The AUD/USD pair rebounded in the short term as the USD was punished by the DXY's drop. Still, the current throwback could be only a temporary one. The bounce-back could bring new selling opportunities. Technically, the currency pair reached a resistance zone, so it remains to see how it will react.

Fundamentally, the NAB Business Confidence came in at 1 point versus 6 points in the previous reporting period, while the Westpac Consumer Sentiment dropped by 3.0%. The US NFIB Small Business Index and the IBD/TIPP Economic Optimism came in worse than expected.

Tomorrow, the RBNZ, BOC, and the US inflation data could be decisive. The fundamentals should take the lead, so you should be careful.

AUD/USD Ignored Strong Resistance Levels!

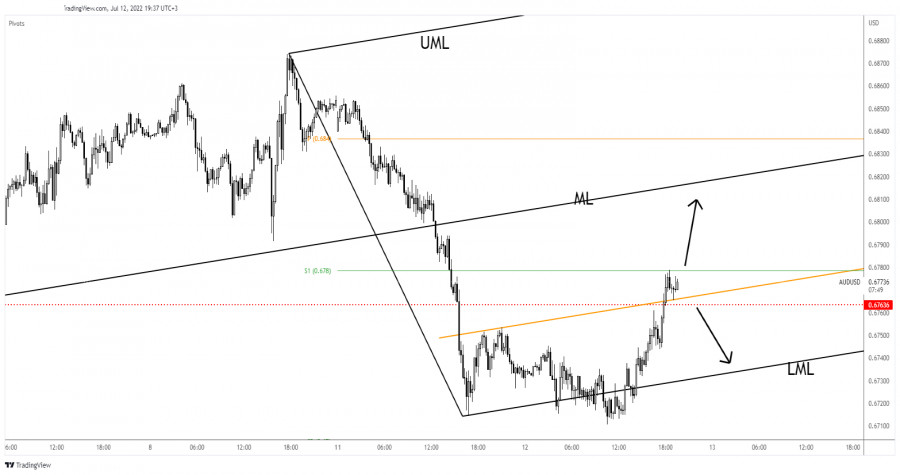

AUD/USD failed to stay below the ascending pitchfork's lower median line (lml) signaling exhausted sellers. Now, it has managed to jump above the 0.6763 key level and above the inside sliding line.

It has climbed as much as 0.6778 level where it has found temporary resistance. The weekly S1 (0.6780) represents a static resistance. In the short term, it's trapped between 0.6763 and 0.6780 levels. A valid breakout could bring new opportunities.

AUD/USD Outlook!

A new higher high, a bullish closure above 0.6778 could activate further growth and could bring new long opportunities with a potential upside target at the median line (ML).

Staying below the S1 (0.6780) and dropping under 0.6763 again could announce a new sell-off towards the lower median line (LML).

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.