The EUR/USD pair continues to move sideways in the short term, that's why we have to wait for fresh trading opportunities before taking action. It is trading at 1.0201 at the time of writing and most likely will challenge the 1.0200 psychological level.

Surprisingly or not, the USD remains sluggish, even though the Non-Farm Employment Change, Unemployment Rate, and Average Hourly Earnings came in better than expected on Friday. Today, the Euro-zone Sentix Investor Confidence came in at -25.2 points versus -29.1 expected. Tomorrow, the US NFIB Small Business index, Prelim Nonfarm Productivity, and Prelim Unit Labor Costs could bring more volatility. Still, only the US inflation figures could help the price escape from the current extended range. The CPI and Core CPI are seen as high-impact events on Wednesday.

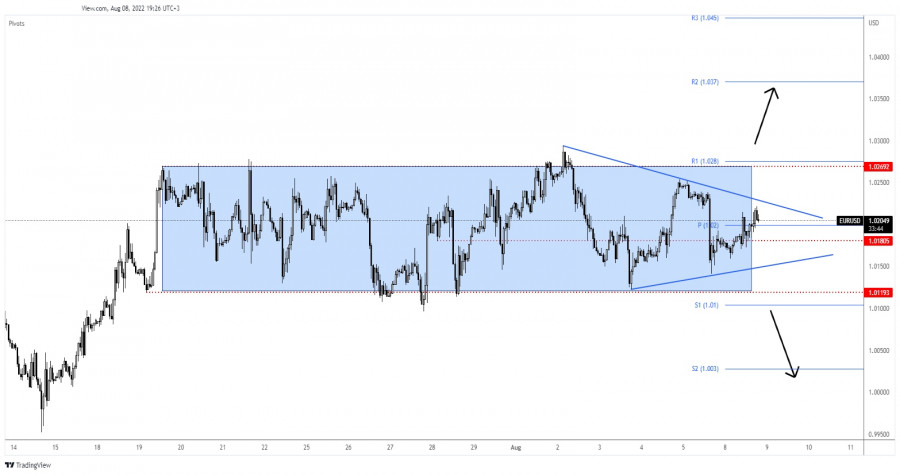

EUR/USD Symmetrical Triangle!

EUR/USD is trapped between 1.0269 and 1.0119 levels and now it has developed a symmetrical triangle inside this range. Only escaping from these patterns could bring new trading opportunities.

In the short term, it continues to move sideways. Most likely the rate will explode after the US inflation figures. The triangle's upside line and the 1.0269 are seen as upside obstacles, while the downside line and 1.0119 represent downside obstacles.

EUR/USD Forecast!

Personally, I'll wait for a valid breakout through 1.0269 or below 1.0119 before taking action. In the medium to the long term, the bias remains bearish. Dropping and stabilizing below 1.0119 and under the S1 (1.0100) activates more declines and brings new short opportunities.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.