European inflation is breaking records again. The latest data on the growth of the consumer price index in the eurozone surprised with its green color: all components of the release exceeded the forecast levels. The euro-dollar pair reacted to the data with symbolic, but short-term growth. EUR/USD bulls have not been able to leave the range of 1.0130-1.0290, within which the pair has been trading for two weeks. It is obvious that traders view the report through the prism of the July European Central Bank meeting, following which the central bank raised the rate by 50 basis points. According to general expectations, the central bank will make a similar decision in September. In this context, the July increase in European inflation does not play any decisive role: the central bank is unlikely to decide on more aggressive steps.

Still, the latest report should not be ignored. So, the overall CPI in July jumped again, reaching 8.9% (it was at the level of 8.6% in June). This is another historical record, that is, the highest value of the indicator for the entire history of observations (since 1997). The result was higher than most experts' forecasts: analysts polled by Reuters expected it to come out at 8.7%. The core consumer price index (excluding volatile energy and food prices) also showed strong dynamics, rising to a four percent mark. Analyzing the structure of the release, we can conclude that energy prices have increased the most in the eurozone countries. They increased by almost 40% last month. Food, alcohol and tobacco rose in price by almost 10% in June (there was an increase of 8.9% in May), industrial goods - by 4.5% (4.3% in May). Services increased in price by 3.7%. The strongest rate of inflation growth among the eurozone countries was registered in the three Baltic countries – it amounted to more than 20 percent.

It should be noted here that the core consumer price index in the eurozone on an annualized basis unexpectedly slowed its growth last month, ending up at 3.7% instead of the planned growth to 3.9%. And German inflation last month showed the first signs of slowing down. All these factors suggested that inflationary growth had reached its peak. However, the latest release has decisively crossed out these assumptions.

It is noteworthy that on Friday, EUR/USD bulls were pleased not only with the inflation report, but also with the release of data on the growth of the European economy: the GDP of the eurozone increased by 0.7% from April to June compared to the previous quarter. In annual terms, the indicator also came out in the green zone, at 4.0% (with a growth forecast of 3.4%). However, with a more detailed study, it can be concluded that the situation does not look as rosy as at first glance: the picture changes from one country to another.

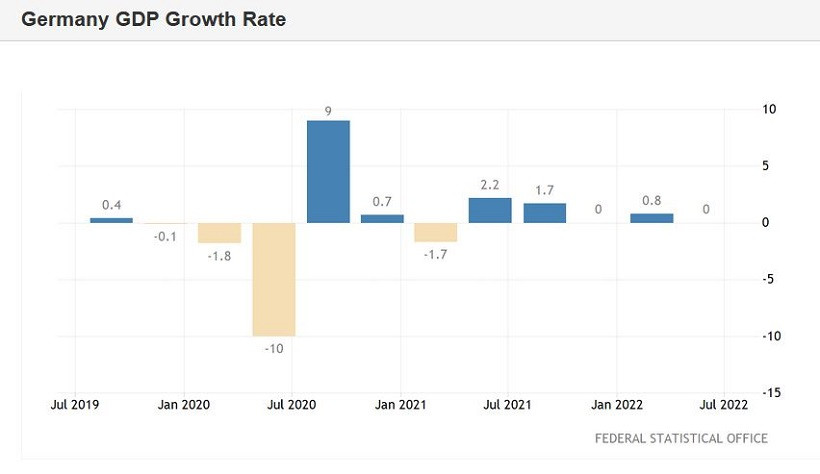

For example, the GDP growth rate in Germany, which is the locomotive of the European economy, disappointed. The German economy stagnated in the second quarter. In the second quarter of this year, German GDP showed zero growth after an increase of 0.8% in the first three months. And judging by indirect signs, as well as macroeconomic indicators (PMI, ZEW, IFO, GfK reports), the situation will only worsen in the third quarter.

Let me remind you that gas prices in Europe have soared by 20% – up to $2,300 per thousand cubic meters – due to Gazprom's reduction in supplies. In addition, this week the eurozone's energy ministers provisionally approved the so-called "compromise version of the agreement on voluntary, temporary reduction of gas use by EU countries." We are talking about reducing dependence on blue fuel from August to March by 15%. And although for some countries this agreement provides for a less drastic reduction, Germany is not included in this list.

I would like to note that last year the European Union received 40% of its gas from Russia, so further sanctions and political confrontation may lead to more sad consequences for the European side. According to the Financial Times, the largest industrial energy consumers in the European Union have already warned that with the arrival of cold weather, some plants may stop. In general, according to a number of economists, during the autumn-winter period, Europeans may face not only a reduction in industrial production, but also power supply failures. Therefore, the pessimism reflected in the reports of the above-mentioned research institutes is quite justified.

Thus, in my opinion, the latest releases are not able to reverse the situation in pairs. Neither the increase in inflation in the eurozone nor the growth of the European economy helped EUR/USD bulls break out of the range of 1.0130-1.0290. Therefore, it is advisable to use any more or less large-scale price growth to open short positions, with targets of 1.0150, 1.0100 and in the medium term – 1.0050.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.