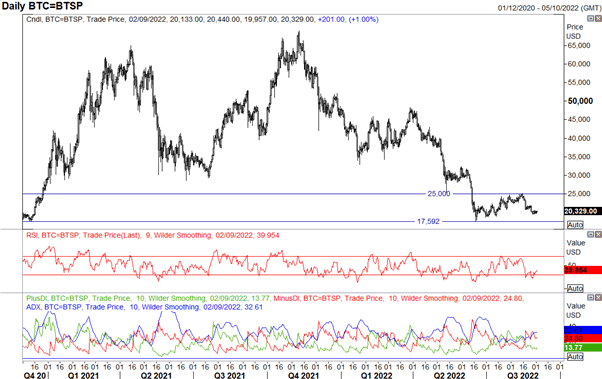

Bitcoin continues to hover around the 20k mark as tight ranges are maintained. The upside in the cryptocurrency has been tepid at best, suggesting that we may have temporarily peaked at 25k. Momentum indicators remain bearish, add this with the fact that the macro environment is also not supportive as global bond yields rally and the USD continues to go from strength to strength. The path of least resistance is to the downside with eyes for a test of the 17500 lows. In recent months, given the hype around Merge for Ethereum, it has felt that Bitcoin has been somewhat left behind which possibly explains why upside in Bitcoin has been hard to come by.

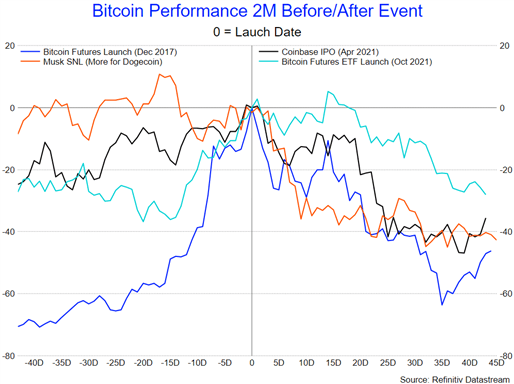

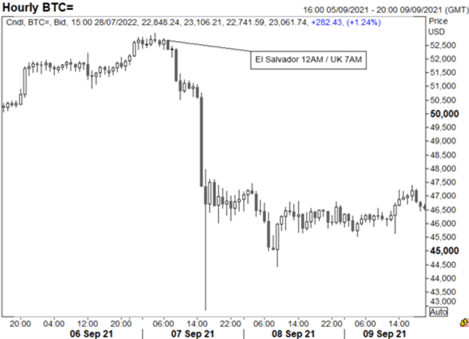

At the same time Bitcoin peaked at 25k, Ethereum also topped out at 2k, which had been around the time of the successful final Merge test, allowing for Merge to launch in mid-September. The excitement of Merge has also been reflected in the outperformance of Ethereum over Bitcoin. Given the anticipation around Merge, I would expect it to be another “buy the rumour, sell the fact”. While I don’t deny that Merge will have significant positives for Ethereum. Over its short lifespan, market psychology has been evident in the crypto space as we have seen time and time again that hyped events have often resulted in cryptos rallying into the event and selling off shortly after launch. The charts below highlight this. As such, Ethereum is likely to remain underpinned heading into the event, but it would be worthwhile reducing exposure either the few days before or on the day (Sep 15th touted Merge Date). Keep in mind, that US CPI will be released on Sep 13th.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.