Long-term perspective.

The EUR/USD currency pair has lost about 90 points during the current week. Thus, we can immediately conclude that the global downward trend persists, and the euro continues to fall. The pair made sluggish attempts to adjust a little from Tuesday to Thursday, but nothing came of it. Recall that within the framework of the entire global downward trend, which has lasted for more than a year and a half, the maximum correction of the pair was 400 points. That's how the euro currency adjusted a couple of weeks ago. And then, having considered its mission accomplished, it rushed down again. At the same time, it rushed without any "push" in the form of a fundamental event or a macroeconomic report. It just resumed a landslide fall. In the same week, traders took a short pause against the background of Friday's speech by Jerome Powell. The Jackson Hole Symposium is a simple economic conference. We did not expect the head of the Fed to radically change his rhetoric in the short period that has passed since the last meeting. We did not expect Powell to gush with new revelations and openly declare the Fed's plans for the coming months. And so it turned out in reality. Powell only confirmed that the fight against inflation is the first goal for the Fed, and rates will continue to rise and remain at levels that will restrain economic activity in the United States for some time. That is, we have received another "hawkish" signal. Powell also confirmed that the growth rate would begin to decline at some time, but he did not say a word about the September meeting and a possible rate increase of only 0.5%. Therefore, the probability of an increase of 0.75% remains. The head of the Fed also confirmed that current statistical data, particularly on inflation, will be of great importance. A report for August will be released, based on which a decision can be made on September 20–21. As a result, the euro ended the week just 50 points from its 20-year lows and is likely to continue falling.

COT analysis.

COT reports on the euro currency in the last few months reflect what is happening in the euro/dollar pair. For most of 2022, they showed a frank "bullish" mood of professional players, but at the same time, the European currency was steadily falling. At the moment, the situation is different, but it is not in favor of the euro currency. If earlier the mood was "bullish" and the euro currency was falling, now the mood is "bearish," and the euro currency is also falling. Therefore, we do not see any reason for the euro to grow because most factors remain against it. During the reporting week, the number of buy contracts from the "Non-commercial" group increased by 11.6 thousand, and the number of shorts – by 12.9 thousand. Accordingly, the net position increased by about 1.3 thousand contracts. After several weeks of weak growth, the decline in this indicator has resumed, and the mood of major players remains "bearish." From our point of view, this fact very eloquently indicates that, at this time, even professional traders still do not believe in the euro currency. The number of buy contracts is lower than sell contracts for non-commercial traders by 44 thousand. Therefore, we can state that not only the demand for the US dollar remains high, but also the demand for the euro is quite low. The fact that major players are not in a hurry to buy euros may lead to a new, even greater drop. Over the past six months or a year, the euro currency has not been able to show even a tangible correction, let alone something more.

Analysis of fundamental events.

There were few macroeconomic statistics in the European Union this week. By and large, traders could only pay attention to business activity indices. And all three indicators decreased compared to the previous month. At the same time, two of the three indicators fell below the level of 50.0, which is critical. Such a fall may be a harbinger of a recession in the economy, but who can be surprised by this statement now? In the States, the economy has been shrinking for two quarters.

Moreover, in the European Union, everyone talks about a winter recession triggered by the energy crisis. And at the same time, the dollar continues to break all value records against the euro currency. Therefore, we can say statistics did not affect the market's mood. Most global factors remain on the side of the US currency.

Trading plan for the week of August 29 – September 2:

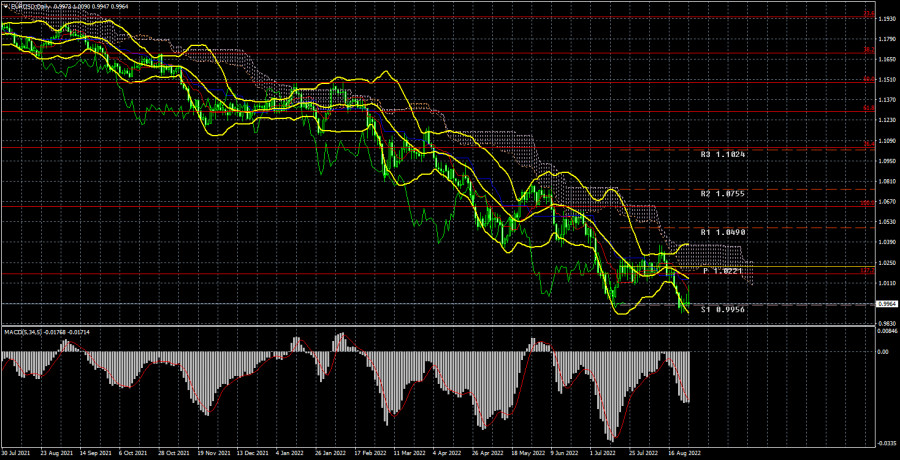

1) On the 24-hour timeframe, the pair resumed moving South. Almost all factors still speak in favor of the long-term growth of the US dollar, and the situation has not changed for a very long time. Traders failed to overcome the Ichimoku cloud, so the upward movement and purchases of the euro currency are still irrelevant. To do this, you must wait at least for consolidation above the Senkou Span B line and only consider long positions.

2) The sales of the euro/dollar pair are still more relevant now. The price has overcome the critical line, so we expect the fall to continue with a target of 0.9582 (161.8% Fibonacci). In the future, if the fundamental background continues to remain the same as it is now and geopolitics deteriorates, the euro currency may fall even lower.Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.