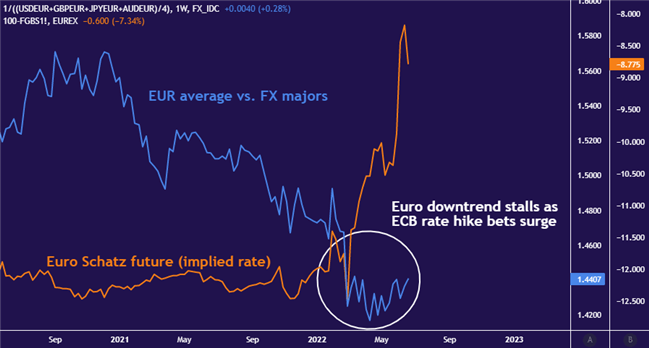

The Euro has steadily depreciated against a basket of major currencies since Dec. 2020. Tellingly, that turning point coincided with topping gold prices and the start of a creep higher in Fed rate hike expectations. The US central bank had signaled it was done adding to Covid-inspired stimulus measures.

Not surprisingly, the overt start of the Fed’s tightening effort in June 2021 marked the beginning of the deepest drop along this bearish trajectory. The markets reckoned the ultra-dovish ECB would not be as quick to follow the US lead as many other top central banks, pushing yield spreads against the Euro.

Then, in the second quarter of 2022, European officials finally signaled a readiness to act as regional CPI inflation roared to record highs. It would go on to hit an eye-watering rate of 8.1 percent in May. The Euro found a floor and began to inch upward as rate hike expectations began to be absorbed into prices.

Speculation culminated on June 9, as the ECB formally announced incoming interest rate hikes. The central bank previously said it would end bond purchases – a form of non-standard stimulus – in July. Less than a week later, an emergency meeting was scrambled and a mandate given to create a new tool against ‘fragmentation.’

That stopped the Euro’s ascent in its tracks. ECB tightening expectations revived worries about high levels of debt in some Eurozone economies. The spread between Italian and benchmark German 10-year government bond yields widened sharply to a two-year high of 242 basis points (bps) after June’s policy meeting.

Managing ‘fragmentation’ – that is, diverging lending rates across Eurozone states – now seems like it will necessarily keep ECB tightening modest relative to global peers. That puts the single currency at an acute disadvantage, suggesting the downtrend is due to resume.

The kind of structural reforms needed to untie the ECB’s hands – creating a joint “Euro-bond” or finally slashing debt levels in southern Europe – seems distant at best, if only because the critical Franco-German push needed for progress is a tall order. Berlin and Paris are likely to be focused on other priorities.

The war in Ukraine and its implications for regional geopolitical and economic stability – most pressingly, the challenge it poses for securing energy supply at a reasonable cost without reliance on Russia – are clearly front-of-mind. Disruption of trade with a key market in China amid that country’s Covid-driven lockdowns is another worry.

A hamstrung administration in the Eurozone’s number-two economy complicates fiscal matters further. French President Emanuel Macron managed to win another term in office, but his coalition lost its majority in the legislature. This means that the fragile government will struggle to get anything big done in the next five years.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.