Long-term perspective.

The EUR/USD currency pair has not gained or lost a single point during the current week. Although the euro did nothing but fall during the first four days, it managed to recover all the losses on Friday. We think the pair's movement this week has been strange, and here's why.

The Fed meeting was scheduled for Wednesday evening as the most significant event of the week. Why was the dollar strengthening up until this time? It is because the Fed rate was supposed to rise for the fourth time in a row by 0.75%, so the market worked out the tightening in advance. However, after the Fed raised the rate, the market continued to buy dollars, although we expected a backlash, as it had a week earlier with the ECB meeting. However, Jerome Powell's rhetoric turned out to be a little more "hawkish" than expected, so the market continued to sell the pair on Thursday. But on Friday, the US currency collapsed when the most important statistics on the labor market and unemployment were published in the States. And this is even stranger than its growth on Thursday.

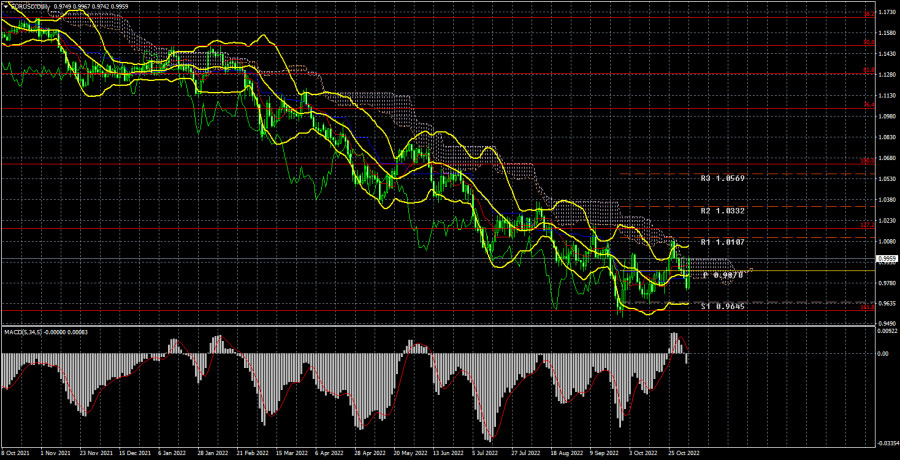

The Nonfarm report turned out to be quite strong. In October, 261 thousand of new jobs were created outside the agricultural sector, which is at least 20 thousand more than predicted. Once again, the US labor market showed its excellent condition, and the dollar had to continue to grow. In addition, the September report's value was revised upward to 315 thousand. The only negative moment was the unemployment rate, which rose to 3.7%. However, the unemployment rate had already increased to this level a couple of months ago and then returned to 3.5%. And in any case, unemployment in the United States remains at the lowest level in half a century, so if this report provoked a fall in the dollar with an excellent value of Nonfarm, then this is a very strange reaction of the market. The pair on the 24-hour TF has grown back to the Senkou Span B line and will try to overcome it again next week. There are certain chances of an upward trend, but they are still small. On Monday and Tuesday, the market may realize the illogical reaction on Friday and start selling the pair again.

COT analysis.

COT reports on the euro currency in 2022 are becoming more and more interesting. Half of the year, they showed a frank "bullish" mood among professional players, but at the same time, the European currency was steadily falling. Then they showed a "bearish" mood for several months, and the euro also steadily fell. The net position of non-profit traders is bullish again and is strengthening, and the euro has barely moved away from its 20-year lows by 500 points. This is happening because the demand for the US dollar remains very high against the backdrop of a difficult geopolitical situation. Therefore, even if the demand for the euro currency grows, the high demand for the dollar does not allow it to grow. During the reporting week, the number of buy-contracts from the non-commercial group increased by 13 thousand, and the number of shorts decreased by 17 thousand. Accordingly, the net position increased by about 30 thousand contracts. However, this fact does not matter much since the euro remains "at the bottom" anyway. The second indicator in the illustration above shows that the net position is now quite high. Still, a little higher, there is a chart of the pair's movement, and we can see that the euro cannot benefit from this seemingly bullish factor. The number of buy contracts is higher than that of sell contracts for non-commercial traders by 106 thousand, but the euro is still trading very low. Thus, the net position of the "non-commercial" group can continue to grow, and it does not change anything. If you look at the general indicators of open longs and shorts for all categories of traders, then sales are 23 thousand more (617k vs. 594k).

Analysis of fundamental events.

This week, all the main data came from overseas, but there was also something to pay attention to in the European Union. On Monday, it became known that the GDP grew by 0.2% in the third quarter, which was generally in line with forecasts, and that inflation rose to 10.7%, forcing the ECB to continue to adhere to the plan to tighten monetary policy. However, this did not save the euro currency from a new fall. Only a strange movement on Friday allowed it not to finish another week in the red. Also, in the European Union, business activity indices were published this week, which are forecast to remain below 50.0.

Trading plan for the week of November 7–11:

1) On the 24-hour timeframe, the pair rose again to the Senkou Span B line, but now, to continue growing, this line needs to be overcome. In this case, we will seriously consider forming a new uptrend and recommend small purchases of the pair with a target of 1.0177. However, it should be remembered that the fundamental and geopolitical backgrounds do not favor the euro currency.

2) As for the sales of the euro/dollar pair, they have now become temporarily irrelevant since the price has overcome the critical line and increased to Senkou Span B. Thus, a rebound from Senkou Span B will mean a possible resumption of the downward trend. Fixing below the critical line will mean the resumption of the downtrend. We believe it is still too early to speak confidently about the end of the downward trend that has been forming for two years.

Explanations of the illustrations:

Price levels of support and resistance (resistance and support), Fibonacci levels – targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "non-commercial" group.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.