Long-term perspective.

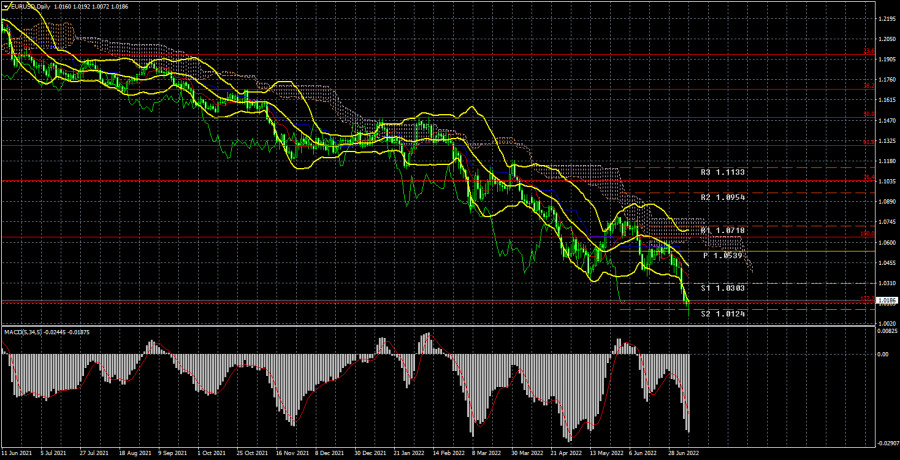

The EUR/USD currency pair has fallen by 240 points over the past week. We expected the pair's decline to continue in the medium term, so this is not all that surprising. The peculiar aspect is that it occurred this week. There was little macroeconomic and fundamental context, and Monday was typically a day off because the United States celebrated Independence Day. Nonetheless, on Tuesday, almost out of the blue, the euro began a precipitous decline that lasted until the end of the week. Thus, the euro was already trading below 1.0100 on Friday, which is close to parity with the US dollar.

Moreover, the pair's 20-year lows were updated this week, which is significant in and of itself. Consequently, why did the euro collapse without waiting for a crucial "foundation" or "macroeconomics"? We believe there was no particular event that would have preceded this autumn. Let's analyze: the dollar's fundamental position remains unchanged, geopolitics continues to exert pressure primarily on the European economy, and market sentiment is "bearish." With such a set of input data, the euro had theoretical grounds to decline at any time. The only issue was that it was difficult to predict the decline in those days because there were no obvious causes. However, if you disregard this moment, everything is logical and goes according to plan. As stated previously, the key question is how much the euro will eventually fall. In general, how much further will it fall? We believe it can continue to decline freely until the end of the year, and if the geopolitical situation in Europe continues to deteriorate, this decline may accelerate.

COT analysis.

COT's reports on the euro currency have raised many questions in the past six months. The illustration above demonstrates that professional players were in a "bullish" mood while the European currency fell simultaneously. Currently, the circumstances are not favorable for the euro currency. If previously the sentiment was "bullish" but the euro was falling, it is now "bearish," and the euro is also falling. Therefore, we see no reason for the euro to grow, as many factors continue to work against it. During the reporting week, buy contracts increased by 7.7 thousand, while the number of non-commercial shorts increased by 14,000 contracts.

Consequently, the net position decreased by nearly 7,000 contracts. In recent weeks, the "bearish" sentiment of the market's major participants has increased slightly. From our perspective, this demonstrates that even professional traders do not currently believe in the euro currency. The number of buy contracts for non-commercial traders is 17,000 fewer than those of sell contracts. Consequently, we can state that the demand for the US dollar is not only quite high but also the demand for the euro. This may result in a fresh, greater decline in the euro's value. In principle, the euro currency has not been able to demonstrate even a tangible correction over the past few months, let alone anything more. The greatest upward movement was approximately 400 points.

Evaluation of fundamental occurrences.

Friday's US Nonfarm Payrolls report was the only truly significant event of the week. Earlier published business activity indices in the United States and the European Union were either neutral or insignificant. Tuesday marked the beginning of a precipitous decline in the euro's value, which lasted almost until the close of trading on Friday. Thus, it is improbable that at least one weekly report influenced the market sentiment. The number of nonfarm in June was 372 thousand. Remember that the maximum predicted increase was 300 thousand. It turns out that the dollar gained support from this report but fell after its publication. We cautioned that the dollar has been appreciating throughout the week, so the Nonfarm Payrolls report may cause an illogical market response. Thus it transpired. In any case, the general macroeconomic environment continues to favor the US dollar. The euro cannot continue to fall indefinitely, but it is currently extremely difficult to predict what can encourage traders to make at least some adjustments.

Trading strategy for the week of July 11–15:

1) On the 24-hour timeframe, the pair's 20-year lows have been updated, and each new decline will be an update of these new lows. Almost all factors continue to support the dollar's long-term growth. Traders could not overcome the Ichimoku cloud, so the euro's upward movement and purchases remain irrelevant. You must at least wait for consolidation above the Senkou Span B line before considering purchasing the euro.

2) The euro/dollar pair's sales remain more relevant now. The price has reached the Fibonacci retracement level of 1.0172 (127.2 percent), so it is likely to continue falling to the next target of 0.9583. (161.8 percent Fibonacci). In addition, the rebound from the 1.0172 level does not even smell yet.

Explanations of the figures:

Price levels of support and resistance (resistance /support), Fibonacci levels – levels used as entry points for purchases and sales. Take Profit levels may be positioned nearby;

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5);

The first indicator on the COT charts is the net position size of each trading category.

On the COT charts, indicator 2 represents the net position size for the "Non-commercial" group.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.