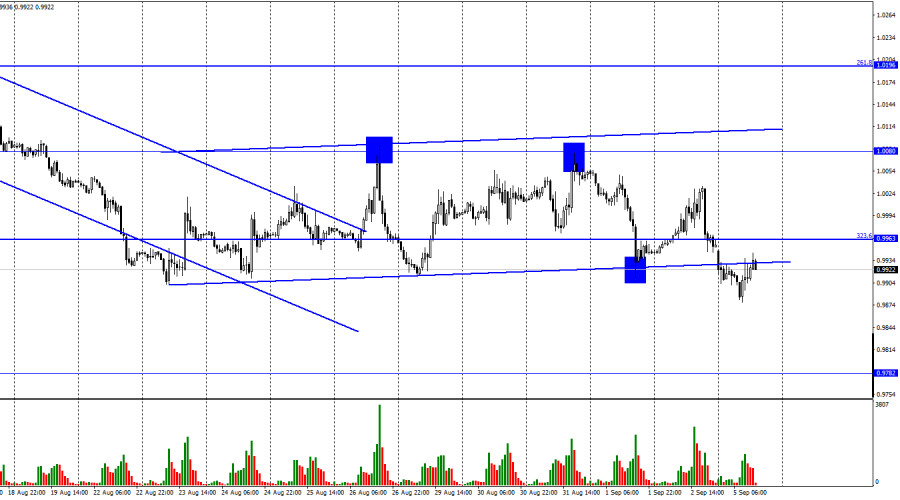

Hello, dear traders! On Friday, the EUR/USD pair again fell to the lower line of the sideways channel. Today, it closed below this line. Therefore, the probability of the further euro's decline towards 0.9782 level has increased. Notably, it has been within the sideways channel for about two weeks. However, the bears are currently increasing the pressure, which may lead to a new euro's decline. Moreover, traders had reasons to sell the euro again both on Friday and Monday. On Friday, positive US labor market data were released. It turned out that nonfarm payrolls totaled 315,000 in August, which was slightly above traders' expectations. The unemployment report was disappointing. It rose from 3.5% to 3.7%. However, the reaction of traders was almost unambiguous, they focused on new purchases of the US dollar. That indicates that nonfarm payrolls are more significant to traders than unemployment or wages reports. Moreover, today the Service PMI (49.8 at expectations of 50.2), Composite PMI (48.9 at expectations of 49.2) and retail sales (-0.9% y/y with -0.7% expected) were published in the EU.

From my point of view, the European reports cannot be considered as important as the American ones, but the traders had a right to keep selling the Euro on the basis of these reports. Thus, the situation for the euro which has been trading near its lows for two decades, remains very difficult and even critical. Traders have not paid due attention to the ECB promises to raise the rate several more times in 2022, but the gas crisis has. Although gas prices have stabilized a bit over the past couple of days, they promise to keep rising as the Nord Stream pipeline is no longer delivering gas to Europe. Moscow said it could take a long time to fix the problem, as anti-Russian sanctions are making repairs difficult. It is possible that gas will no longer flow to the European Union through this pipeline at all, which could have a very negative impact on the European economy, which is very dependent on this fuel, in the coming years.

