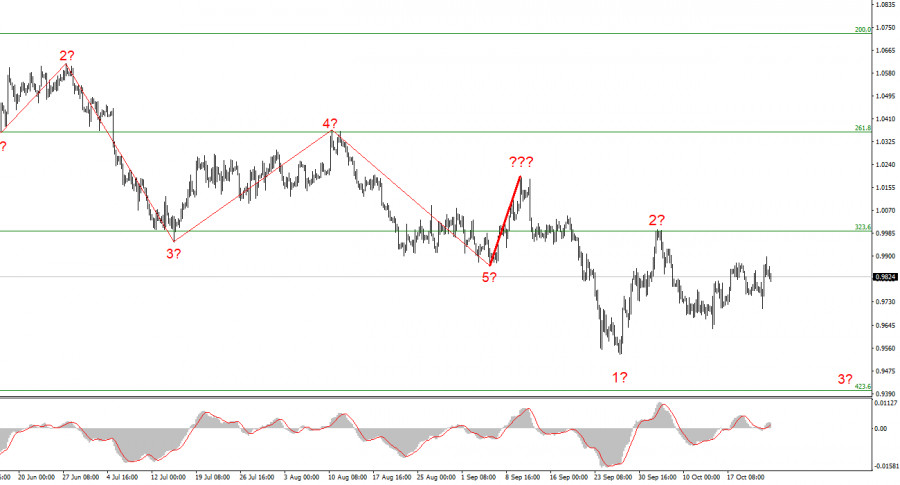

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may become more complicated than once in the future. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one upward correction wave (marked with a bold line), after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There has been no talk of any classical wave structure (5 trend waves, 3 correction waves) for a long time. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture "a strong wave down - a weak corrective wave up." Even now, when the construction of a new upward wave seems to have begun, which may well be 3 as part of a new upward trend section, the entire wave marking can transform into a downward one, and the waves built after October 4 will be waves 1 and 2 in 3.

How much will the European regulator raise the rate?

The euro/dollar instrument fell by 60 basis points on Monday. The European currency still retains chances to resume the formation of a downward trend segment. The market has not yet seen any reason to buy the euro, especially ahead of the ECB and Fed meetings. Let me remind you that, according to many analysts, the ECB rate may rise to a maximum of 2.5% and the Fed rate – to a minimum of 4.5%. Thus, such an imbalance remains not in favor of the euro. Business activity indices were released in the European Union this morning. The indicator fell to 46.6 points in the manufacturing sector and the service sector – to 48.2. However, it does not matter to what values these indicators have fallen, they remain below the 50.0 mark, and in this area, any value is considered negative. We saw a timely and logical reaction from the market to these reports.

The economic situation in the European Union is deteriorating. In recent weeks and even months, what has not been predicted for the European economy. And the crisis, the recession, the shortage of energy resources, the shutdown of industrial production in winter, and the change of power due to the dissatisfaction of European citizens with high electricity and heating bills. All these problems are not insignificant, and they are not as scary as they are painted. They have been known for a long time, so the market could have already considered them. However, in this case, it becomes even more difficult to predict the further movement of the instrument since it is unclear what factors the market will now pay attention to. I think it's best to focus on the ECB meeting and the Fed meeting right now. These are the next important events for the euro and the dollar.

General conclusions.

Based on the analysis, I conclude that the construction of an upward trend section has begun. At this time, the instrument can build a new impulse wave, so I advise buying with targets above the calculated mark of 0.9993, which equates to 323.6% by Fibonacci, by MACD reversals "up." I have not changed the wave marking yet; the reasons for the growth of the euro are the high probability of an increase in the British.

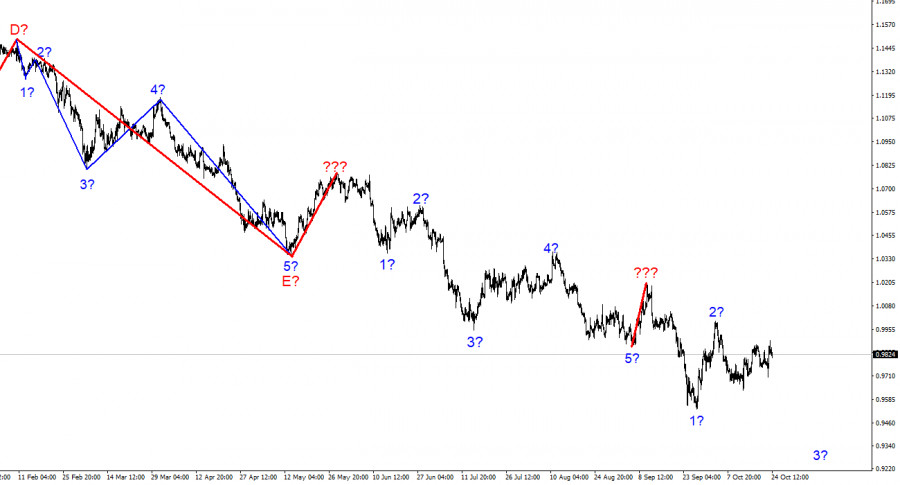

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves can be just completed, and a new one has begun its construction.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.