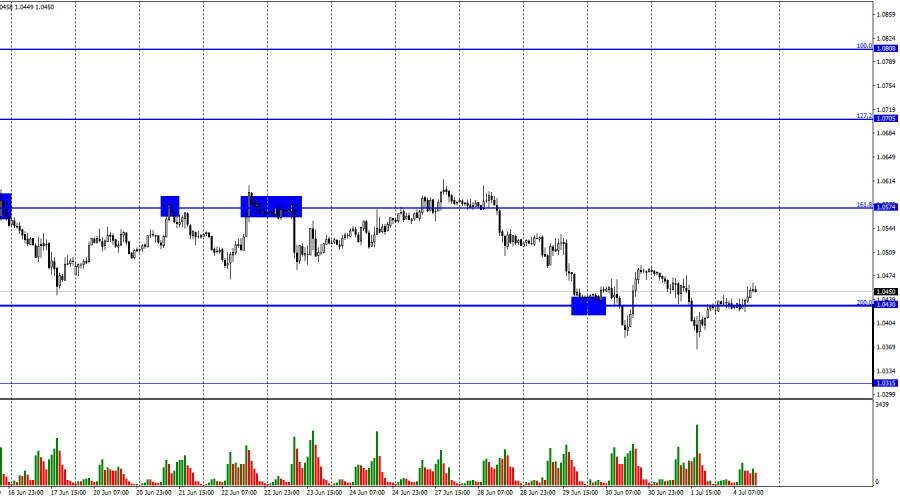

The EUR/USD pair executed a close above this level on Monday after performing a second consecutive consolidation under the corrective level of 200.0% (1.0430). However, this time, the pair were unable to continue sliding. As a result, the graphical analysis provides a buy signal, allowing us to predict that the euro will rise in the direction of the Fibo level of 161.8% (1.0574). The likelihood of a price decline in the direction of the level of 1.0315 will once again grow if there is a new consolidation below the level of 1.0430. The euro/dollar pair has been active for a few weeks. Specifically, it cannot fall much more and keeps circling its multi-year lows.Interestingly, it can't start growing. The euro's pullback or indications of the start of an upward trend won't even be visible on earlier charts. The euro has already been close to 1.0315 three times, but the bears lacked sufficient momentum to carry on losing ground each time.

In the United States, today, Monday, is a holiday commemorating Independence Day. Trading activity is at a zero level, which was to be expected. There will be additional days this week when the background information for the euro will be crucial. Friday will be the most crucial day. The Nonfarm Payrolls data, one of the most crucial events for traders, will be released in the US on this day, while ECB President Christine Lagarde will deliver a speech. Why is Lagarde's speech relevant at this time? Because all the central banks will soon hold regular meetings, though it will happen discreetly and covertly. And the ECB will have to increase interest rates for the first time in a very long time. The fact that rates have increased for the first time in a long time may be what prevents the euro currency from sinking once more. Although I do not believe that the ECB's tightening of monetary policy would aid the euro in beginning a new strong growth, if this does not occur, the euro will undoubtedly plunge even further.

