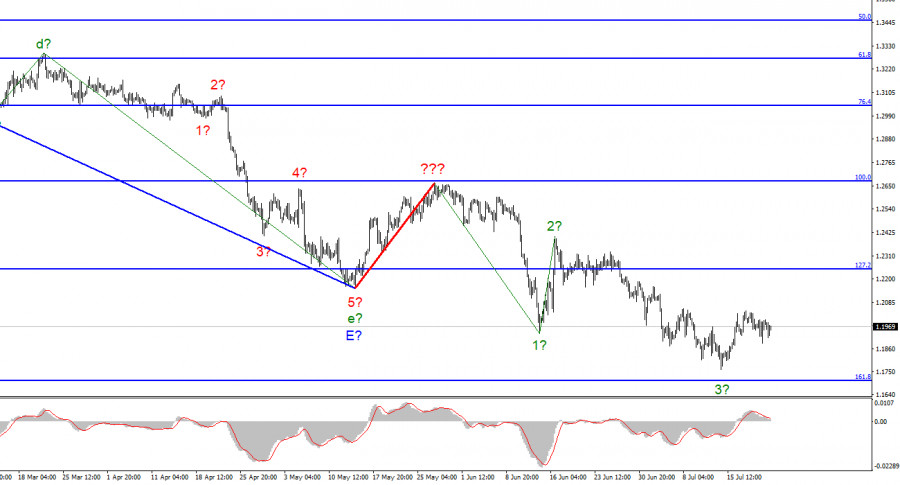

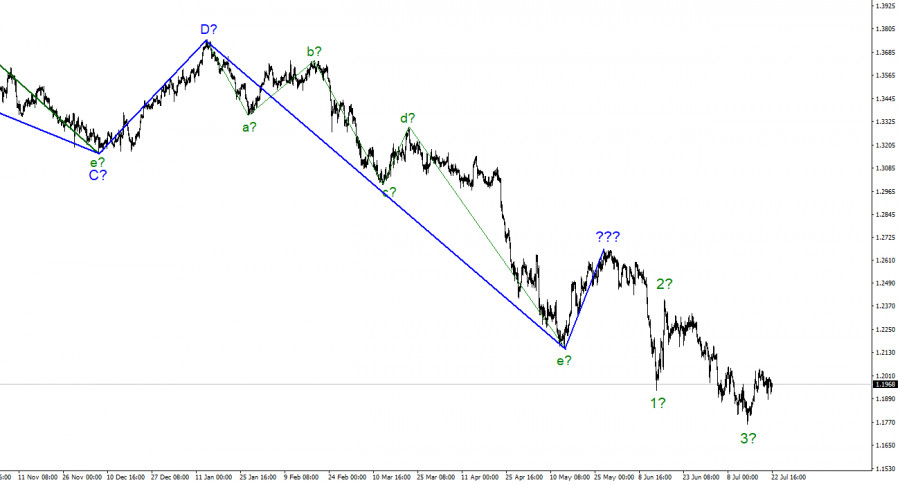

The wave marking for the pound/dollar instrument required clarifications, which were made. The upward wave constructed between May 13 and May 27 does not currently fit into the overall wave picture, but it can still be regarded as a segment of the downward trend. Thus, we can now definitively state that the building of the upward correction phase of the trend has been canceled, and the downward component of the trend will have a longer and more complex shape. I'm not a big fan of continually complicating the wave marking when dealing with a highly elongating trend zone. I believe it would be far more efficient to recognize rare corrective waves, following which new impulse structures can be constructed. Now that waves 1 and 2 have been completed, we may infer that the instrument is in the process of constructing wave 3. However, this wave proved unconvincing (if finished now), as its low is not significantly lower than wave 1's low. Consequently, the current downturn cannot be characterized as impulsive, but it may be a complex correction. Focus on the wave marking of the EUR/USD instrument in this regard.

Furthermore, British data was far from perfect.

The pound and dollar exchange rates jumped by 40 basis points on July 22. The instrument increased by 140 points in the last few hours, although the British pound declined in the first half of the day. I want to point out that the market's reaction to the dismal British and American numbers has been appropriate today. It's only that the American one was a flop, and the British one was ineffective. But let's start in order. June's retail sales volume in the United Kingdom was the first to be revealed. The indicator declined by 0.1% monthly and 5.8% annually. Excluding fuel purchases, the indicator increased 0.4% monthly and is down 5.9% yearly. The market's anticipations were roughly the same. The business activity indices followed. The service sector decreased by 1.0 points, the production sector by 0.6 points, and the overall index fell by 0.9 points. Consequently, none of the British figures exceeded market expectations, and demand for the British decreased until the release of American statistics, which turned out to be much worse.

As stated in the article on the euro currency, two of the three business activity indices went below the 50.0 threshold, resulting in a decline in afternoon demand for the US dollar. This week has been filled with news and reports, but next week promises to be even more exciting. According to the present markup, the euro and the pound must continue to lose demand to develop five-wave structures. At first look, this will be a simple task, as the Fed will nearly entirely increase the rate by 75 basis points. Some analysts estimate that the surge might reach 100 points. From my perspective, this is sufficient to initiate the formation of new downward waves for both instruments. Otherwise, the wave pattern could grow even more complex.

General conclusions

The increased complexity of the wave structure of the pound/dollar pair signals a further downturn. For each "down" MACD signal, I recommend selling the instrument with objectives at the estimated mark of 1.1708, corresponding to 161.8 percent Fibonacci. Now, there is a prospect of an upward wave forming, but I do not anticipate it to be robust and protracted.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.