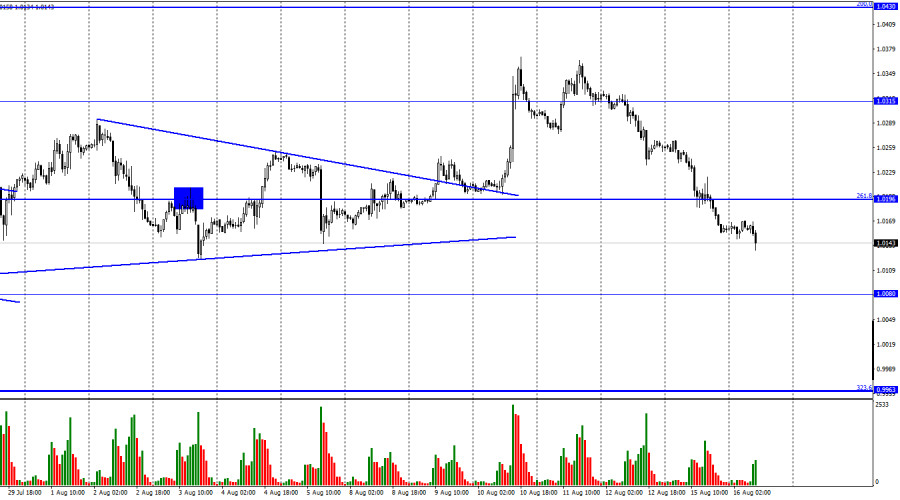

The EUR/USD pair continued the process of falling on Monday and secured the corrective level of 261.8% (1.0196). The quotes continue to fall today, already in the direction of the 1.0080 level. The European currency has fallen by more than 200 points in just three incomplete days. And this is even though there was no informational background either yesterday or today. As I said on Monday, a huge amount of attention is now being paid to a possible recession in both the United States and the European Union. Many economists believe that the recession in America has already begun, as confirmed by the GDP data for the first and second quarters. Some call this phenomenon a "technical recession." The Fed believes that this is not a recession but a small recession after a period of strong economic growth. The meaning remains the same: the American economy has been shrinking for two quarters, and you can call this process whatever you want. But if the American economy is shrinking and the European economy is growing, why is the euro at its lowest value in 20 years and cannot even show decent growth?

From my point of view, the issue of recession is not too important for traders right now. According to economists, the European economy is also on the verge of recession and will definitely slide into it as soon as the ECB starts raising interest rates. Thus, both economies are in approximately equal conditions. And the difference lies precisely in the actions and plans of the central banks of the United States and the European Union. The Fed raises interest rates, and the ECB continues to "wait for the right moment," watching inflation grow. The difference between the values of rates in the US and the EU is growing every month, becoming more and more, and this, let me remind you, is a very serious factor for traders in favor of buying US currency. And it has been so for six months since the Fed first raised its rates. From my point of view, this is the most important factor for traders, and the US dollar can continue to grow.

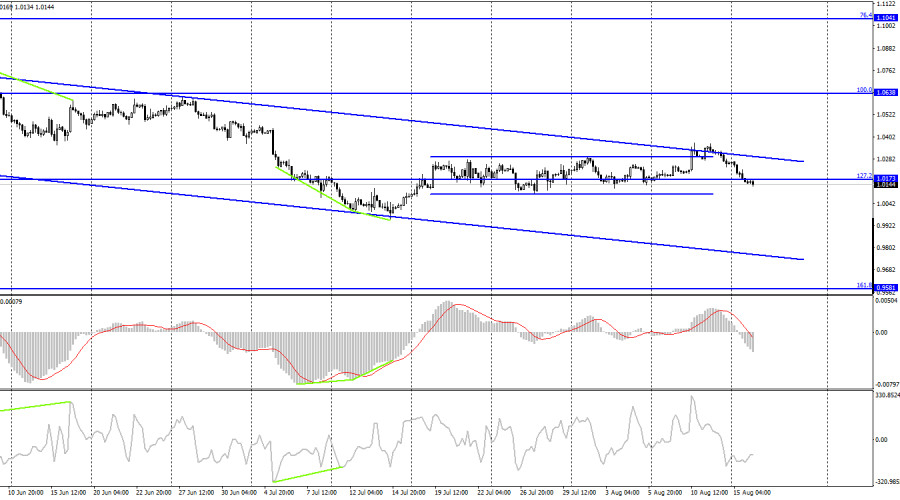

On the 4-hour chart, the pair reversed in favor of the US currency and anchored under the corrective level of 127.2% (1.0173). The pair failed to consolidate over the descending trend corridor, which continues to characterize the current mood of traders as "bearish." Thus, the fall can be continued in the direction of the Fibo level of 161.8% (0.9581).

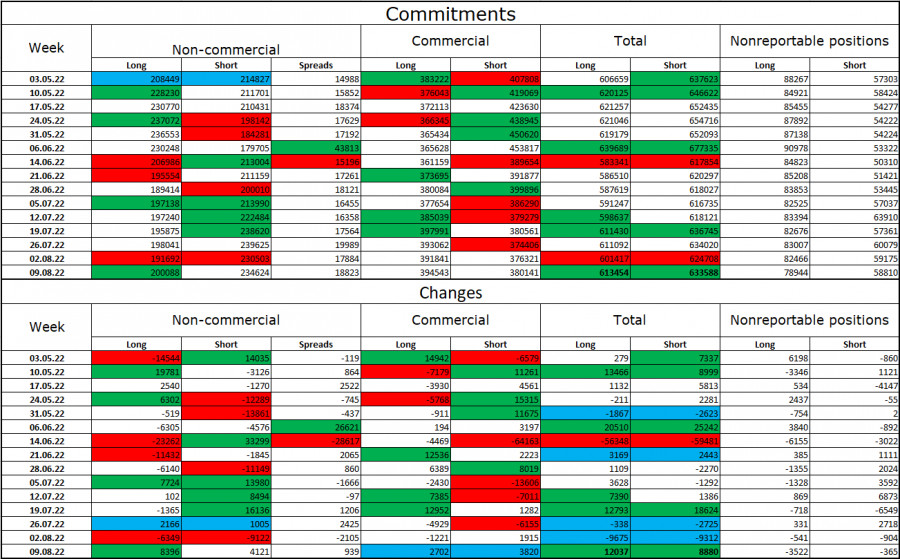

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 8,396 long contracts and 4,121 short contracts. It means that the "bearish" mood of the major players has become a little weaker, but it has remained. The total number of long contracts concentrated in the hands of speculators is now 200 thousand, and short contracts – 234 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually increasing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro currency has not been able to show convincing growth in the last five weeks. Thus, it is still difficult for me to count on the strong growth of the euro currency. So far, I am inclined to resume the fall of the euro-dollar pair.

News calendar for the USA and the European Union:

On August 16, the calendars of economic events of the European Union and the United States do not contain a single interesting entry. The influence of the information background on the mood of traders today will be absent.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair when anchoring under the 1.0196 level on the hourly chart with a target of 1.0080. Now, these deals can be kept. I do not recommend buying the euro currency yet, since the probability of a fall is now high.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.