Early in the American session, the Japanese yen fell below the psychological level of 135.00. A few days earlier, USD/JPY was consolidating within a symmetrical triangle pattern.

In our previous report, we predicted that a sharp break could happen in this symmetrical triangle pattern. The key was to expect a consolidation below the 200 EMA. We invite you to read our article and get some details here.

The US headline CPI remained flat in July, versus expectations for a modest 0.2% rise, following a 1.3% increase in the previous month. In addition, the annual rate fell more than expected to 8.5% in July from 9.1% previously.

These data suggest that US inflation may have peaked and could change expectations of an aggressive tightening by the FED, which, in turn, affects the strength of the US dollar.

The US inflation data helped the recovery of the Japanese yen, accumulating a gain of almost 300 pips. USD/JPY is now trading at the price levels of August 1st.

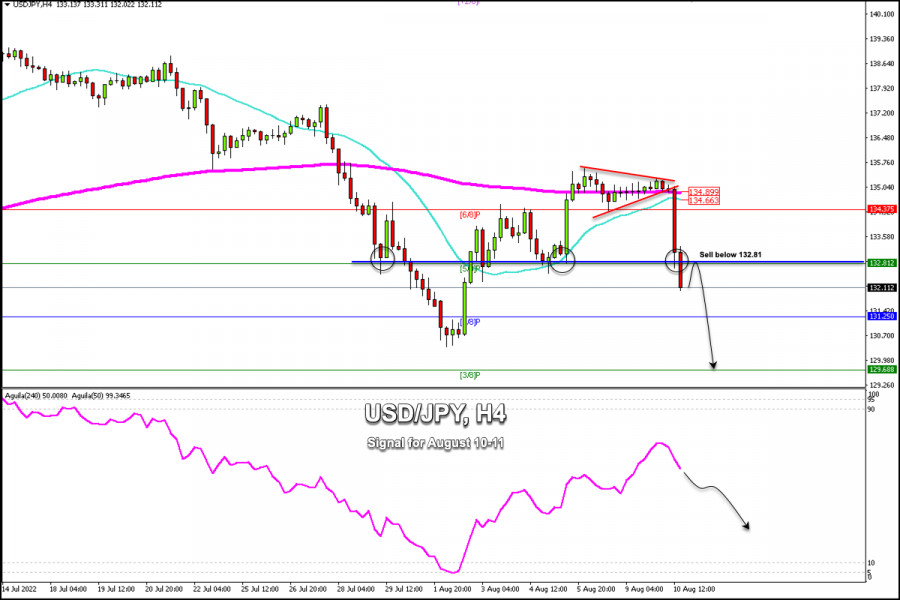

According to the 4-hour chart, USD/JPY has broken the strong support located at 132.80 (5/8). The pair is currently trading at around 132.11. Amid strong bearish pressure, the trading instrument may reach 4/8 Murray at 131.25 and could even drop towards the psychological level of 130.00.

On the other hand, a return above 133.00 could mean a rally towards the 134.37 (6/8) resistance zone and the price could even reach the 200 EMA at around 134.89.

This strong movement seen in the last hours could signal the continuation of the bearish movement in the short term and the pair could reach the zone of 3/8 Murray at 129.68.

The outlook remains positive for the Yen in the short term. The yen asserted its strength, having reached the level of 139.37 on July 14.

However, the divergence between the interest rate of the bank of the United States and the bank of Japan could limit the fall in USD/JPY and it could find strong support at around 129.70-130.00. From that point, USD/JPY may resume the uptrend and could reach the psychological level of 140.00.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.