Overview :

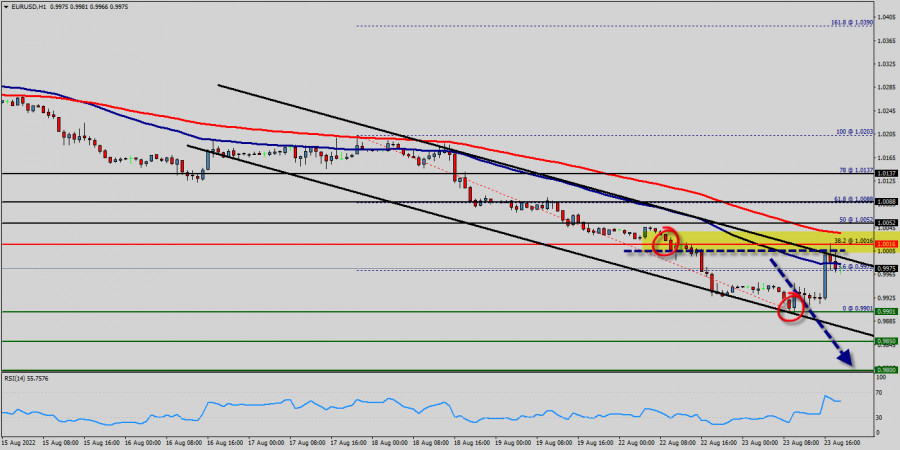

The EUR/USD pair continues to move downwards from the level of 1.0016. Yesterday, the pair dropped from the level of 1.0016 to the bottom around 0.9901. But the pair has rebounded from the bottom of 0.9901 to close at 0.9970.

The EUR/USD pair's outlook and further decline is expected with 1.0016 minor resistance intact. Current down trend should move from the last resistance levels of 1.0016, 1.0052 and 1.0088. Firm break there could prompt downside acceleration to last bearish wave of 0.9901.

Today, the first support level is seen at 0.9901, the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.0052, which coincides with the 50% Fibonacci retracement level.

This resistance has been rejected several times confirming the veracity of a downtrend. Additionally, the RSI starts signaling a downward trend.

As a result, if the EUR/USD pair is able to break out the first support at 0.9901, the market will decline further to 0.9850 in order to test the weekly support 2.

Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 0.9901 with the first target at 0.9850 and further to 0.9800.

Technical indicators are recovering from extreme oversold readings, holding far below their midlines, a sign that there's a long way ahead before a substantial recovery takes place. Moving averages, in the meantime, maintain their bearish slope way above the current level. Furthermore, although the news is bearish for the Euro, professional may not want to sell weakness, but rather following a rebound rally. Additionally, some aggressive counter-trend buyers may be defending parity.

In case a continuousion takes place and the EUR/USD pair breaks through the support level of 0.9800, a further decline to 0.9750 can occur which would indicate a bearish market. However, stop loss is to be placed above the level of 1.0052.

Trading recommendations:

According to previous events, the EUR/USD pair is still moving between the level of 1.0052 and the 0.9901 level (these levels coincided with the fibonnacci retracement levels 38.2% and last bearish wave). It should be noted that the 1.0016 price will act as a minor resistance on August 22, 2022. Therefore, it will be too gainful to sell short below 1.0052 and look for further downside with 0.9901 and 0.9750 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 1.0052 level today.

Upside outlook :

If the trend is able to break out through the first resistance level at 1.0052, we should see the pair climbing towards the double top (1.0137) to test it. Therefore, buy above the level of 1.0052 with the first target at 1.0088 in order to test the daily resistance 1 and further to 1.0137. Also, it might be noted that the level of 1.0137 is a good place to take profit because it will form a double top.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.