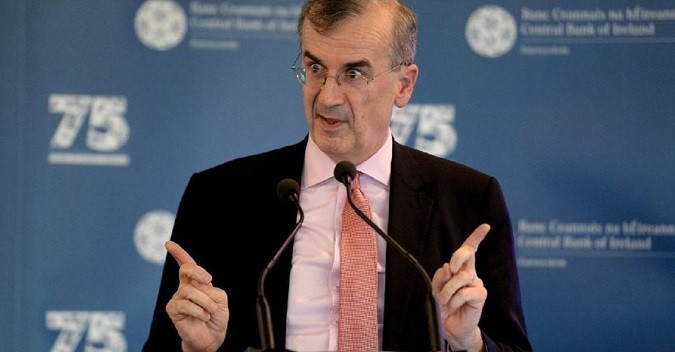

According to Francois Villeroy de Galhau, a member of the Governing Council, the European Central Bank should finish raising interest rates "by the summer" and then be prepared to maintain them for an extended length of time to control the inflation rate, which is still too high.

The head of the Bank of France claims that it is too early to forecast rates' peaks because the arrival of new data will determine how much they rise in the coming months.

He stated that the ECB should conduct the second phase of tightening in the direction of "monetary stabilization" after having just lowered the deposit rate to 2%, a level that is seen to be close to the so-called neutral level, which does not stimulate or restrain the economy.

When addressing representatives of the financial industry in Paris on Thursday, Villeroy declared, "Then we will be willing to continue at this marginal rate for as long as it takes. In 2022, a sprint with increased speed will resemble a long-distance race and the length will at least be slightly taken into account."

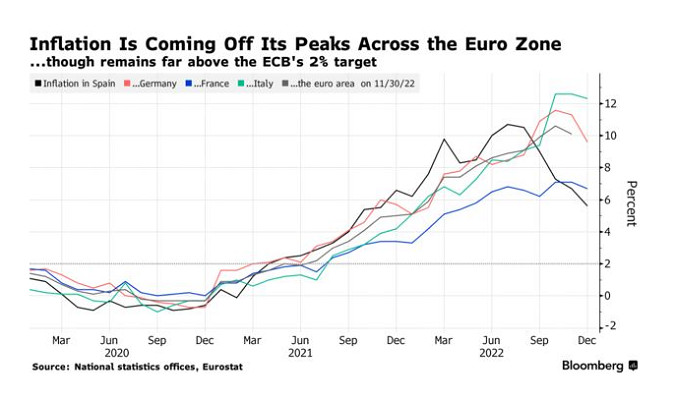

The French official's remarks provide the first hint of how long the ECB's rate-hike cycle may last and come amid indications that the most challenging part of the eurozone's inflation high may be over.

His colleagues' thus far cautious response to recent consumer pricing data demonstrates their dedication to further lowering borrowing costs.

In reliance on a 250 basis point hike from July, President Christine Lagarde has already committed to another half-point increase at the upcoming meeting in February, "and possibly the next." Rates are currently expected to reach just below 3.5% by September, according to money market dealers.

The surprise drop in France's inflation rate in December, according to Villeroy, was "encouraging," but it was "not enough." He added that the ECB should be realistic and not become fixated on rising rates since it is "very mechanical."

Inflation is expected to reach 2% between the end of 2024 and the end of 2025, according to Villeroy's prediction and pledge.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.