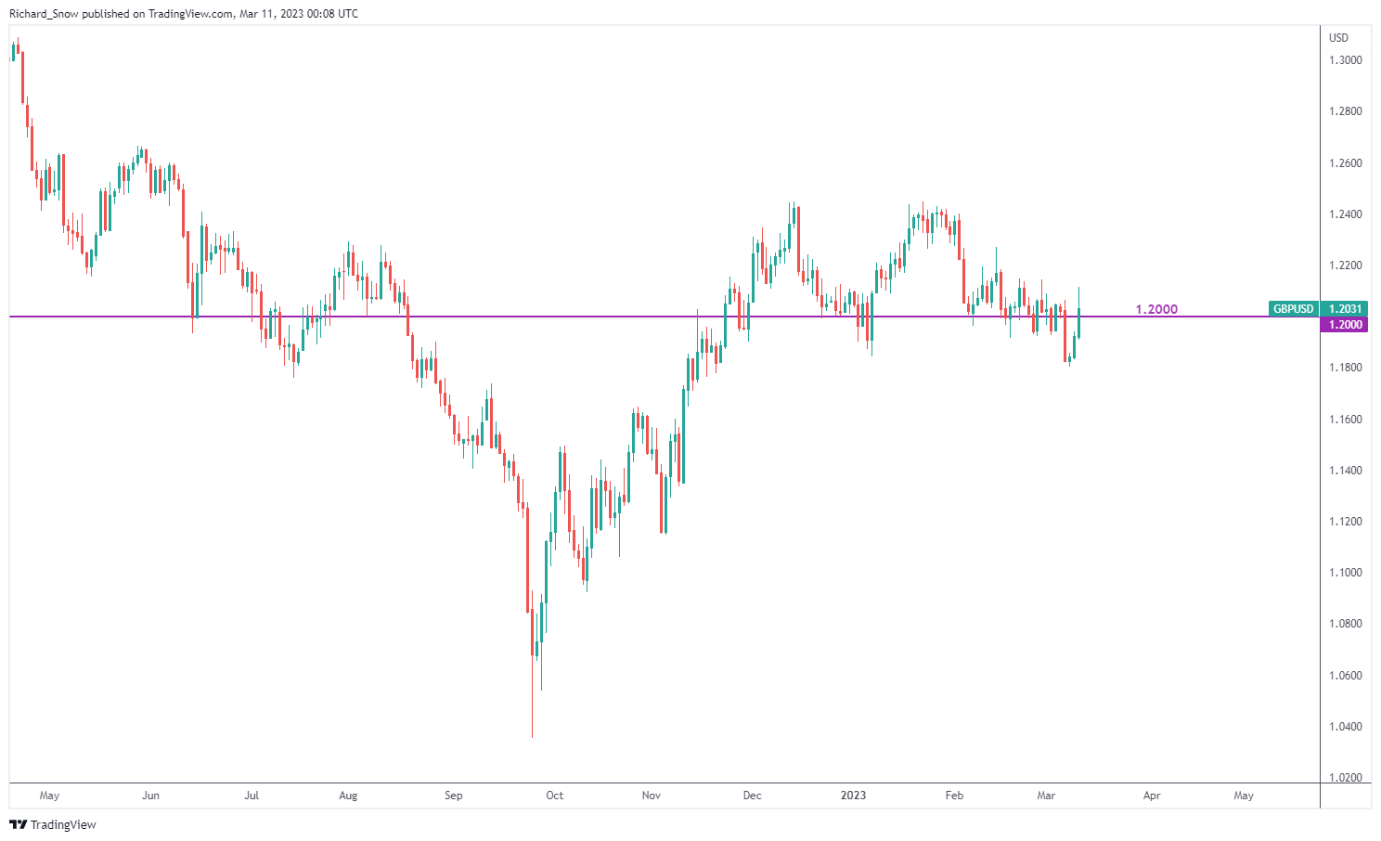

GBP/USD Daily Chart

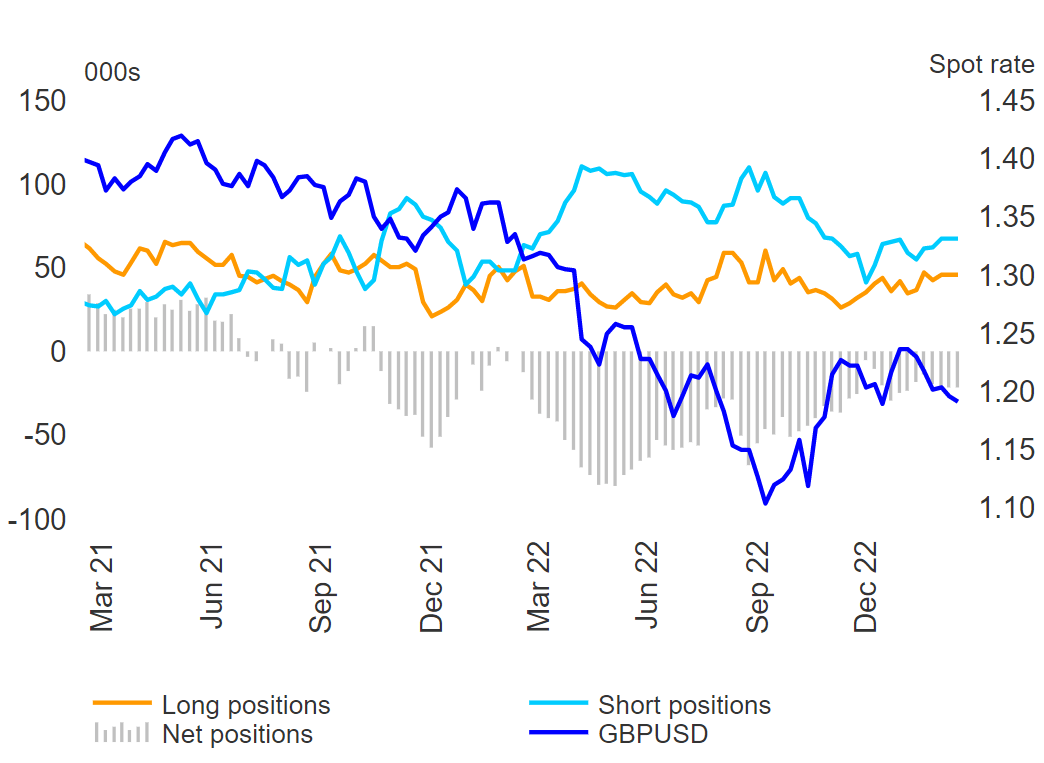

Large Speculators Anticipate Continued Sterling Weakness

The Commitment of Traders (CoT) report shows large hedge funds and money managers maintain net-short positioning on the whole when it comes to the pound. However, it is noteworthy that speculators have not increased their aggregate short bias – suggesting that sterling’s woes may be nearing its peak. For now though, it appears that the direction of travel for the pound favors the downside.

CoT Report: Shorts (light blue) vs Longs (orange) with GBP/USD Price Overlay

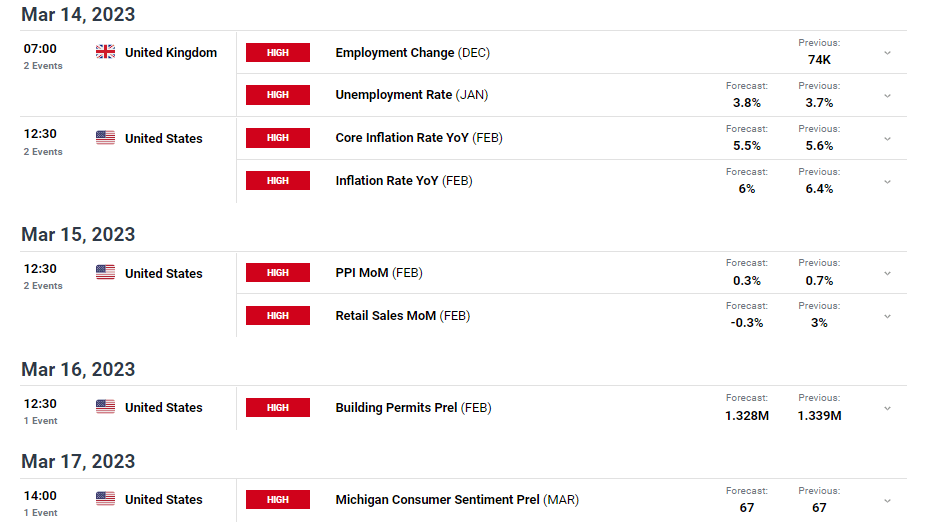

Considerable Uptick in High Importance Data Next Week

Tier 1 economic data returns for both the dollar and sterling next week. The headline obviously goes to US CPI given the recent stickiness of numerous inflation prints, but the chances of a hotter print elevating the dollar and interest rate expectations appear much lower given the possible systemic risk within the US banking sector; as Silicon Valley Bank fails to convince investors that all is well with the tech lender. As a result, we may see a flight to safety next week which typically does not bode well for high beta currencies like the pound and Aussie dollar for example.

UK employment data for December and January accompany the UK’s Chancellor of the Exchequer, Jeremy Hunt’s budget statement where he is expected to remove the tax incentive for business investment alongside an increase in the corporate tax rate – both measures that reduce the UK’s attractiveness to do business. This, along with the windfall tax on energy companies may force index heavyweights like BP and Shell to reconsider being domiciled on the UK.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.