Long-term perspective.

The GBP/USD currency pair has fallen by 90 points during the current week. It doesn't seem to be that much, but the pair is falling almost constantly if you don't consider those rare and weak corrections commensurate with the meager corrections in the euro currency. If the euro shows a maximum correction equal to 400 points, then the pound is equal to 500 points. That is, both major pairs continue to trade almost identically. The pound sterling finished the week near its 2-year lows, so there is no technical reason to expect the downtrend to end. Recall that usually, the trend ends with a powerful rebound and a sharp movement in the opposite direction. We are not observing this now.

Jerome Powell's speech on Friday assured traders even more strongly that the Fed rate will continue to rise until the end of 2022 and maybe even in 2023. That is, it is still very far from the end of the tightening monetary policy cycle in the fight against inflation. And it is simply impossible to consider decreasing the rate as a "dovish" moment. Thus, no matter how hard the Bank of England tries to raise its rate, the US dollar is still growing. Sometimes it seems to us that the whole "foundation" and "macroeconomics" from the UK or the EU do not matter to market participants. If they had, then the pound and the euro, at least from time to time, showed slightly different movements. At the same time, we will again focus on the fact that the Bank of England, unlike the ECB, raises its rate. Thus, the pound could show at least a weaker rate of decline against the US currency. I would also like to note that the probability of a recession in the US and the UK is almost the same. It cannot be said that the pound is falling now due to a higher probability of a stronger recession in the UK than in the United States. Consequently, geopolitics and divergence of BA and Fed rates remain the main factors of the pound's sell-off in the market.COT analysis.

The latest COT report on the British pound was quite interesting. During the week, the Non-commercial group opened 14.7 thousand buy contracts and 9.5 thousand sell contracts. Thus, the net position of non-commercial traders increased by 5.2 thousand at once. Despite the growth of this indicator for several months now, the mood of major players remains "pronounced bearish," which is seen by the second indicator in the illustration above (purple bars below zero = "bearish" mood). It should be paid tribute that in recent months the net position of the "Non-commercial" group has constantly been growing, but the pound shows only a very weak tendency to grow. And even then, only from time to time. And now its decline has resumed altogether, so the "bearish" mood of major players may soon begin to intensify again. The Non-commercial group has opened 86 thousand sales contracts and 58 thousand purchase contracts. The difference is not as frightening as it was a few months ago, but it is still there. Net positions will have to grow for a long time for these figures to at least level up.

Moreover, COT reports reflect the mood of major players, and the "foundation" and geopolitics affect their mood. If they remain as failed as they are now, the pound may be at a "downward peak" for a long time. It should also be recalled that it is not only the demand for the pound that matters but also the demand for the dollar, which remains very high. Therefore, even if the demand for the British currency grows, if the demand for the dollar grows faster, then we will not see a strengthening of the pound.

Analysis of fundamental events.

In the UK, business activity indices were also published this week. Only one failed – in the manufacturing sector, the reduction was as much as 6.1 points, and the index was 46 points in August. Thus, the British economy is racing towards recession at full speed. In the States, with business activity, everything is just "fine." In the service sector, the index has already dropped to 44.1 points. In addition, the increase in orders for long-term goods in July amounted to 0%, and the final value of GDP for the second quarter is -0.6% q/q. Well, the personal income and expenses of the American population grew much weaker in July than predicted. As you can see, the dollar had few reasons to rejoice, but what difference does it make in how many reasons it has if the market buys it anyway?

Trading plan for the week of August 29 – September 2:

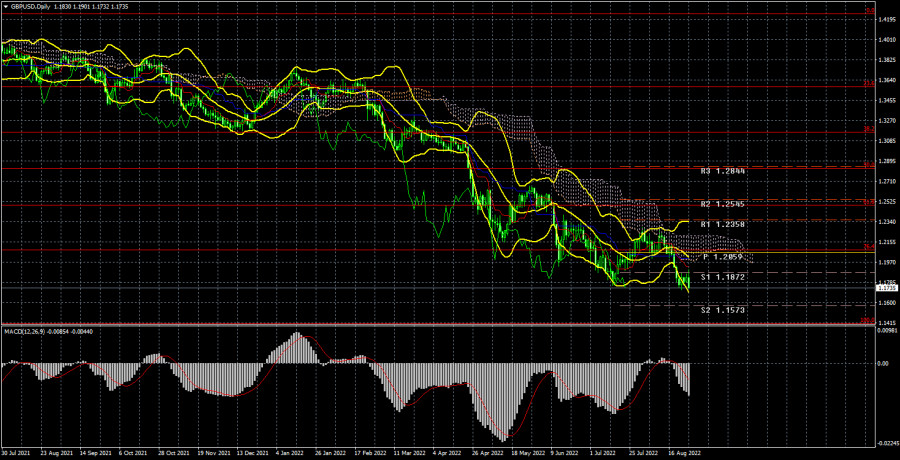

1) The pound/dollar pair maintains a long-term downward trend and is below the critical line this week. Above the Ichimoku cloud, it failed to gain a foothold, so everything suggests that the downward movement of the pair will continue for some time. Therefore, purchases are not relevant now.

2) The pound continues to be near its 2-year lows and may update many more times in 2022. Since the pair has returned to the area below the critical line, this may provoke a new round of falling of the pound with a target of 1.1410 (100.0% Fibonacci). And these are the absolute lows of the pound over the past 30 years. So far, we do not see how the pound can show a significant increase.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.