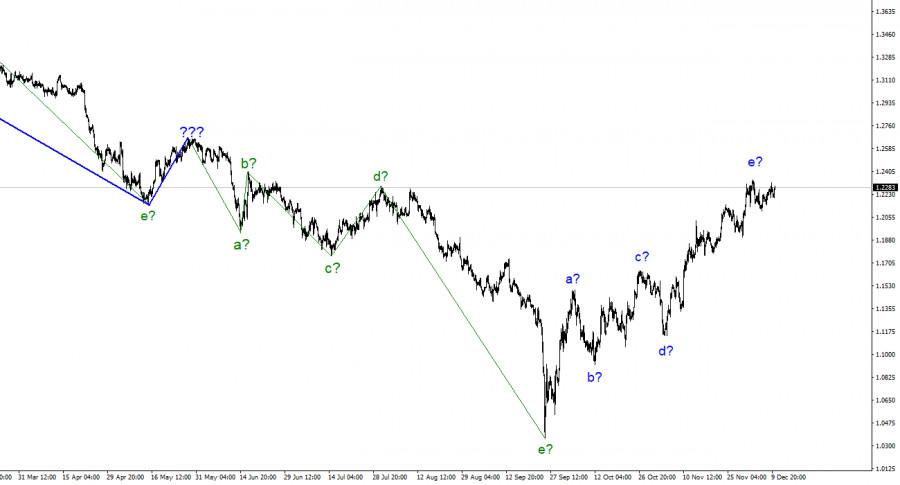

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still needs to be clarified. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. As a result, the instrument's price increase may last for a while. Both instruments are still forming an upward trend segment that will eventually lead to a mutual decline. Recently, the British pound's news background has been so varied that it is challenging to sum it up in one word. The British pound had more than enough reasons to rise and fall. As you can see, it primarily chose the first option and still does so today. The proposed wave e has become more complicated due to the recent rise in quotes. It's already evolved into a fairly extended form at this point. I am currently waiting for the decline of both instruments. Still, these trend sections may take an even longer form because the wave marking on both instruments allows the ascending section to be built up to completion at any time.

The Bank of England is considering a 50 or 75-point increase.

The pound/dollar exchange rate on Friday increased by 40 basis points. The British pound had another successful start to the week, and it is still close to its peak. This morning, several significant reports were released in the UK, making the British pound optimistic today. As I mentioned above, the recent news background needs to be read categorically in the British pound's favor. Numerous reports and occasions occurred, some of which favored the dollar over the pound. The same is true of early publications.

At the end of October, monthly industrial production increased by 0%. Market participants anticipated a 0% increase. And what does this report mean? GDP. It expanded by 0.5% monthly in October, exceeding market expectations of +0.4%. In other words, the real value exceeded expectations, but only by 0.1%. As a result, the demand for the British pound can be seen as logical, though the reports needed to be more convincing so that the subsequent rise in the instrument would not confuse. The pound's potential should have been reached long ago, and even positive UK data should no longer increase demand.

This week, the Bank of England will increase the interest rate. The only unknown is the size of the increase. Let me remind you that the market forecast for the rate has changed recently. Initially, a rise of 75 basis points was anticipated; today, a rise of 50 basis points. Now, the likelihood of the first scenario is 78%, while the second is 22%. Since UK inflation is still rising, a 75-point increase would be more appropriate. However, the Bank of England might reject this risk given the likelihood that it will put significant pressure on the economy.

Conclusions in general

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. Since the wave marking permits the construction of a downward trend section, I cannot advise purchasing the instrument. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer form.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.