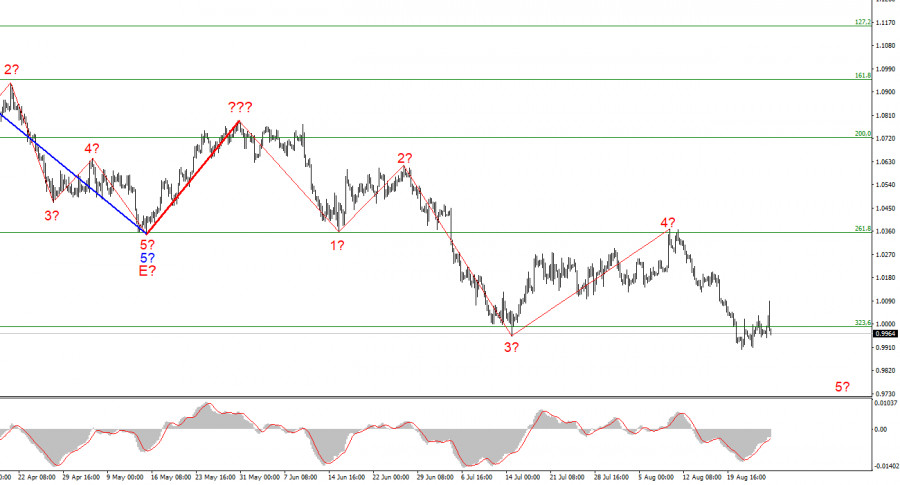

The wave marking of the 4-hour chart for the euro/dollar instrument at the moment still does not require adjustments, although wave 4 turned out to be longer than I expected. The whole wave structure can become more complicated once again, but any structure can always take a more complex and extended form. The construction of an ascending wave has been completed, which is interpreted as wave 4 of the downward trend section. If this is the case, the instrument continues to build a descending wave 5. The assumed wave 4 has taken a five-wave but corrective form. However, it can still be considered wave 4. There are no grounds to assume the completion of the downward trend segment yet. A successful attempt to break through the 0.9989 mark, which corresponds to 323.6% Fibonacci, indicates the market's readiness to continue reducing demand for the euro. I expect the decline in the quotes of the instrument will continue with targets located below the 1.0000 mark within wave 5. Wave 5 can take on almost any length since wave 4 was much longer than wave 2.

Wave marking remains in the first place

The euro/dollar instrument rose by 120 basis points during the day on Friday but fell by 130 within a few hours before the market closed. It's no secret that Jerome Powell spoke on Friday evening and made several important statements. Although he did not directly answer the question of what rate hike the markets should expect in September, he clarified that the tightening of monetary policy would continue. From my point of view, his performance went as it should have. If Powell had clearly said every month before the next meeting how much the rate would be raised or lowered, what would be the point of waiting for the meeting and its results? Many FOMC members believe responding to inflation reports when adjusting the PEPP is necessary. In other words, if inflation continues to decline, there will be no rush to raise the rate, and the Fed will gradually switch to 50-point or 25-point steps. If not, then another 75-point rate increase would be appropriate. It is not important for the US currency which steps the Fed will take to raise the rate. In any case, we are talking about tightening the PEPP. Therefore, the demand for the US dollar may continue to grow compared to the demand for the euro. If this is true, wave 5 may take on a more extended form and the entire downward section of the trend, too, since it may take at least a few more months to bring the interest rate to 3.5-4%. And, most likely, before the beginning of 2023. Thus, it will not be surprising to me if we see the euro at around 90% in six months.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you to sell the instrument with targets near the estimated 0.9397 mark, equivalent to 423.6% Fibonacci, for each MACD signal "down" in the expectation of building a wave.5 So far, I don't see a single signal indicating this wave's end.

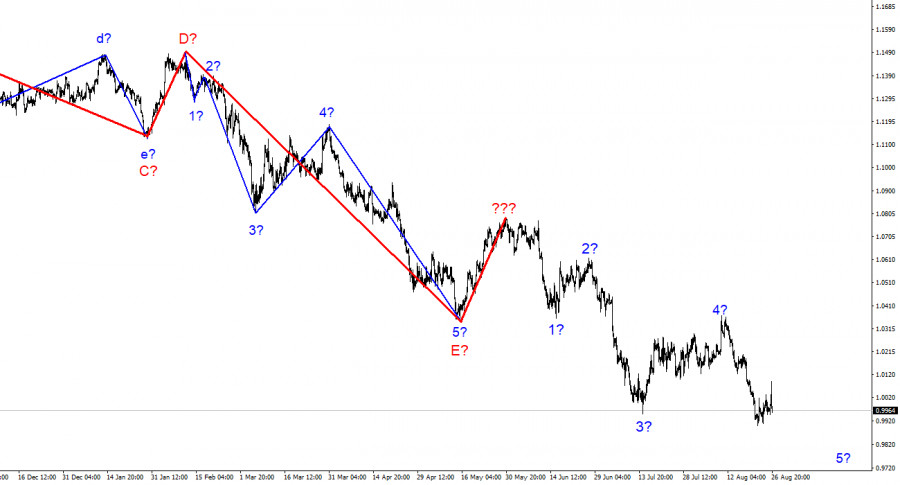

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three and five-wave standard structures from the overall picture and work on them.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.