Overview :

The GBP/USD pair traded in different directions in the range of 1.1570 - 1.1404 and closed the day without significant changes. Today it fell a little, dropping from the top price of 1.1570 to 1.1477.

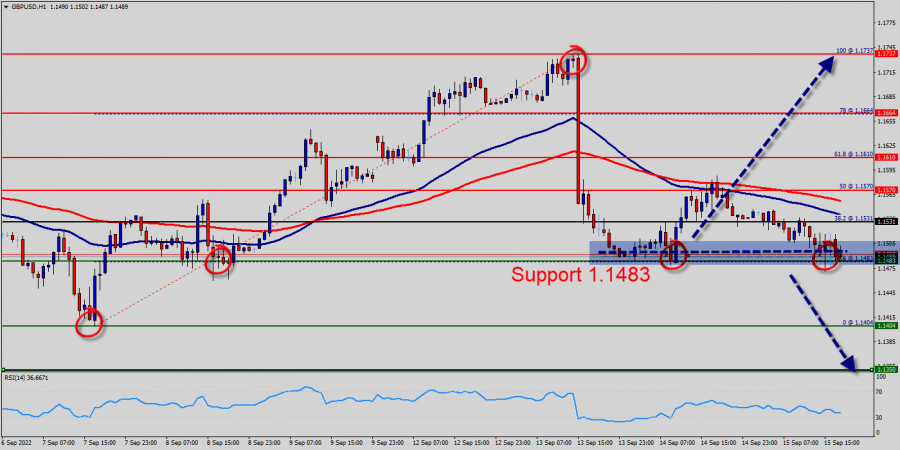

The GBP/USD pair stayed below the psychological level of 1.1531 over the weekend, indicating a lack of urgency to accumulate at the current levels. The bears are attempting to extend the GBP/USD pair's decline below 1.1531 in the week beginning of this week. Following the price of 1.1531 rejection, the seller takers still have the upper hand in the market, as they were able to impose more correction on the GBP/USD pair from the price of 1.1531. The GBP/USD pair couldn't reach stiff resistance at 1.1570 and pulled back near 1.1483 support, which could be a swing entry opportunity.

On the hourly chart, the GBP/USD pair is still trading below the MA (100) H1 moving average line (1.1531). The situation is similar on the one-hour chart. Based on the foregoing, it is probably worth sticking to the north direction in trading, and as long as the GBP/USD pair remains below MA 100 H1, it may be necessary to look for entry points to buy for the formation of a correction.

The GBP/USD pair slides below 1.1531 mark amid rebounding oil prices, modest USD weakness. The GBP/USD pair maintained its offered tone through the early European session and slipped below the 1.1531 psychological mark, hitting a fresh daily low in the last three hour at the price of 1.1472.

The RSI is still signaling that the trend is downward as it is still strong below the moving average (100). Additionally, the RSI starts signaling a downward trend. Bitcoin dropped from the level of 1.1570 to the bottom around 1.1483.

Technical outlook :

The GBP/USD pair faced resistance at the level of 1.1570, while minor resistance is seen at 1.1531. Support is found at the levels of 1.1404 and 1.1350.

Pivot point has already been set at the level of 1.1531. Equally important, the GBP/USD pair is still moving around the key level at 1.1483, which represents a minor support in the H1 time frame at the moment.

Yesterday, the GBP/USD pair continued moving downwards from the level of 1.1531. The pair fell to the bottom around 1.1483 from the level of 1.1531 (coincides with the ratio of 38.2% Fibonacci retracement).

In consequence, the GBP/USD pair broke support, which turned into strong resistance at the level of 1.1531. The level of 1.1531 is expected to act as the minor resistance today.

We expect the GBP/USD pair to continue moving in the bearish trend towards the target levels of 1.1404 and 1.1350.

On the downtrend:

If the pair fails to pass through the level of 1.1531, the market will indicate a bearish opportunity below the level of 1.1531. Moreover, a breakout of that target will move the pair further downwards to 1.1404 in order to form a new double bottom. So, the market will decline further to 1.1404 and 1.1350. On the other hand, if a breakout happens at the support level of 1.1610, then this scenario may be invalidated.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.