In the meantime, it is still to be hoped that trading will continue within the side channel and the downward correction won't be as severe as many fear. Ether was unable to reach its maximum price of $1,700. Additionally, the UK continues to control the bitcoin industry there, even though traders are keenly watching the direction of the market.

The UK is likely to soon impose a limit of 10,000 to 20,000 pounds for the storage of a new digital currency, according to the Bank of England spokesperson. The Central Bank and the Treasury are currently working harder to release a digital version of the British pound. However, the government aims to establish limits on the amount of money people can store after the new digital coin goes live to stop the outflow of funds from traditional bank accounts.

Before the end of June this year, it is anticipated that these and comparable measures will be debated. Rumor has it that the UK may launch its own CBDC, or central bank digital currency, to be known as "Britcoin." To facilitate transactions using online and mobile platforms, the deputy governor of the Bank of England, John Cunliffe, has remarked that a digital version of the pound is likely to be required in the coming years.

"The £10,000 limit will mean that 75 percent of individuals will be able to get their salaries in digital pounds, and the £20,000 maximum would allow practically everyone to receive their incomes digitally," Cunliffe said in a speech on Tuesday in London.

Although the concept is based on cryptocurrencies like bitcoin, CBDC will receive the same support from the government as fiat currency. The Bank of England intends to develop a financial product that functions similarly to cash and maintains its value while not charging interest to prevent speculators from using it as a tool.

"As traditional banknotes and coins become less common, the central bank intends to provide a cash-like tool that will operate more smoothly in online transactions. Cash is now used in barely 15% of everyday transactions, down from 60% just 15 years ago," according to Cunliffe.

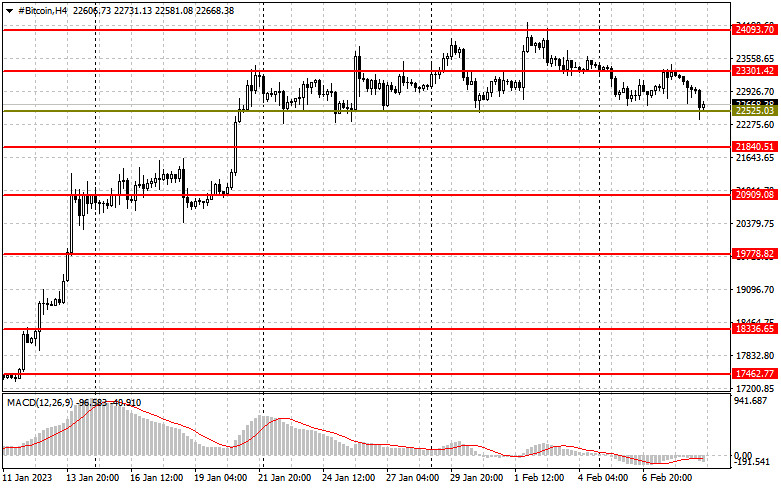

Regarding the technological state of bitcoin right now, pressure is progressively building. The level of $23,255, which was missed yesterday, is the bulls' closest target. If you fixate on it, the bullish trend will return, and you'll have the chance to update $23,950 and $24,400. The $25,034 area will be the farthest target, where significant profit-taking and a rollback of bitcoin may take place. In the case of renewed pressure on the trading instrument, protecting the $22,500 level will take priority because a breach by sellers would be detrimental to the asset. This will put pressure back on bitcoin and create a direct path to $21,840. The first cryptocurrency in the world will "drop" about $20,900 if this threshold is broken.

The collapse of the nearest resistance level of $1,670 is what ether buyers are concentrating on. This is going to be sufficient to establish a foothold at the current highs and keep the bullish trend going. The market will undergo considerable adjustments as a result of this. The balance will be returned to the ether upon consolidation above $1,670, with the possibility of an increase up to a maximum of $1,758. Longer-term targets will be at the $1,819 level. The $1,594 mark, which is just below where $1,504 is shown, will come into play when the pressure on the trading instrument resumes. If it succeeds, the trading instrument will rise to a minimum of $1,410. It will be quite difficult for bitcoin owners below - merely $1,320.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.