Bitcoin continues to move sideways in the short term. It was trading at 19,384 at the time of writing. The current indecision forced the altcoins to move sideways as well. Technically, after its previous rally, a temporary retreat or a sideways movement was natural.

In the last 24 hours, BTC/USD is down by 0.58% but it's still up by 2.18% in the last 7 days. As long as the rate continues to move sideways, it's premature to talk about a new trading opportunity.

BTC/USD Accumulates More Bullish Energy!

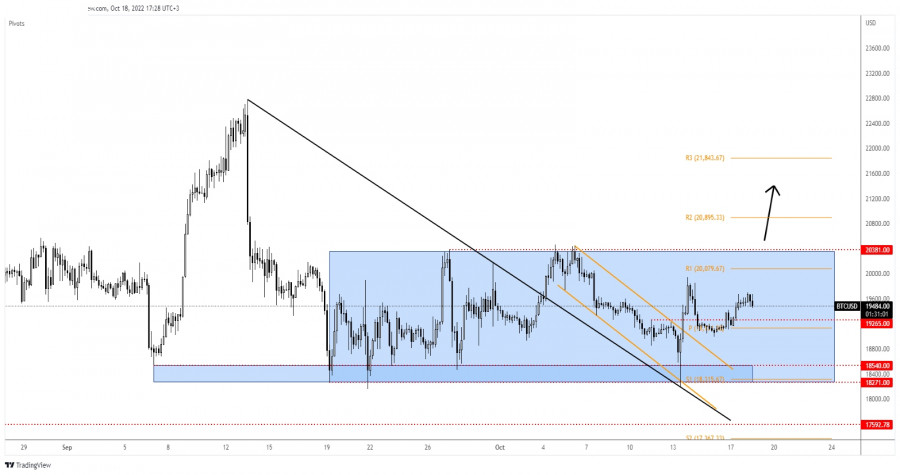

Technically, the rate retreated after the aggressive rally registered after the US inflation data publication. The weekly pivot point of 19,131 represents static support. As long as it stays above it, BTC/USD could try to approach and reach the weekly R1 (20,079).

Dropping and stabilizing below the pivot point signals a potential drop towards 18,540 again. Still, after its false breakdown with great separation below this level, the rate could still try to resume its growth.

BTC/USD Outlook!

Bitcoin could continue to move sideways in the short term. Personally, I will look for new trades only after the rate escapes from this pattern. As you already know, a new higher high, a valid breakout above 20,381 could really activate a larger rebound and may offer new long opportunities.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.