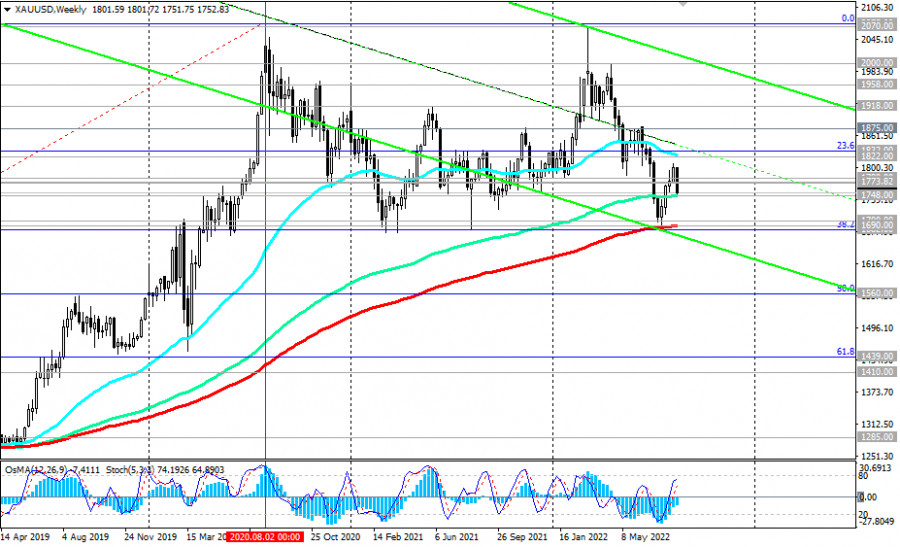

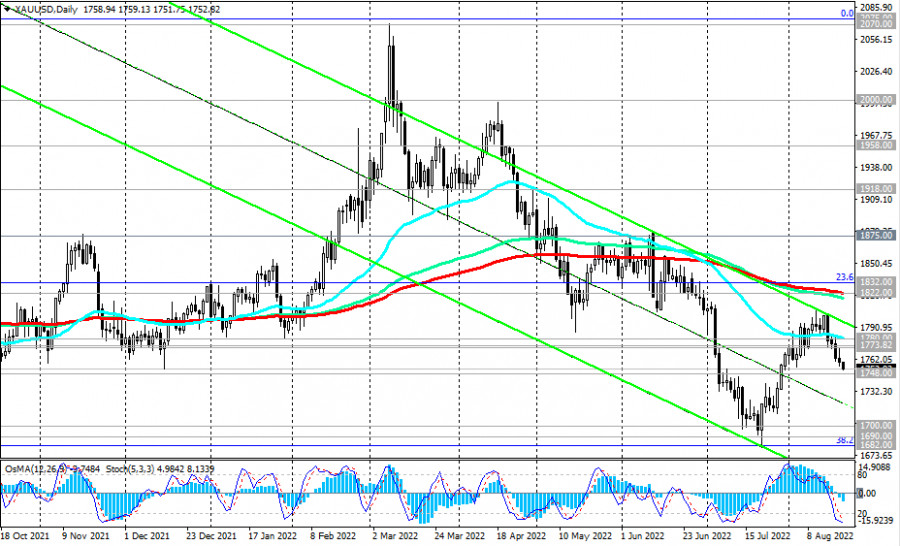

Gold is giving way to its role as a defensive asset to the dollar, and the XAU/USD pair is declining for the 5th day in a row today. As of this writing, the pair is trading near 1753.00, close to the strong support level of 1748.00 (144 EMA on the weekly chart). Given the long-term upward trend of XAU/USD, it is logical to assume a rebound near this support level. In case of its breakdown, the key support level 1690.00 (200 EMA on the weekly chart) becomes the target, the breakdown of which will cause XAU/USD to enter the zone of a long-term bearish market.

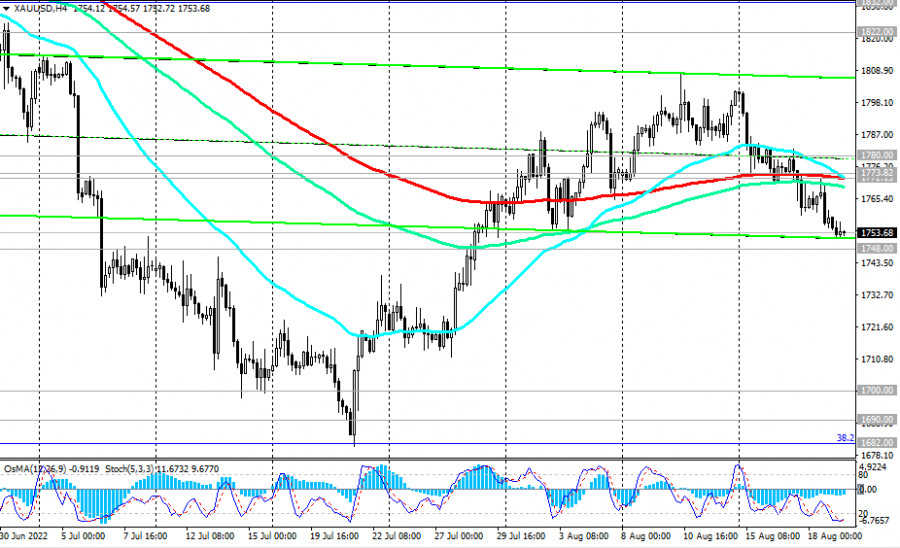

If there is still a rebound near the current levels and the support level of 1748.00, then the signal for the resumption of long positions will be a breakdown of the important resistance levels of 1772.00 (200 EMA on the 4-hour chart), 1773.00 (200 EMA on the 1-hour chart), chart). In this case, a retest of the "round" resistance level 1800.00 is possible, which became a kind of "balance line" for the pair for a long time until the beginning of 2022.

The breakdown of the key resistance level of 1822.00 (200 EMA on the daily chart) will confirm the scenario for the resumption of the long-term bullish trend for XAU/USD.

Support levels: 1748.00, 1700.00, 1690.00, 1682.00, 1670.00

Resistance levels: 1772.00, 1773.00, 1780.00, 1800.00, 1822.00, 1832.00, 1875.00

Trading Tips

Sell Stop 1746.00. Stop-Loss 1761.00. Take-Profit 1700.00, 1690.00, 1682.00, 1670.00

Buy Stop 1761.00. Stop-Loss 1746.00. Take-Profit 1772.00, 1773.00, 1780.00, 1800.00, 1822.00, 1832.00, 1875.00

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.