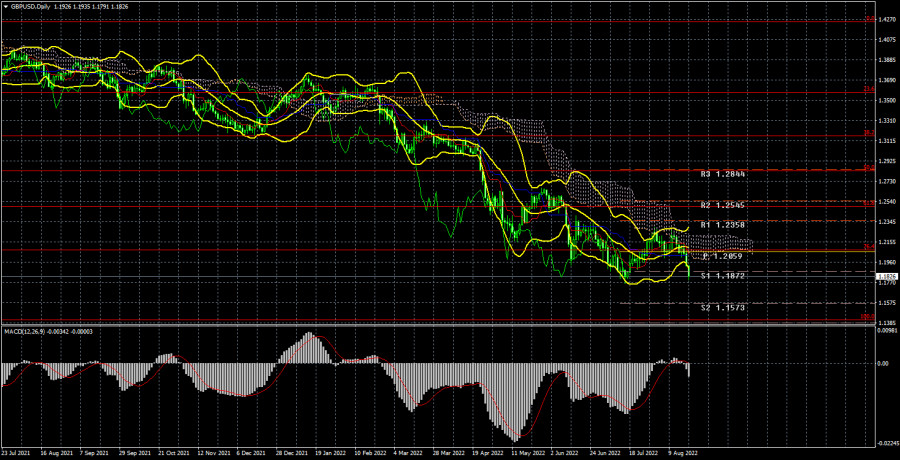

Long-term perspective.

The GBP/USD currency pair has fallen by 300 points during the current week. Again, we can make an unambiguous conclusion that the euro and the pound traded almost identically. Why did the pound fall? There were quite a lot of macroeconomic statistics in the UK this week, but the most important one was the inflation report. It showed that prices accelerated by 10.1% compared to July last year, and provoked a fall in the pound. However, we cannot say that the pound has been falling all week because of this report alone. After all, the euro currency was also declining at that time. Therefore, the inflation report, which was supposed to provoke the growth of the British currency in a good way, turned out to be just a "cherry on the cake." The foundation and geopolitics for the pound remain almost as negative as for the euro, and after an upward correction of 500 points, due to which the pair could not even gain a foothold above the cloud, traders simply resumed selling the pair, which they were not going to abandon. And the inflation report, which a couple of months ago could have been interpreted as a positive moment for the pound, can no longer be perceived as such. If earlier, at each acceleration of inflation, it was possible to expect an increase in the aggressiveness of the Bank of England in raising the key rate, now, when the British economy is already preparing for a powerful recession, further rate increases are no longer at all obvious. The Bank of England has raised the rate six times in a row, and inflation has been growing and continues to grow. The "gas issue" concerns Britain too, because prices for "blue fuel" are rising everywhere, not just in the European Union. Well, the US dollar still looks the most attractive for traders.COT analysis.

The latest COT report on the British pound was again not impressive. During the week, the Non-commercial group opened 1.8 thousand buy contracts and 0.5 thousand sell contracts. Thus, the net position of non-commercial traders increased by 2.3 thousand at once, but for the pound sterling, this is a minimal change. Despite the growth of this indicator, the mood of major players remains "pronounced bearish", which is seen by the second indicator in the illustration above (purple bars below zero = "bearish" mood). It should be paid tribute that in recent months the net position of the "non-commercial" group has been constantly growing, but the pound shows only a very weak tendency to grow. And now its decline has resumed altogether, so the "bearish" mood of major players may increase in the near future. The non-commercial group has now opened a total of 77 thousand sales contracts and 44 thousand purchase contracts. That is, the difference is almost twofold. Net positions will have to show growth for a long time for these figures to at least level up. Moreover, COT reports are a reflection of the moods of major players, and the "foundation" and geopolitics affect their moods. If they remain as failed as they are now, then the pound may be at a "downward peak" for a long time. It should also be noted that when the green and red lines of the first indicator are very far from each other, this is a harbinger of the end of the current trend. But in our case, these lines have been converging for several months in a row, but the pound has been falling and falling in the long run anyway.

Analysis of fundamental events.

In the UK this week, in addition to inflation, reports on unemployment, applications for unemployment benefits, wages, and retail sales were published. Moreover, some of these reports, for example, unemployment and retail sales, turned out to be quite good. However, the pound sterling failed to extract any benefit from this data. It turns out that market participants did not need macroeconomic statistics, which only confirms our assumptions about the fundamental and geopolitical nature of the fall of the pound sterling. There were practically no important events in the States this week. The Fed's minutes only once again confirmed what everyone has known for a long time: the regulator will continue to raise the rate, struggling with high inflation.

Trading plan for the week of August 22-26:

1) The pound/dollar pair as a whole maintains a long-term downward trend and has consolidated below the critical line this week. Above the Ichimoku cloud, it also failed to gain a foothold, so everything suggests that the downward movement of the pair will continue for some time. Therefore, purchases are not relevant now and, as we can see, even overcoming the Kijun-sen line does not make them relevant.

2) The pound continues to be near its 2-year lows and may update many more times in 2022. Since the pair has returned to the area below the critical line, this may provoke a new round of falling of the pound with a target of 1.1410 (100.0% Fibonacci). And these are the absolute lows of the pound over the past 30 years. So far, we do not see how the pound can show a significant increase.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – levels that are targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.