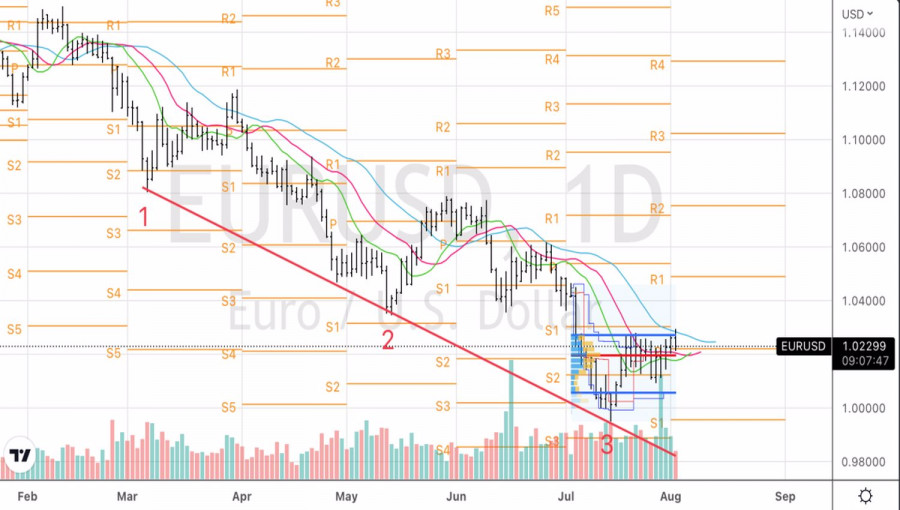

Bulls on EURUSD again attempted to take the main currency pair outside the trading range of 1.01–1.027, but it ended in a fiasco. No matter how much the markets want to sell the US dollar, the euro has so many vulnerabilities that rumors of a slowdown in the process of tightening the Fed's monetary policy will not be enough for the regional currency to break above $1.03 and gain a foothold there. However, we'll wait and see.

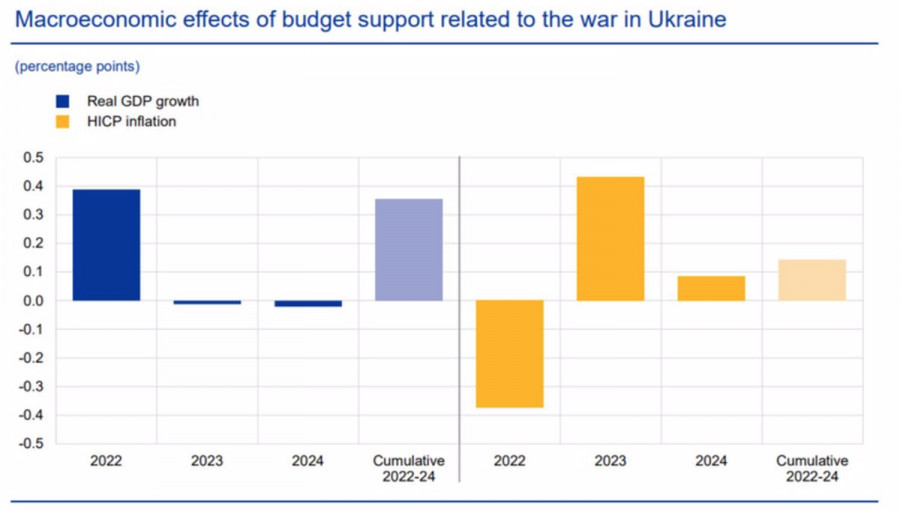

The positive from the Eurozone GDP, which grew by 0.7% QoQ and 2.8% YoY, was a surprise not only for investors, but also for the ECB. The Central Bank tried to explain the strong statistics by fiscal stimulus, which the governments of the countries of the currency bloc are using to mitigate the consequences of the energy crisis. Allegedly, fiscal assistance added 0.4 percentage points to the gross domestic product in 2022 and somewhat slowed down inflation. However, in 2023 the situation will change: the impact of stimulus on the economy will be exhausted, consumer prices, on the contrary, will rise.

Impact of fiscal stimulus on European GDP and inflation

Despite the strong statistics for the first half of the year, investors do not expect anything good from the second. Data on business activity, retail sales in Germany, which showed the worst dynamics since the beginning of accounting in 1994, and other indicators signal an approaching recession. The latter, by the way, may slow down the process of monetary restriction of the ECB and put pressure on EURUSD. Money markets, in particular, have lowered their expectations on the size of the increase in the deposit rate to a peak value from +200 bps to a modest +100 bps since the beginning of the cycle. This means that after the increase in borrowing costs by 50 bps in July, the next similar step of the European Central Bank will be the last. How can the euro grow in such conditions?

However, there are always two currencies in any pair, and given the importance of the US dollar for the global economy and financial markets, its decline against the background of potentially weak statistics on US employment will allow EURUSD to continue the correction. The labor market is almost the only stronghold of the US economy. The Fed has repeatedly pointed to its strength to substantiate its version that the US are still far from recession. The reduction in employment growth and average wages is a reason to sell the US currency on expectations of a slowdown in the process of monetary restriction by the Fed. The futures market gives an 82% chance that the federal funds rate will rise by 50 bps to 3% in September, although the chances were 44% a week earlier.

On the contrary, a further wage hike will increase the risks of maintaining inflation in the United States at elevated levels and force the Fed to return to its previous aggression with the idea of increasing borrowing costs by 75 bps at the next FOMC meeting. In this scenario, the US dollar will get stronger.

Technically, on the daily chart, EURUSD retains a tendency to consolidate. A break of fair value at 1.019 is a reason to sell the pair.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.