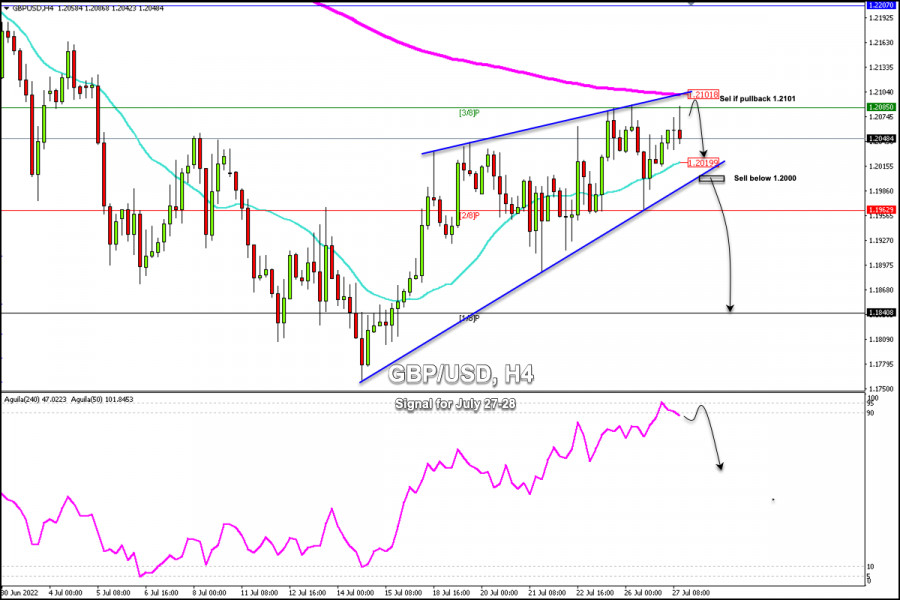

According to the 4-hour chart, the British pound is trading below the 200 EMA located at 1.2108 and below the strong resistance of 3/8 Murray at 1.2085.

Strong resistance has been established at 1.2085 which has prevented the British pound from a further rise. In the next few hours, the Fed's policy update will be released. The regulator is expected to increase the interest rate, which could spark off a strong movement in the British pound.

Bullish optimism for GBP remains in play as long as the sterling trades above the 21 SMA located at 1.2019. The pound is expected to continue rising and could reach the resistance of 1.2101 (200 EMA).

Conversely, with a sharp break of the rising wedge pattern and a close below the psychological level of 1.20, we could expect an acceleration to the downside towards the support zone of 2/8 Murray at 1.1962 and even to 1/8 Murray at 1.1840.

On July 26, the eagle indicator reached the overbought zone, so a technical correction is likely in the next few hours. We could expect the GBP/USD pair to fall towards levels of 1.20 and 1.1962.

Our trading plan for the next few hours is to wait for a pullback towards 1.2101 to sell or wait for a sharp break below the psychological level of 1.2000 to sell with targets at 1.1962 (3/8 Murray), 1.1890, and 1.1840 (2/8 Murray).

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.