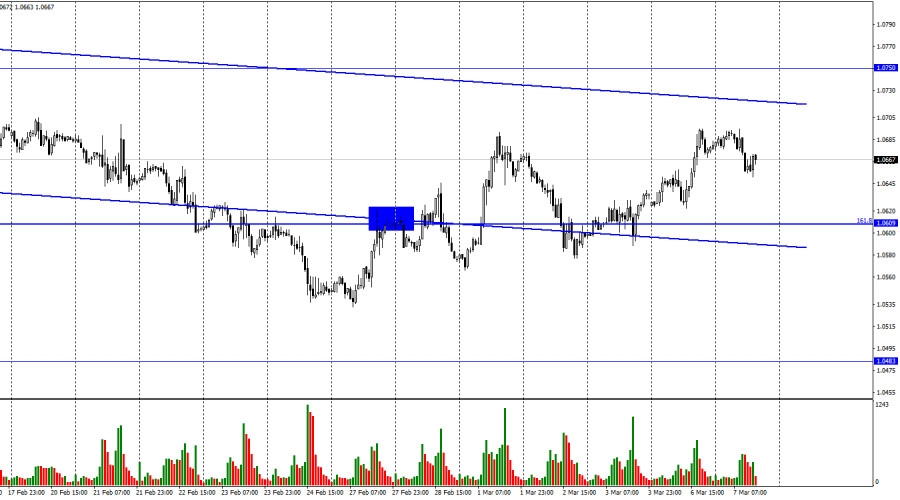

On Monday, the EUR/USD pair kept growing in the direction of the upward trend corridor's upper line. This corridor continues to describe the traders' attitude as "bearish." Although I don't anticipate a significant strengthening of the euro, traders will be able to anticipate a stronger rise in the pair's rate if it stays above the corridor.

The background information was essentially nonexistent on Monday. In Germany and the European Union, there were several unimportant reports that traders didn't even pay attention to. The ECB and Fed meetings, which will take place in the middle of this month, are gradually coming to the fore. Traders are regaining interest in FOMC and ECB member statements, and there have been a significant number of them recently. I'd like to highlight some of the most high-profile statements that can have a significant impact on traders' moods. The rate will keep rising after the March meeting, according to almost all ECB representatives who spoke. The rate at which it will continue to rise is unknown, but the euro can already benefit from the indication that the hawkish stance will be maintained.

If the FOMC members hadn't lately indicated that they would keep a "hawkish" stance, I might have been able to. In addition, given the recent inflation report's disappointment and the recent payroll and unemployment reports' satisfaction, several economists concede that the Fed's interest rate may increase by 0.50% again in March. Yet, it should be realized that the rate in America may rise today more strongly and for a longer period than anticipated a month ago. I believe the Fed is not implementing this scenario. The Fed has all the necessary powers and capabilities to raise inflation as much as is required if it drops extremely slowly in the US (as was the case in the previous report). And there are extremely particular limitations set by the European Central Bank. There have been no indications that the government is prepared to tighten monetary policy at all, and such signals are unlikely to be heeded.

