The Australian Dollar finished last week vulnerable to US Dollar strength in response to Federal Reserve Chair Jerome Powell’s much anticipated Jackson Hole symposium address.

His remarks were pretty much in line with expectations, but doubts linger of his dedication to extinguishing inflation.

On one hand, he invoked the inflation fighting spirit of Paul Volker, then in almost the same breath, he revived the extremely loose policy minded Alan Greenspan and Ben Bernanke.

Where exactly Mr Jerome Powell sits on the scale of gumption to fight horrendously high inflation, remains a mystery. Nonetheless, the US Dollar was bought in response.

In terms of the Aussie Dollar, for many years, the RBA has called out stagnant wage growth as a problem within the Australian economy. That might be about to change at a time when it is the last thing that they may want.

In June, the government raised the minimum wage by 5.2%. This week, the Federal government will host a jobs summit and a number of parties have already started media campaigns to push the case for further significant wage increases.

It is hard to argue against wage rises when the cost of living continues to rise with high inflation.

This could create a potential problem for the RBA further down the track. Large wage increases could kickstart a cycle of higher incomes, enabling households to pay more for goods and service. In turn, this pushes the prices of goods and services higher.

This forces the RBA to hike more, increasing the costs of living, putting further upward pressure on wages and so around and around it goes.

It is exactly this wildfire of entrenched inflation that global central banks are desperately trying to hose down.

Without a CPI read until late October, the RBA may take the safe option. Jumbo hikes seem to be off the table for now and 25-basis point rate rises appear to be a safe option for the September and October meetings.

Commodity markets have been favourable for the Aussie of late. Iron ore, copper and gold are firmer over the last week with hopes of a China revival emerging.

Last Monday, the Peoples Bank of China (PBOC) cut interest rates. The 1-year prime loan rate was reduced to 3.65% from 3.7%, while the 5-year prime loan rate was lowered to 4.30% from 4.45%. The moves were slightly different to markets forecasts of 10-basis points for both.

Then on Thursday, Chinese State Council Premier Li Keqiang announced another round of stimulus measures. A 1 trillion Yuan (146 billion USD) 19-point plan to bolster the economy with a focus on infrastructure projects.

While the boost is welcome news, the underlying causes of Chinese economic frailty remain. Namely, the zero-case Covid-19 policy and the problematic property sector.

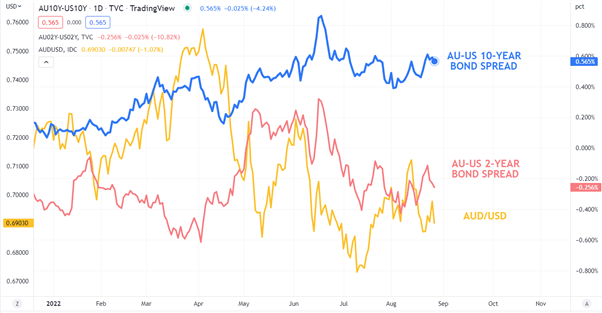

For AUD/USD, the RBA actions are taking a back seat to Fed actions. Changes in expectations around rate increases by the US central bank are driving Treasury yield moves, which are flowing into US Dollar gyrations, pushing AUD/USD around.

The interest rate spread between Australian and US government bonds might be indicative of where AUD/USD could be heading.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.