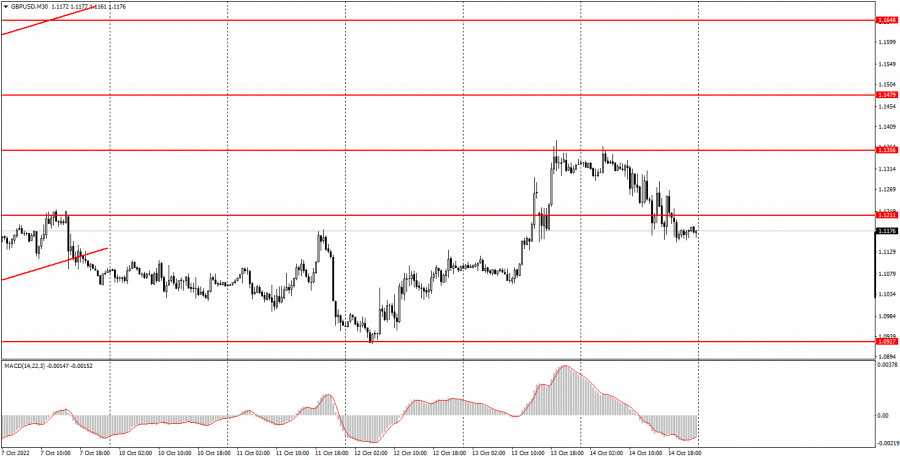

Analysis of Friday's deals: 30M chart of the GBP/USD pair

The GBP/USD pair also showed completely inadequate movements on Friday. We draw your attention to the fact that the euro and the pound have been trading differently throughout the current week, which, in principle, happens infrequently. There is a clear correlation between the two main pairs, but still this moment can be explained by a strong fundamental background from the UK. Recall that passions have been raging in Great Britain for several weeks regarding the initiative of British Prime Minister Liz Truss to lower taxes, which can lead to a huge budget deficit. Treasury Minister Kwasi Kwarteng was fired on Friday, and Truss herself is looming with a possible no-confidence vote a little more than a month after Truss took office as prime minister. By the way, Kwarteng also spent a little over a month in his position. Therefore, the UK is now facing another political crisis that could provoke an internal economic one. We also note that two relatively important US reports were released on Friday. Retail sales remained unchanged in September, which provoked a fall in the US currency, while the consumer sentiment index from the University of Michigan rose only slightly compared to September. As a result, we got the same "fence" as for the euro.

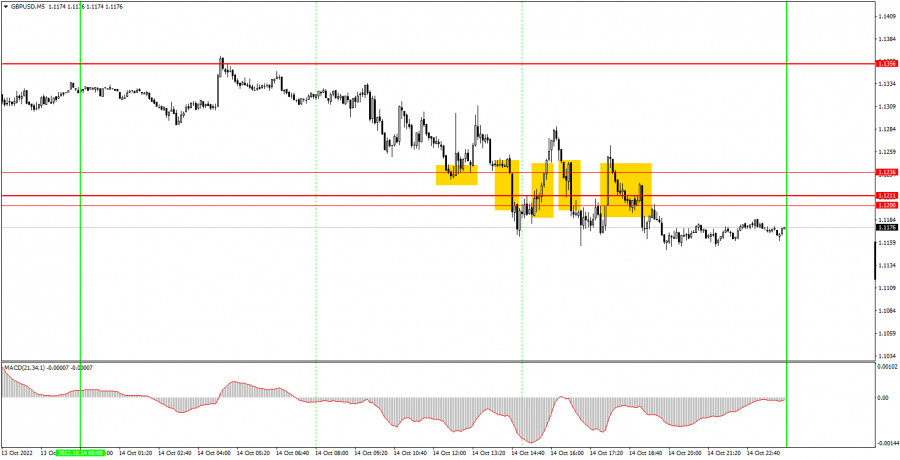

5M chart of the GBP/USD pair

The "fence" is visible on the 5-minute timeframe. The price constantly changed the direction of movement during the day and, as a result, constantly formed signals. There was a powerful area (1.1200-1.1236) on the way, but, by and large, the price ignored it. The first buy signal was formed during the rebound from this area. The price went in the right direction for 50 points, but it was unlikely to get a profit on this position, since it was not possible to reach the target level of 1.1356, and the price quickly turned back down. Therefore, Stop Loss worked at breakeven. The second sell signal also turned out to be false, and here beginners could no longer avoid losses. The price did not move a single point in the right direction, but around the same time, a weak retail sales report came out, which you should have paid attention to. Since the dollar's fall after it was logical, the short position should have been closed immediately, without waiting for Stop Loss. As a result, the loss amounted to about 35 points. All subsequent signals around the 1.1200-1.1236 area should have been ignored.

How to trade on Monday:

The GBP/USD pair is leaning more and more every day to resume the long-term downward trend on the 30-minute timeframe. During this week, the pound showed a good segment of growth, but nevertheless, at the end of the week, it again rolled down. The fundamental background for the British currency is very complex, so we believe more in a new fall in the pound than in its growth. On the 5-minute TF tomorrow, it is recommended to trade at the levels of 1.0833, 1.0927, 1.1024, 1.1200-1.1211-1.1236, 1.1356, 1.1443, 1.1479. When the price passes after opening a position in the right direction for 20 points, Stop Loss should be set to breakeven. There are no important events planned for Monday in the UK and the US, but, as we can see, the pound continues to trade rather volatilely. On Friday, from the low to the high of the day, it again passed more than 200 points.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.