The week ahead was setup on Friday by Fed Chair Jerome Powell who expectedly delivered a hawkish slant to his address. He touched on the misalignment of demand and supply factors and the steps required (hiking rates) to realign the current high demand and low supply backdrop. Mr. Powell emphasized the Fed’s mandate to maintain price stability by forcefully using its tools to quell inflationary pressures before they become entrenched.

The ECB now faces a tougher task as central bank divergence seems to be increasing once more. The job of the ECB is far fiddlier than the U.S. juggling multiple nations under a deteriorating fundamental setting and should keep the euro depressed through 2022.

The lead up to Jackson Hole saw nothing of significance in the ECB minutes last week but there was mention of concern around the euro. The recent euro weakness will naturally contribute to inflationary pressures and trying to find a floor for the euro will prove difficult considering the grim economic outlook on the eurozone.

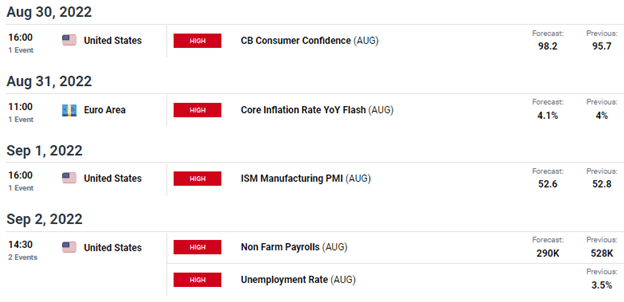

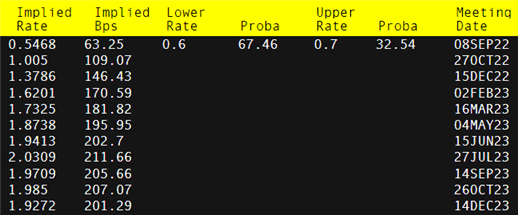

The upcoming week holds some notable events (see economic calendar below) but from a EU perspective, core inflation will rank highly for euro pundits. Core inflation is expected higher at 4.1% and may add further pressure on the ECB to continue it’s hiking cycle. Currently, money markets anticipate a 63bps rate hike in the September meeting as shown in the table below – up almost 6bps post-Jackson Hole! Continued hikes post September could be risky as the winter months are likely to put further strain on the energy complex (higher prices) and with recession talk being thrown around (albeit underplayed by the ECB), higher rates just don’t make sense.

Chart prepared by Warren Venketas, IG

Price actionon thedaily EUR/USD chart was largely unchanged after Fed Chair Powell’s speech, if anything, a slightly stronger euro. I did not expect much in the way of price volatility under these circumstances as markets had adequately priced in a hawkish speech. While the Relative Strength Index (RSI) indicates bullish divergence, the recent cluster of candlesticks may be forming a bear flag chart pattern (blue) bringing into consideration parity and beyond flag support break.

Resistance levels:

Support levels:

IGCS shows retail traders are currently LONG on EUR/USD, with 66% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term cautious bias.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.