XAU/USD rallied in the short term and was now traded at 1,788 at the time of writing. The bias remains bullish, so further growth is in the cards as the Dollar Index drops. DXY's failure to make a new higher high helped the yellow metal to grow.

Surprisingly or not, the price of gold increased, even though the US data came in better than expected on Friday. The NFP came in at 528K versus 250K expected, the Unemployment Rate dropped from 3.6% to 3.5%, while the Average Hourly Earnings rose by 0.5% versus 0.3% expected.

Fundamentally, the most important event of the week is represented by the US inflation data on Wednesday. The CPI is expected to report a 0.2% growth in July, while the Core CPI could register a 0.5% growth in the last month.

XAU/USD Challenges Upside Obstacle!

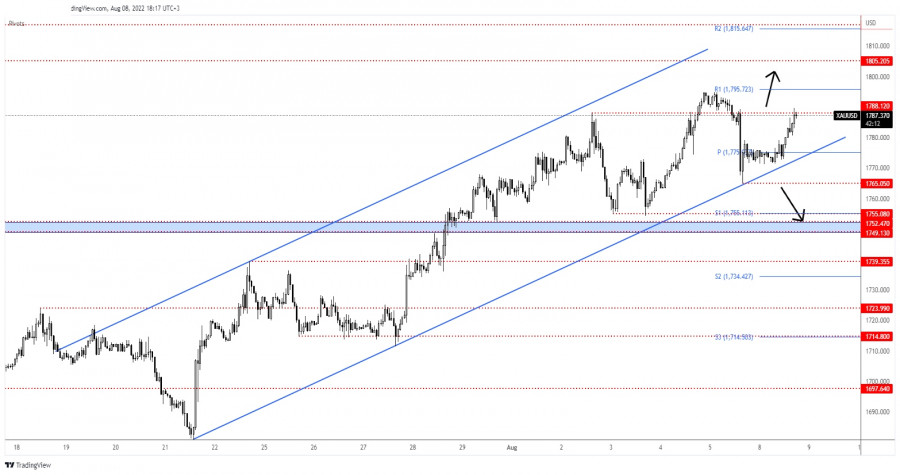

As you can see on the H1 chart, the yellow metal retested the uptrend line where it has found support and now it challenges the 1,788 key upside obstacle. You knew from my previous analysis that an upside continuation is favored as long as it stays inside of the up-channel.

Technically, the price action signaled that the buyers are exhausted after failing to reach and retest the channel's upside line.

XAU/USD Outlook!

The weekly R1 (1,795) represents an upside obstacle, so only a valid breakout above this level, a new higher high could really activate further growth. This scenario could bring long opportunities.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.