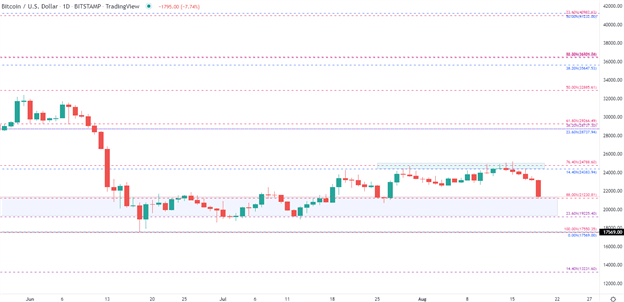

Bitcoin is currently down by 12% for the week (at the time of writing) as digital assets remain vulnerable to monetary policy which has been driving USD strength.

Visit DailyFX Education to Learn About the Impact of Politics on Global Markets

The same fundamental factors that have been driving markets since the invasion of Ukraine remain a concern for cryptocurrency. With energy prices, rampant inflation and dampened sentiment weighing on risk assets, rate expectations have recently appeared to be the primary catalyst for price action.

After being rejected by the $25,000 resistance level late last week, the release of the FOMC minutes on August 17 revealed that the Federal Reserve will continue to be pursue QT (quantitative tightening) by raising rates aggressively until inflation has been tamed. This poses and additional threat to the broader crypto market while supporting the safe-haven Dollar.

Chart prepared by Tammy Da Costa using TradingView

ETH 2.0 is expected to be launch on September 15th which would successfully complete the transition to a proof of stake (PoS) network. With the merge expected to reduce the energy consumption for processing transactions, Ethereum has ended its six-week rally, falling towards the July low at $1,656.

Chart prepared by Tammy Da Costa using TradingView

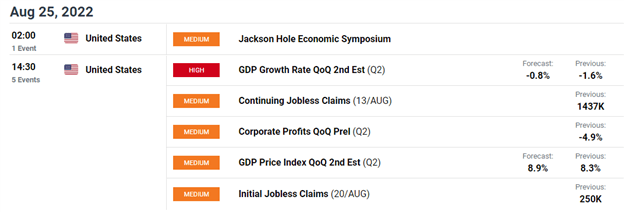

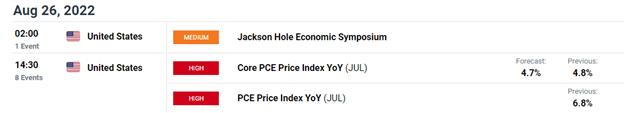

For the remainder of the month, Core PCI, Fed Chair Powell’s speech, Michigan sentiment and the Jackson hole economic policy symposium taking place from 25 – 27 August will likely reverberate throughout crypto markets.

DailyFX Economic Calendar

For those unfamiliar with this event, the annual conference hosts prominent market players including central bankers and finance ministers from across the globe. With this year’s topic focused on ‘reassessing constraints on the economy and policy’, Chair Powell is in the spotlight as investors await confirmation on the trajectory of rate hikes for the remainder of the year. If comments from the symposium likely to shed light on the severity of the current crisis or if rates show no sign of easing anytime soon, cryptos downtrend could see Bitcoin retesting the $18,000 mark.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.