USD/CAD extends the series of lower highs and lows from the yearly high (1.3083) even as Canada’s Employment report shows an unexpected decline in job growth, and the exchange rate may face a larger correction ahead of the Bank of Canada (BoC) interest rate decision as the central bank is expected to normalize monetary policy at a faster pace.

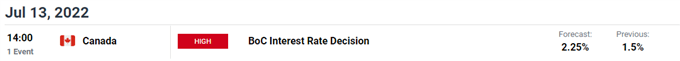

USD/CAD appears to be falling back toward the 50-Day SMA (1.2844) after clearing the June range, and it remains to be seen if the exchange rate will track the positive slope in the moving average as the BoC is anticipated to deliver a 75bp rate hike on July 13.

A shift in the BoC’s approach for normalizing monetary policy may keep USD/CAD under pressure as the “Governing Council is prepared to act more forcefully if needed to meet its commitment to achieve the 2% inflation target,” and the developments coming out of the central bank may sway the near-term outlook for the exchange rate if the updated Monetary Policy Report (MPR) reveals a higher neutral rate of interest.

As a result, the advance from the monthly low (1.2837) may continue to unravel if Governor Tiff Macklem and Co. highlight a steeper path for the benchmark interest rate, but a 50b rate hike may undermine the recent pullback in USD/CAD as the Federal Reserve shows a greater willingness to implement a restrictive policy.

With that said, more of the same from the BoC may generate a bearish reaction in the Canadian Dollar as the central bank follows a steady approach in normalizing monetary policy, but a 75bp rate hike may push USD/CAD toward the 50-Day SMA (1.2844) as market participants brace for a more aggressive hiking cycle.

Follow me on Twitter at @DavidJSong

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.