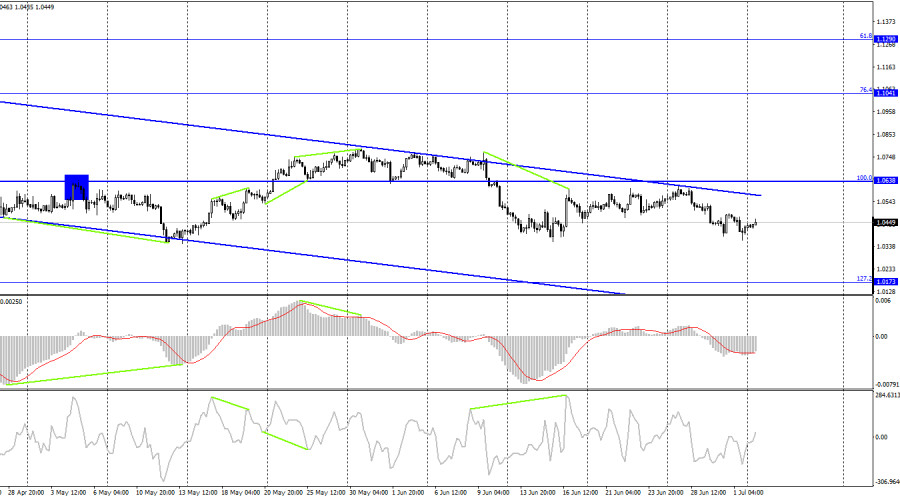

The pair reversed in favor of the US dollar on the 4-hour chart, and the decline toward the corrective level of 127.2% (1.0173) resumed. We can predict the rise of the euro currency in the direction of the corrective level of 76.4% (1.1041) if the pair's rate is fixed above the negative trend corridor, which continues to describe the trading environment as "bearish." Emerging divergences are currently undetectable in any indication.

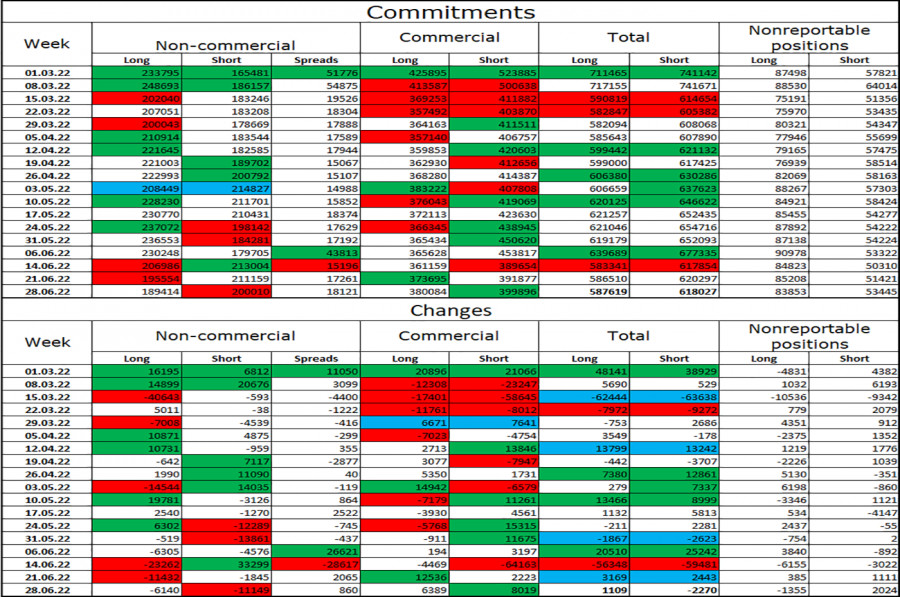

Report on Commitments of Traders (COT):

Speculators closed 6,140 long contracts and 11,149 short contracts over the previous reporting week. It indicates that the key players' "bearish" attitude has slightly waned but is still present. Currently, 189 thousand long futures and 200 thousand short contracts are concentrated in traders' hands. Although there is a slight discrepancy between these numbers, it does not benefit bulls. The euro has mostly maintained a "bullish" sentiment in recent months among "Non-commercial" traders, which did nothing to benefit the euro currency itself. The likelihood of a rise in the euro currency has been progressively increasing over the past few weeks, but recent COT reports have revealed that additional sales of the EU currency may now occur as speculators' sentiment has shifted from "bullish" to "bearish." Neither the Fed nor the ECB has provided the euro with any positive news.

News calendar for the USA and the European Union:

There are no significant entries on the economic calendars for the European Union or the United States on July 4. As I stated, today is a holiday in the USA, whereas the EU calendar is completely blank. As a result, the information background won't impact the traders' attitude today.

Forecast for EUR/USD and trading suggestions:

With a target price of 1.0315, I advise selling the pair right away when it is anchored below the 1.0430 level on the hourly chart. On a 4-hour chart, I advise buying the euro when it is anchored above the corridor with a goal of 1.1401.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.