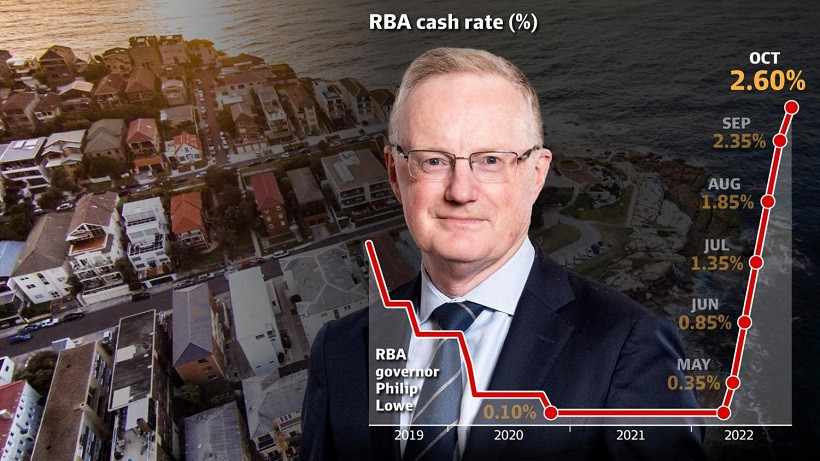

The Reserve Bank of Australia disappointed buyers of the AUD/USD pair. The regulator raised the interest rate by only 25 points, although most experts predicted a 50-point increase. However, not all analysts were confident that the RBA would maintain the previously set pace of tightening monetary policy. Some indirect signs indicated that the central bank would not increase the rate by 50 points for the fifth time in a row.

For example, the rhetoric of the accompanying statement of the September meeting has noticeably softened compared to previous meetings. The minutes of the September meeting did surprise, which stated that the members of the RBA "are quite determined in the fight against inflation," but at the same time, the ways to achieve the goal "should take into account the risks for economic growth and employment." In addition, the protocol contained another very eloquent phrase: "interest rates have been raised quite quickly and are approaching normal settings." Similar rhetoric was voiced in September by Governor Philip Lowe and Deputy Governor Michele Bullock.

Given this disposition, it cannot be argued that the Reserve Bank of Australia shocked the markets today. Yes, on the one hand, the regulator did not implement the basic scenario that most experts voiced. But on the other hand, there were certain prerequisites for slowing down the pace of monetary policy tightening. Some analysts (in particular, Scotiabank) warned their clients on the eve of the meeting that the central bank could increase the rate by only 25 points.

And indeed, the RBA did not justify the hopes of the majority of hawks. By all appearances, the regulator will continue to stick to the 25-point step for at least the remaining two meetings this year. Following the results of the October meeting, the regulator demonstrated its readiness for further tightening of monetary policy, that is, the rate increase cycle is still far from over. But at the same time, now we can say with confidence that the "aggressive" stage has already been left behind. It is also possible that the RBA will take a break after the December increase in order to assess the effectiveness of the measures already taken

In general, further prospects for tightening monetary policy will depend on the dynamics of key macroeconomic indicators, primarily in the field of inflation and the labor market. In the accompanying RBA statement, it is indicated that the size and timing of future rate hikes will be determined by these factors. In this context, it is worth quoting the phrase of the final communique: "... given the shortage of labor in the labor market and pressure on prices, the central bank will continue to pay close attention to both the dynamics of labor costs and the behavior of companies in the field of pricing in the coming period."

Commenting on the results of the October meeting, RBA Governor Philip Lowe made it clear that the members of the central bank fear the negative consequences of tightening financial conditions for consumer spending. According to him, the simultaneous rise in inflation and the increase in the rate "put strong pressure on the budgets of consumers." At the same time, he added that one of the sources of uncertainty is the negative outlook for the global economy, "which has only worsened recently."

By and large, today's events were predictable. In my opinion, there were only two scenarios for the October meeting: either the regulator raises the rate by 50 points and voices dovish rhetoric about slowing down the pace of monetary policy tightening, or the regulator slows down the pace of the rate increase, not in word but in deed. In any case, the Aussie would have been the loser, as the hawkish mood still prevailed in the market.

De facto, the Reserve Bank decided to start slowing down already in October, putting pressure on the Australian dollar.

It is worth noting that the AUD/USD pair showed a rather modest downward momentum, only leveling yesterday's corrective growth. But this "anomaly" is primarily due to the behavior of the greenback, which, against the background of increased risk appetite, weakened its positions throughout the market. The key Wall Street indices opened with a steady increase today, while demand for the US currency has noticeably decreased.

But in general, the downward trend is still in force, and today's events only confirmed this fact. The Reserve Bank of Australia has slowed down the pace of monetary policy tightening, while the US Federal Reserve continues to demonstrate an aggressive attitude. Therefore, short positions on the AUD/USD pair are still relevant.

Technology says the same thing. The pair on the daily chart is between the middle and lower lines of the Bollinger Bands indicator and below all the lines of the Ichimoku indicator (including the Kumo cloud). In addition, Ichimoku has formed a bearish "Parade of lines" signal, warning of further price declines. All this suggests that from the current positions (or on the waves of corrective pullbacks) one can consider selling to the nearest support level of 0.6350—the lower line of the Bollinger Bands on the same timeframe.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.