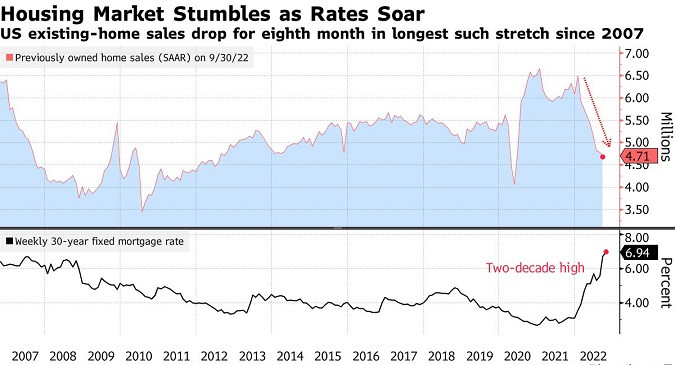

Sales of previously owned US homes fell for the eighth straight month in September, underscoring how soaring mortgage rates are punishing the housing market.

According to data from the National Association of Realtors on Thursday, contract closings declined by 1.5% to an annualized pace of 4.71 million last month, the slowest since May 2020.

The stretch of monthly decline is the longest since 2007, when a housing market collapse swept the economy into the Great Recession. Home sales have deteriorated rapidly this year as the Federal Reserve kicked off an aggressive campaign to crush inflation with high interest-rate hikes.

"We are not yet at the bottom," Lawrence Yun, NAR's chief economist said on a call with reporters while talking to reporters. Yun expects the figures to keep deteriorating given the current data doesn't reflect where mortgage rates are now.

Mortgage rates are now at a two-decade high, and applications to purchase or refinance a home have crumbled to levels not seen since 1997.

"Despite weaker sales, multiple offers are still occurring with more than a quarter of homes selling above list price due to limited inventory," Yun said in a statement. "The current lack of supply underscores the vast contrast with the previous major market downturn from 2008 to 2010, when inventory levels were four times higher than they are today."

The average selling price rose by 8.4% from a year earlier to $384,800. Despite this fact, that is the lowest since March.

Separate data released earlier this week showed that builders were also slowing down. Beginning construction of single-family homes dropped to a two-year low, and homebuilder sentiment has fallen every month this year.

The number of homes for sale has fallen to 1.25 million since August. At the current sales pace it would take 3.2 months to sell all the homes on the market, up from 2.4 months in September 2021. Realtors believe the supply below five months indicates a tight market.

Properties remained on the market for longer in September, and 70% of homes sold were on the market for less than a month, down from 81% in August.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.