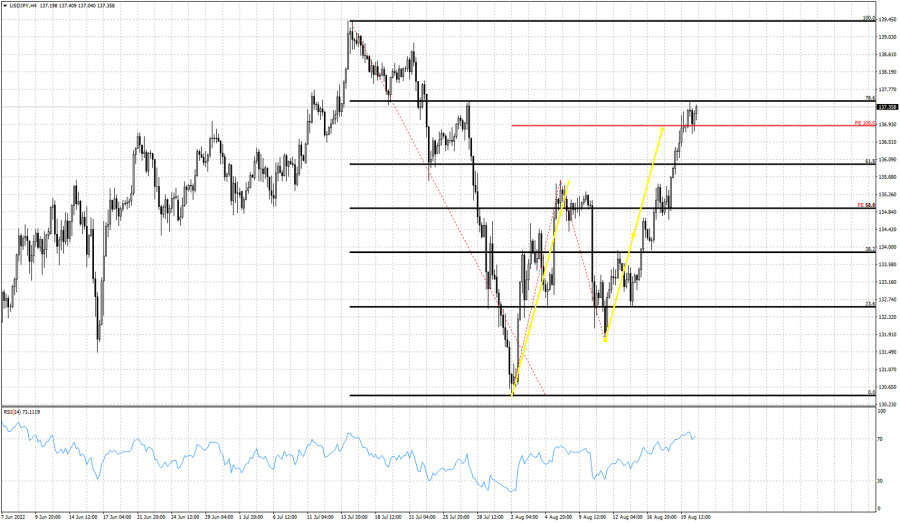

Black lines- Fibonacci retracement levels

Red line- Fibonacci extension levels

Yellow lines- two equal size advances

USDJPY is trading above 137 making new higher highs. As we mentioned in our previous post, USDJPY technically remains in a bullish trend. A pull back is justified but so far there is no such a signal of a coming reversal. USDJPY is trading right below the 78.6% Fibonacci retracement of the entire decline. This Fibonacci level is the last line of defence for bears. Price has made a 100% extension move and some more, relative to the first upward leg. The RSI is at overbought levels. All conditions are met in order for price to make an important top and reverse lower at least towards 135.50-136. This is not the time to be buying USDJPY. I expect to see USDJPY at lower levels over the coming weeks.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.