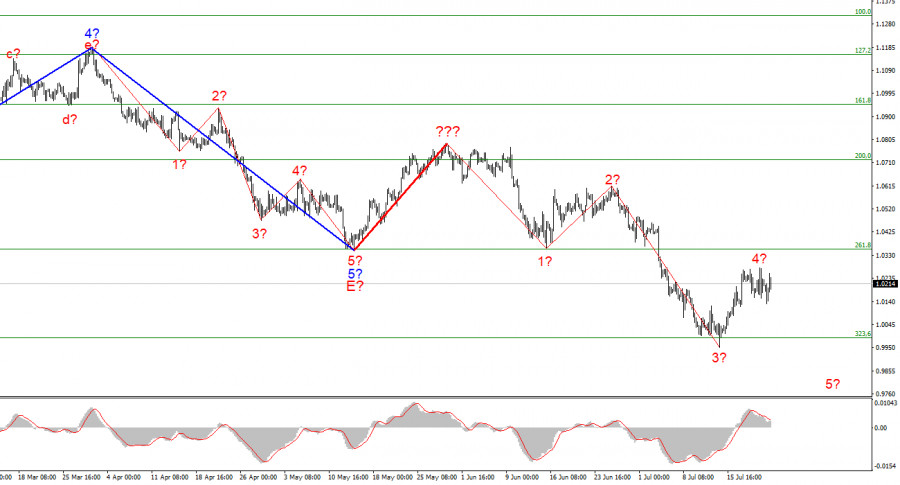

A few weeks ago, the wave markings on the 4-hour chart for the Euro/Dollar instrument got more complex and no longer had a holistic appearance. There was a successful attempt to break through the 261.8 percent Fibonacci level, which was also the low of the waves E and b; hence, these waves are no longer E and b. Thus, I have constructed a new wave markup that does not yet account for the ascending wave indicated by a bold red line. I've already stated that the entire wave structure can be complicated indefinitely. It is the drawback of wave analysis, as any structure is always capable of assuming a more complicated and extensive shape.

Consequently, I propose to now focus on simpler wave structures, including waves of a smaller scale. As shown, the creation of an upward wave, which may be wave 4 of a new downward trend section, is proceeding. If this estimate is accurate, the instrument might gain another 100-150 basis points before resuming its slide within wave 5 with objectives below 1.0000. Additionally, the development of the fifth wave may have already begun. So far, I see no reason to anticipate additional instrument moves.

The resignation of Mario Draghi and the dissolution of the Italian Parliament.

Friday saw the euro/dollar contract decrease by 15 basis points. As I mentioned yesterday, the instrument experienced substantial decreases and increases during the day, but the day ended with the same values as it began. I will not repeat my analysis of yesterday's numbers, but I will state that it was equally negative in the United States and the European Union. However, due to the background of economic news, the market completely disregarded other equally significant developments. One of these is the Italian political turmoil.

Italy has been one of the most difficult nations in the European Union in recent years. During the pandemic, Italy suffered the most economically and demanded the highest rehabilitation grants from the European Union. Its public debt was constantly increasing, and many EU countries accused the Italian government of living beyond its means and expecting other EU countries to fund its lavish lifestyle. Premier Mario Draghi of Italy has resigned for the second time, resulting in the dissolution of Parliament. I do not wish to comprehend this event's causes, as they are of little importance. It is significant that one of the greatest economies in the European Union is racing towards recession at full speed and that its government must now go through a new formation process. These developments do not bolster buyers' optimism or the euro's additional reasons to drop.Nonetheless, this is advantageous for us, as the current wave marking entails building a new falling wave. The next Fed meeting, scheduled for next Wednesday, also looms in the distance. No longer does anyone question that the rate will increase by 75 basis points. Consequently, I believe a new downward wave will form.

General observations.

I infer based on my findings that construction of the downward trend segment continues. Consequently, it is now viable to sell the instrument with goals at the estimated 0.9397 level, which corresponds to 423.6 percent Fibonacci, for each "down" MACD signal generated during the development of wave 5. Wave 4 is currently completeable.

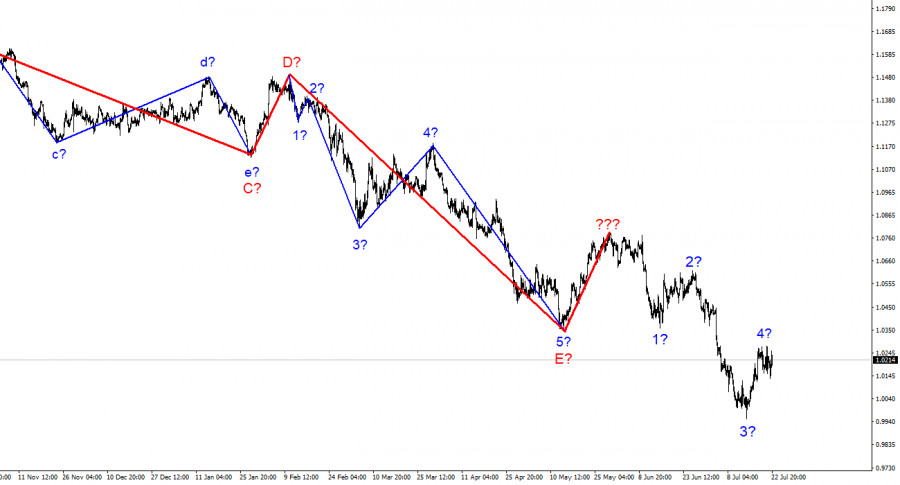

At the larger wave size, the wave marking of the descending trend segment becomes considerably more complex and extends in length. It can assume virtually any length, so I believe it is best to focus on three and five-wave conventional wave shapes for the time being.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.