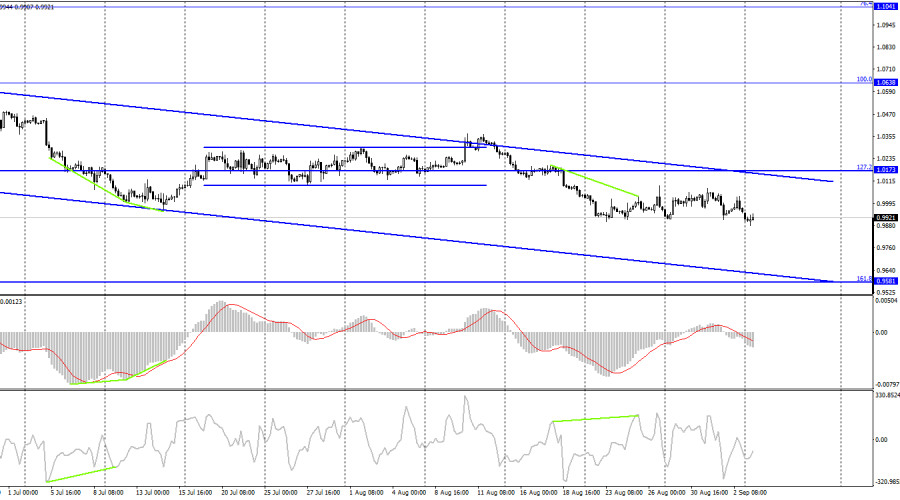

On the 4H chart, the pair performed a reversal in favor of the US dollar and consolidated at 1.0173, below the correction level of 127.2%. Thus, the decline may continue towards the Fibo level of 161.8% at 0.9581. A downward trend channel still characterizes traders' sentiment as bearish. No indicator has new emerging divergences today.

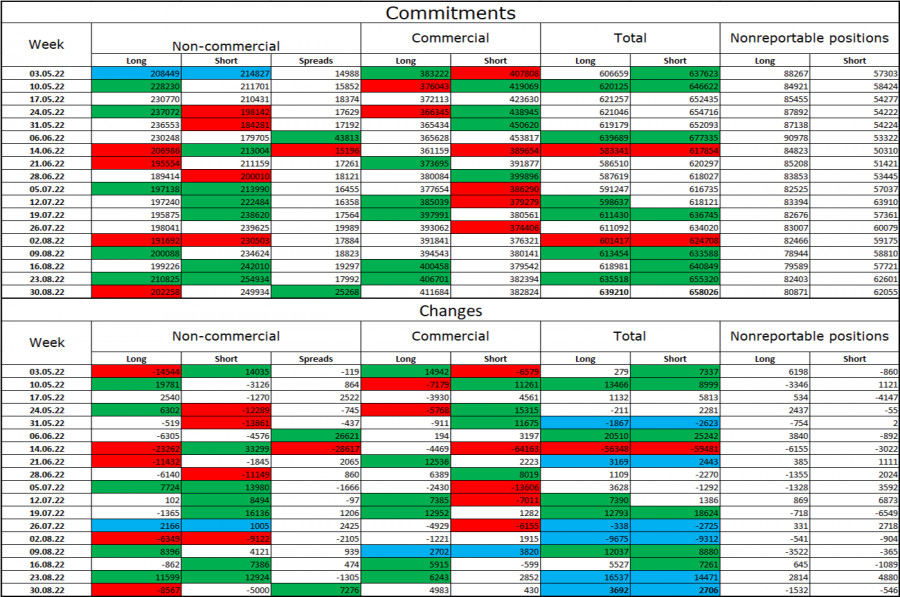

COT report:

Speculators closed 8,567 long contracts and 5,000 short contracts last week. This means that the bearish mood of the major players has strengthened again, and the total number of long contracts, held by speculators, is now 202,000, and the number of short contracts is 249,000. The difference between these figures is still not too big, but it remains not in favor of the Euro bulls. During the last few weeks the Euro has been gradually growing, but the latest COT reports showed that the bulls are not getting any stronger. The Euro currency has failed to show a convincing growth during the last seven to eight weeks. Therefore, it is still difficult for me to count on a strong rise in the Euro. So far, I'm inclined to continue the decline of the Euro-dollar pair, judging by the COT.

US and EU economic news calendar:

EU - Services PMI (08-00 UTC).

EU - Composite PMI (08-00 UTC).

EU - Retail Sales (09-00 UTC).

On September 5, all the reports of the day are already out. Only the EU economic calendar contained more or less interesting entries. The influence of the information background on the traders' mood today was weak in the first half of the day, and will be lacking in the second half.

EUR/USD outlook and recommendations for traders:

I recommended new sales when closing under the sideways corridor on the hourly chart with a target of 0.9782. These trades can be held now. I recommend buying the euro when the quotes fix above the descending corridor on the 4-hour chart with the target 1.0638.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.