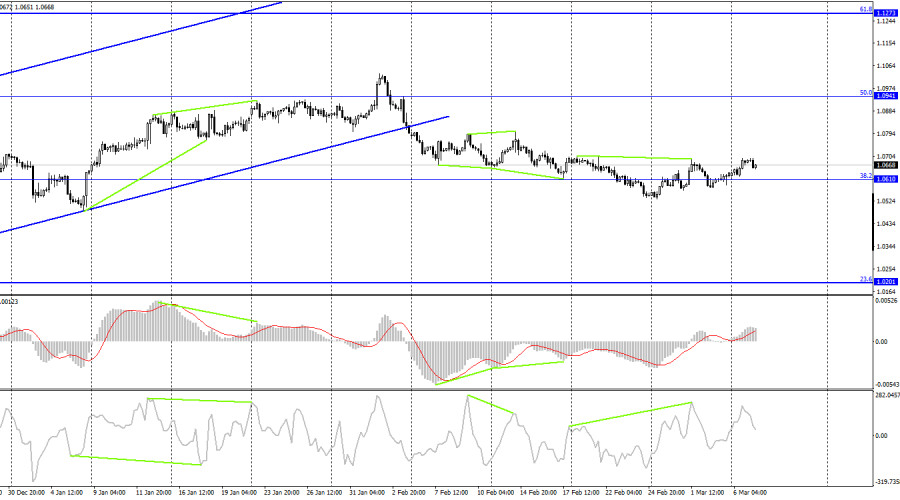

The pair has stabilized under the upward trend corridor on the 4-hour chart, allowing us to still anticipate a further decline even if the pair has left the corridor it has been in since October. Trader sentiment is described as "bearish," which creates strong growth opportunities for the US dollar with a target of 1.0201. There hasn't been any indication of any new emerging divergence yet.

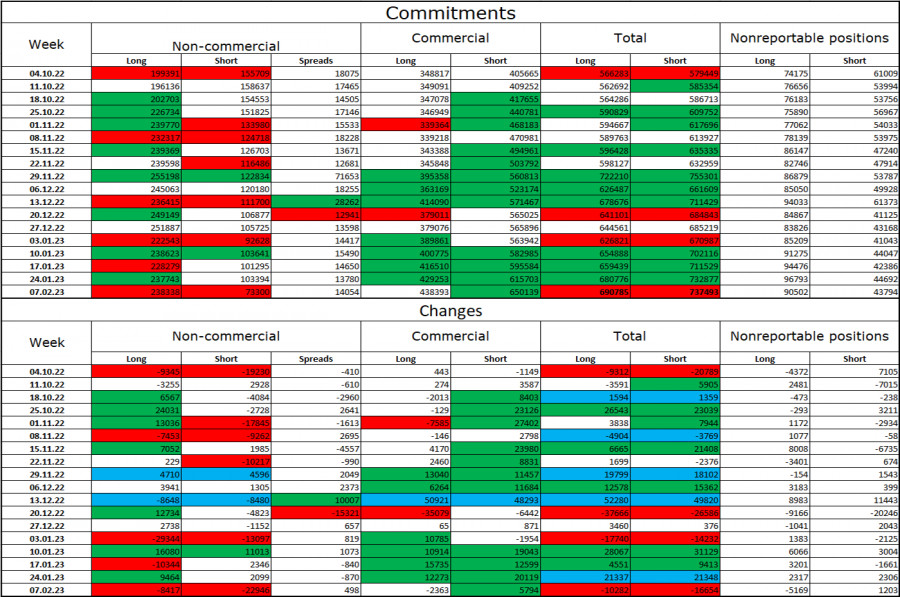

Report on Commitments of Traders (COT):

Speculators closed 8,417 long contracts and 22,946 short contracts during the most recent reporting week. The positive sentiment among large traders is still present and getting stronger. The most recent report, though, is dated February 7, so please be aware of that. The "bullish" attitude may have grown stronger at the start of February, but how are things now? Speculators now have 238 thousand long contracts, while just 73 thousand short contracts are concentrated in their hands. While the value of the euro has been declining for some weeks, we are currently without new COT data. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still in the euro's favor, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

News calendar for the USA and the European Union:

US – Speech by the head of the Fed, Mr. Powell (15: 00 UTC).

On March 7, the European Union and the United States' economic calendars include one entry for two, but what? The information backdrop might have a significant impact on how traders feel today.

Forecast for EUR/USD and trading advice:

On the hourly chart, new sales of the pair with a target of 1.0483 can be initiated when the price closes below the level of 1.0609. Alternatively, while reversing from the ascending corridor's upper line with a target of 1.0609. On the hourly chart, purchases of the euro were possible when it closed above the level of 1.0614 with a target of 1.0710. These can now be stored.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.