Recession risks remain elevated after US CPI (Consumer Price Index) data for June surpassed expectations once again, reaching another four-decade high of 9.1% (YoY). With market participants now pricing in a Fed rate hike of at least 75 (or a possible 100) basis point rate hike later this month, the current geopolitical backdrop does not bode well for speculative assets.

Visit DailyFX Education to Learn About the Relationship Between Interest Rates & FX

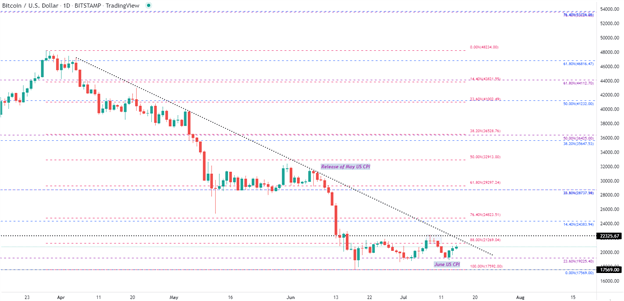

That being said, after the release of the May US CPI print, Bitcoin prices fell sharply, with the downtrend gaining traction throughout last month. However, after this week’s release, Bitcoin prices pulled back slightly before bulls were able to drive price action back above the $20,000 psychological level.

Chart prepared by Tammy Da Costa using TradingView

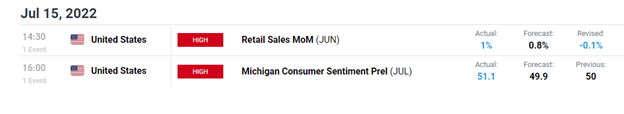

With BTC/USD still trading within the same range that has encapsulated price action over the past month, positive retail sales data and an optimistic Michigan Sentiment report provided some reprieve for cryptocurrency and equities, capping the downward move.

DailyFX Economic Calendar

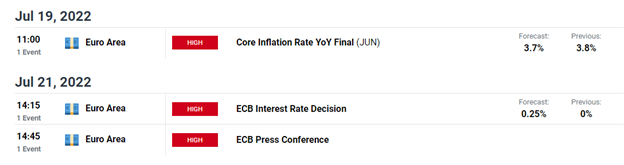

For the week ahead, the economic docket shifts focus to Europe with the core inflation rate, ECB (European Central Bank) rate decision and the press conference expected to provide clarity on Europe’s economic outlook.

DailyFX Economic Calendar

If recession fears intensify, Bitcoin and its peers remain vulnerable to further declines with the technical levels forming additional zones of support and resistance.

As long as the $20,000 mark holds, bulls have an opportunity to drive prices higher with bears gaining favor if prices fall back below $18,000.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.