AUD/USD trades to a fresh yearly low (0.6681) in July as a growing number of Federal Reserve officials show a greater willingness to implement a restrictive policy, and the Reserve Bank of Australia (RBA) Minutes may do little to influence the exchange rate as the central bank appears to be on a preset course in normalizing monetary policy.

AUD/USD appears to be reversing ahead of the June 2020 (0.6648) as the recent weakness in the exchange rate fails to push the Relative Strength Index (RSI) into oversold territory, but the recent rebound in Aussie Dollar may turn out to be a correction in the broader trend as the Federal Reserve normalizes monetary policy ahead of its Australian counterpart.

It seems as though the RBA will stick to its current approach in withdrawing monetary support as “inflation is forecast to peak later this year,” and the minutes from the July meeting may fuel speculation for another 50bp rate hike in August as “the Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead.”

In turn, more of the same from Governor Philip Lowe and Co. may do little to shore up AUD/USD as the Federal Open Market Committee (FOMC) appears to be on track to deliver a 75bp rate hike later this month, but a shift in the RBA’s forward guidance for monetary policy may generate a bullish reaction in the Australia Dollar if the central bank steps up its effort to combat inflation.

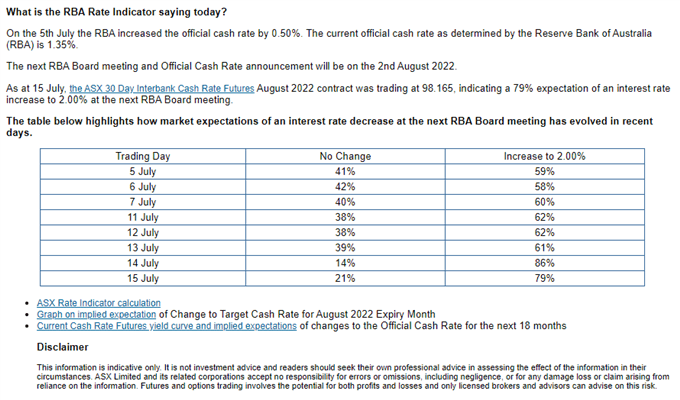

According to the ASX RBA Rate Indicator, the 30-Day Interbank Cash Rate Futures August 2022 contract reflects a “79% expectation of an interest rate increase to 2.00% at the next RBA Board meeting,” and a material chance in the central bank’s guidance may lead to a larger recovery in AUD/USD if the board looks to increase the official cash rate (OCR) at a faster pace.

With that said, more of the same from Governor Lowe and Co. may drag on AUD/USD as the FOMC plans to implement a restrictive policy, and the RBA Minutes may do little to prop up the exchange rate unless the central bank adjusts the forward guidance for monetary policy.

Follow me on Twitter at @DavidJSong

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.