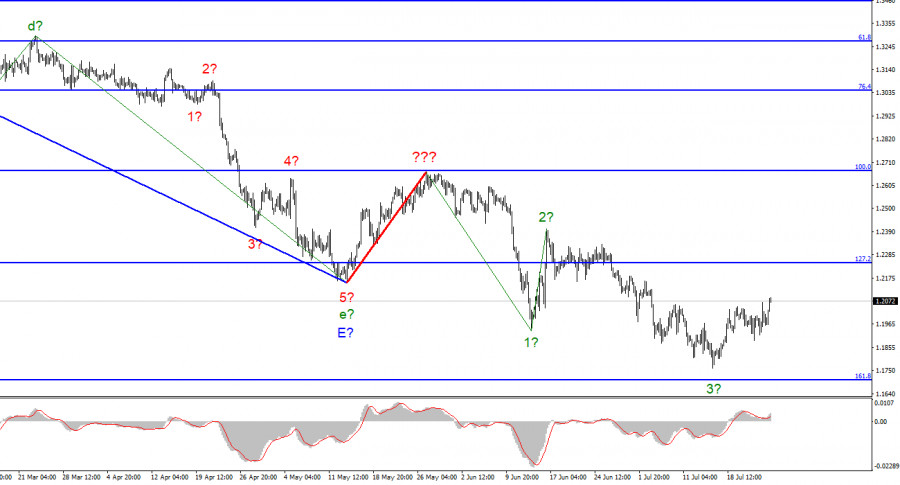

The wave marking required clarification for the pound/dollar instrument, and such was made. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, we can say that the construction of the upward correction section of the trend is canceled, and the downward section of the trend will take a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. It would be much more practical to identify rare corrective waves, after which new impulse structures would be built. We have completed waves 1, 2, and 3, so we can assume that the instrument is now building wave 4. The wave markings of the euro and the pound are slightly different in that the downward trend section for the euro has an impulse form (for now). But the ascending and descending waves alternate almost equally. After the completion of wave 4, I expect a new decline in the British.

The British political crisis may worsen.

The exchange rate of the pound/dollar instrument increased by 70 basis points on July 25, but everything will be decided this Wednesday. I have already discussed the FOMC meeting, so I will not repeat myself. Instead, I would like to focus your attention on the election of the Prime Minister in the UK. Although the race is already nearing its conclusion, many publications and analysts look at everything happening with pessimism. Many believe that in rather difficult times, unity within the ruling party is needed for the country more than ever. And there is very little unity there now.

To begin with, Boris Johnson, like his predecessor Theresa May, could not hold on to his post until the end of his term. It means that his actions did not satisfy the majority of his fellow party members. The question is, who will be the next prime minister: Liz Truss or Rishi Sunak? It is noteworthy that the two candidates are very different and offer completely different ways out of the crisis. Liz Truss is in favor of tax cuts, and Rishi Sunak is in favor of an increase. This factor could be very important if the people elected the prime minister and not by the conservatives themselves. All members of the Conservative Party will vote, and according to YouGov, which specializes in conducting polls, it is Liz Truss who is leading, not Sunak, who won all five intermediate rounds. Boris Johnson opposes Sunak, and many politicians consider him an excellent financier but do not consider him the leader of the country and the party. Therefore, we can assume that Elizabeth Truss will win the election. At the same time, whoever wins the race will face a fragmented government and parliament. Labour, which suffered a crushing defeat in the last parliamentary elections, will continue to criticize any Conservative government. And now, we need to make difficult and important decisions without the opposition's support.

General conclusions

The pound/dollar instrument wave pattern has become much more complicated and suggests a further decline. Thus, I advise now selling the instrument with targets near the estimated mark of 1.1708, which is equivalent to 161.8% Fibonacci, for each MACD signal "down." There is a possibility of building an upward wave, but I do not expect it to be strong and extended.

The picture is very similar to the Euro/Dollar instrument at the larger wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.