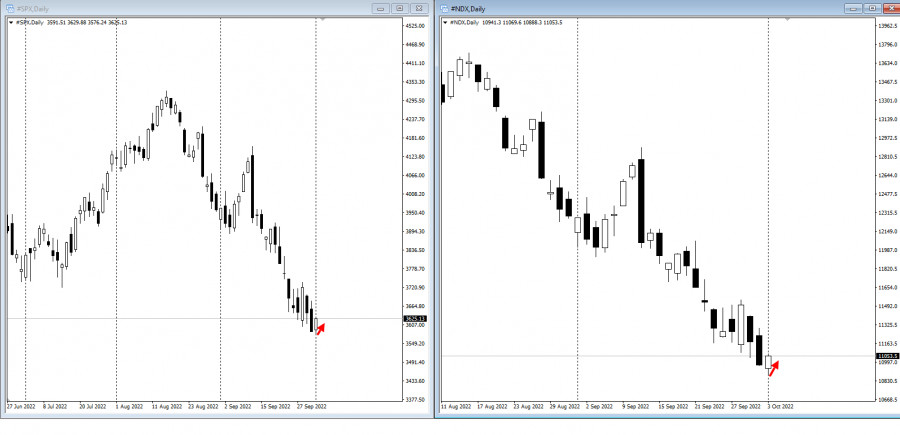

US index futures advanced as investors weighed the possibility of a peak Treasury yields amid fears that hawkish policies by global central banks would trigger a recession.

December contracts on the S&P 500 index rose by 0.6%, while similar futures on the Nasdaq 100 added 0.3%. Treasuries rallied with two-year and 10-year notes down at least 12 basis points each.

Global markets remain concerned about the potential impact of monetary policy tightening after central banks, including the Federal Reserve, reiterated their determination to curb soaring inflation. Traders cut back on their bets for Fed rate hikes, pricing in a peak in the Fed Funds Rate by March. They now await US jobs data later this week for further clues on the path of the economy and Fed policy.

Inflation worries were further fueled by a renewed rise in oil prices as West Texas Intermediate crude traded around $83 a barrel amid signs that the OPEC+ alliance is considering cutting production by more than 1 million barrels a day at its meeting this week.

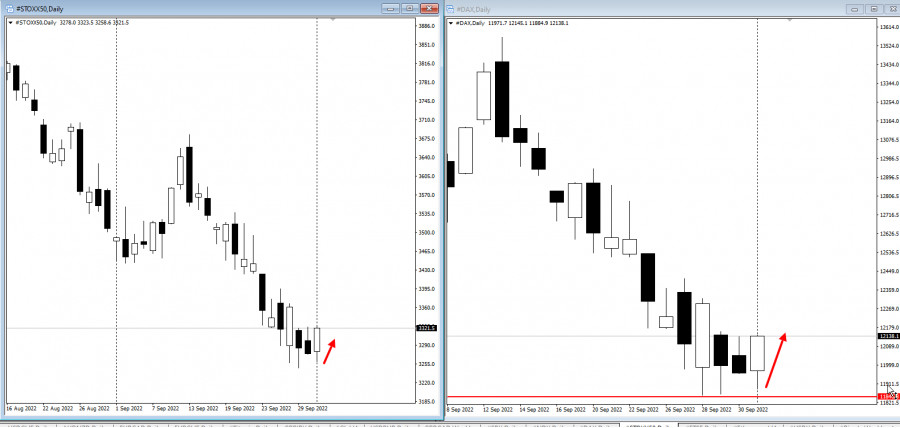

European stocks reduced their losses as energy stocks rose. The pound traded higher after Finance Minister Kwasi Kwarteng reversed a plan to scrap the highest 45% tax rate.

Another major focus was on Switzerland's Credit Suisse Group AG. It fell by more than 11% as speculation intensified about the company's future and its need for fresh capital. The company's exposure insurance costs rose to record highs as investors ignored Chief Executive Officer Ulrich Kerner's efforts to calm the market.

Investors now await this week's jobs data for further clues about the Fed's rate-hike trajectory. According to Bloomberg Economics, central banks in Australia and New Zealand are leaders among developed nations. They are expected to extend their tightening cycles and raise rates by 25 and 50 basis points respectively.

The MOEX Russia Index is trading slightly above 2,000 for the first time in a week:

Key events this week:

- US construction spending, ISM manufacturing, light vehicle sales, Monday

- Fed's Raphael Bostic and John Williams speak at events, Monday

- Euro area and EU finance ministers meet, Monday

- Eurozone PPI, Tuesday

- US factory orders, durable goods, Tuesday

- Fed's John Williams, Lorie Logan, Loretta Mester, Mary Daly speak at events, Tuesday

- Eurozone Services PMIs, Wednesday

- OPEC + meeting begins, Wednesday

- Fed's Raphael Bostic speaks, Wednesday

- Eurozone retail sales, Thursday

- US initial jobless claims, Thursday

- Fed's Charles Evans, Lisa Cook, Loretta Mester speak at events, Thursday

- US unemployment, wholesale inventories, nonfarm payrolls, Friday

- BOE Deputy Governor Dave Ramsden speaks at event, Friday

- Fed's John Williams speaks at event, Friday

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.