If even aggressive rate hikes don't help the currency, can something save it? Money markets, looking at skyrocketing inflation in the euro area, expect the ECB to raise the deposit rate by 100 bps by October, which on paper should lend a helping hand to the EURUSD. Alas, theory is one thing, and practice is quite another. The more aggressively the European Central Bank tightens monetary policy, the worse the economy will be. The deeper the recession will be, and it is the divergence in US economic growth and the currency bloc that is pushing the major currency pair downward.

Dynamics of the expected ECB rate changes by October

According to JP Morgan, a large increase in borrowing costs does not help the currency if it is done in order to anchor inflationary expectations and hurt GDP. Indeed, many European currencies, including the euro and the pound, are not falling because their issuing central banks are extremely slow. On the contrary, their determination could seriously harm the economy.

On the other hand, what is left for Christine Lagarde and her colleagues to do? If you do not raise rates, the fall of EURUSD can turn into a real nightmare. Europe, dependent on raw materials, is facing rising prices for it, exacerbated by the depreciation of the regional currency. Under such conditions, inflation is growing like mushrooms after rain, and the passivity of the ECB can only accelerate this process.

Dynamics of EURUSD and European inflation

The weakness of the euro is due, among other things, to expectations of a slowdown in the monetary restriction of the European Central Bank in 2023. The futures market predicts an increase in the deposit rate to a peak of 2% by September next year. That is, after a stormy start, the Governing Council will press the brakes. But by then, the federal funds rate may exceed 4%.

The ECB is in an extremely difficult position. And this leaves its mark on the views of its representatives. If Fabio Panetta calls for caution, as an excessively rapid tightening of monetary policy will harm economic growth, Isabel Schnabel, on the contrary, notes the weakness of the euro as a factor contributing to the acceleration of inflation and suggests acting decisively.

The Fed's position looks much simpler. Inflation in the US is slowing, allowing the central bank to slow down but remain determined to keep consumer prices from lingering at elevated levels for long. Fed Chairman Jerome Powell's rhetoric is expected to be hawkish at the Jackson Hole symposium, which is why both US stock indices and EURUSD are falling. Our task is to hold the previously formed shorts on the main currency pair until Powell's speech and then start taking profits on them.

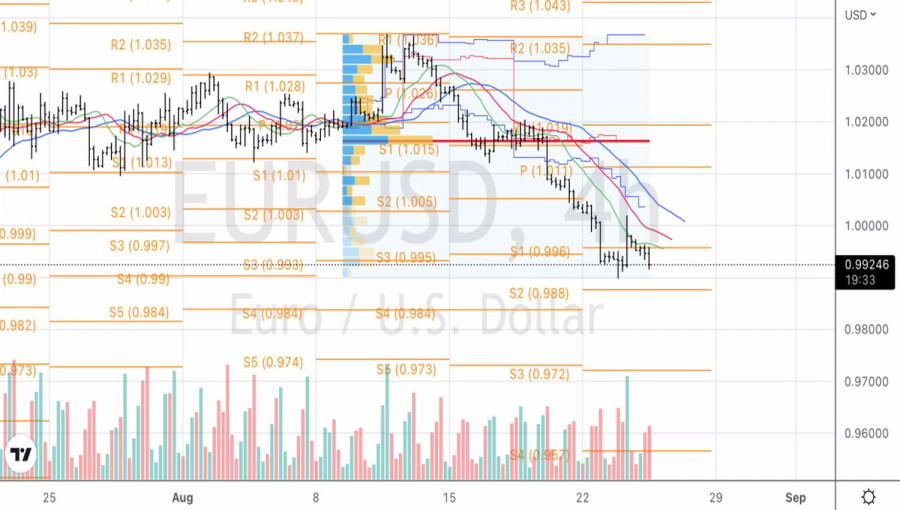

Technically, there was a dead cat bounce on the 4-hour chart of EURUSD, and the rebound from dynamic resistance in the form of a moving average allowed us to build up short positions. At levels 0.984 and 0.972, it makes sense to close some of them.

Trading analysis offered by Flex EA.

Source