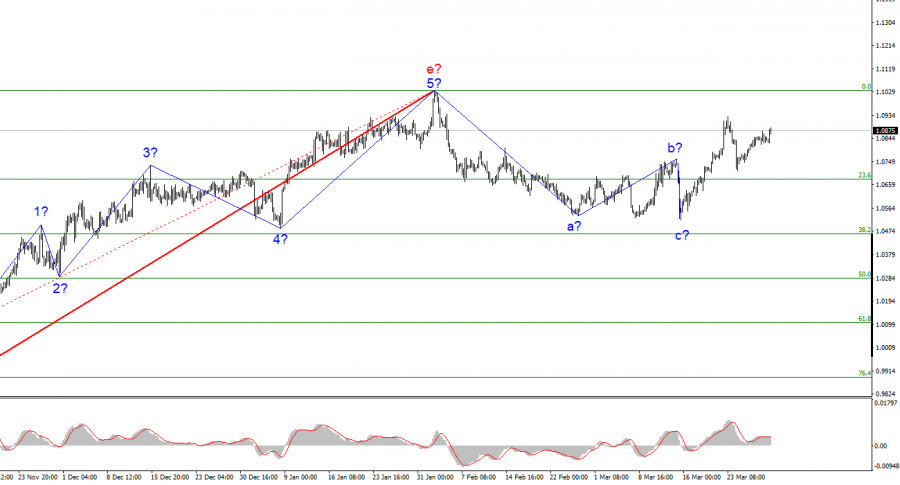

The last upward wave has caused more confusion with the wave analysis on the 4-hour chart for the euro/dollar pair. Given that the previous descending segment can be viewed as having completed three waves, this wave may well represent the initial wave of a new upward trend segment, or it may simply be an internal wave of a more complicated sequence of falling waves. Everything appears to be creating a new upward trend segment so far, but the GBP/USD pair is also developing a simpler structure that anticipates another falling wave. It will therefore be very challenging to work on the wave pattern for the euro currency, which has the potential to become very complicated. The development of the third ascending wave, with targets at least near the 10th figure, can start from the current positions if the development of an upward set of waves has already started. It is now completely confusing, although there are still choices for wave analysis. Because the anticipated wave c turned out to be incredibly weak, I think it is now best to proceed with the scenario with an increase in the pair. As a result, buyers are now stronger than sellers.

The ECB keeps indicating that inflation is higher.

On Wednesday, the euro/dollar pair increased by 30 basis points. The economic plan's news context is still lacking, and today marks the fourth straight day with weak movement amplitude. However, these two statements merely support one another. The market chooses to wait for new developments rather than engage in active trading when the calendar is empty. Germany is releasing its March inflation report right now, but I can almost instantly predict that it won't have a significant impact on the market's mood. Regardless of how much it decreased by the end of March, it is still only German inflation and not European. The market and the euro currency will be much more affected by tomorrow's news. A little later, a report on the American GDP for the fourth quarter will be published. Although both of these reports can be regarded as significant, the market's performance this week has been so impressive that I seriously doubt it wants to gain back this data.

The demand for the euro is gradually increasing, and the three rising waves may be about to come to an end. I have outlined the target for this pattern in the form of the 10th figure, and some 100–130 base points remain before it. The ECB keeps stating that tightening monetary policy is necessary, but a significant number of its statements do not imply that the market will always demand more of the EU currency. We have had sufficient time and opportunities to comprehend that the ECB is still tightening monetary policy, so each new statement of this type does not ensure a new rise in demand for the euro. Even if an ascending series of waves is being developed right now, it might also be almost finished.

Conclusions in general.

I draw the conclusion that the downward trend section's development is finished based on the analysis. However, the wave analysis for the euro is confusing right now, making it challenging to determine where the pair is in the trend. Even after one wave up, which may be a complicated wave b, a new three-wave pattern of waves down can start to form. Therefore, based on the MACD reversals "up," I suggest cautious purchases with targets close to the 10th figure for the time being. It is impossible to fully rule out the possibility of continuing to build a downward trend section.

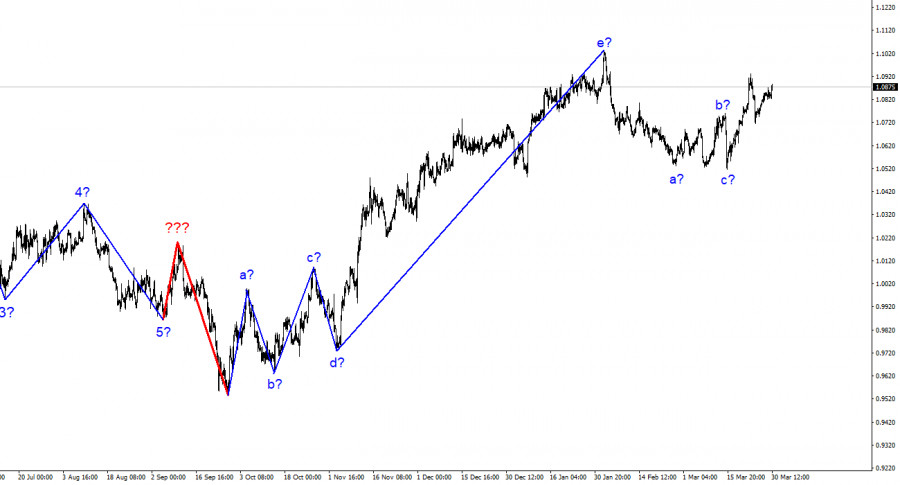

On the older wave scale, the upward trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. It's possible that the downward trend developing isn't finished yet, and it could have any shape or size.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.