Long-term perspective.

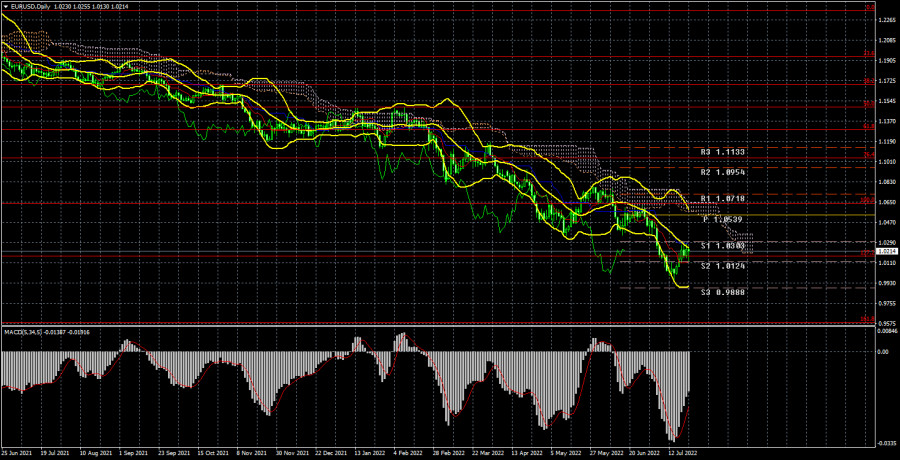

The EUR/USD currency pair has climbed by 140 points during the current week. It is a minuscule value compared with the entire downward trend, which has been going on for about two years, and even in comparison with almost any part of it. Thus, the euro managed to move slightly away from its 20-year lows. It was not even able to acquire a foothold above the key line, so there was no reason to expect the end of the downturn either. All the euro could do was show another unintelligible correction. Therefore, we feel that the probability of resuming the downward movement is currently 80–90%. Of course, if the pair manages to exceed the Kijun-sen line next week, it will considerably enhance its position, but how many such fixations have we seen in recent months above the crucial line? Every time at an essential period, the bulls retreated from the market because there were still no reasons for buying euros. There were nonetheless reasons to buy euros this week. We have seen the strengthening of the European currency since Monday, while the big event of the week (the ECB meeting) was set for Thursday.

Nevertheless, from the beginning of the week, the market began to anticipate that the key rate could be raised by more than 0.25% and began to buy back the euro a little. However, this did not benefit in any way because by Wednesday, the growth had ceased, and after summing up the meeting, the euro could not show additional growth. Of course, an ECB rate hike of 0.5 percent is a substantial "bullish" factor, but the underlying structural background has not changed. The ECB lifted the rate by 0.5 percent, ultimately shifting it to positive territory, but the Fed may boost its rate by 0.75-1.00 percent next week. Moreover, this will not be the first strong increase for the Fed. Thus, the market considers the Fed's future decision and does not want to sell the dollar.

COT analysis.

COT's reports on the euro currency during the past six months have prompted many issues. The image above plainly illustrates that for most of 2022, they displayed the "bullish" mentality of professional players. Yet, at the same time, the European currency was declining. At this point, the situation has shifted, but not in favor of the euro currency. If earlier the tone was "bullish," but the euro was falling, today the attitude has become "bearish," and the euro is also falling. Therefore, we do not see any rationale for the euro's expansion because most forces remain against it. During the reporting week, the number of buy contracts declined by 1.3 thousand, and the number of shorts from the "Non-commercial" group grew by 16,000. Accordingly, the net position has decreased by roughly 15 thousand contracts. The sentiment of the big players remains "bearish" and has even strengthened in recent weeks. From our point of view, this fact clearly illustrates that even skilled traders do not believe in the euro currency at this time. The number of buy contracts is smaller than that of sell contracts for non-commercial traders by 43 thousand. Therefore, we can state that not only the demand for the US dollar remains high, but also the demand for the euro is rather low. It may lead to an even larger slump in the euro currency. In essence, throughout the previous few months or even more, the euro currency has not been able to display even a tangible correction, let alone something greater. The maximum upward movement was roughly 400 points.

Analysis of basic events.

As indicated above, the important event of the week was the ECB meeting. However, not only the ECB meeting was essential. For example, on Tuesday, another report on inflation in the EU was published, which indicated a further acceleration in price growth to 8.6 percent y/y. Also, on Friday, business activity indexes were issued, two of which plunged "below the waterline" - the level of 50.0. Inflation is growing, and business activity is declining. Economic growth is low, and unemployment is high. It was with such baggage that the ECB approached its July meeting. We are even a little astonished that the regulator chose to hike the rate by 0.5 percent in these conditions. Christine Lagarde has often made it obvious that she is concerned about the problem of inflation, but there are more serious problems. The essential question is, what's next? If the ECB continues to raise the rate, this will lead to negative economic growth and an even larger "cooling" of the economy. So far, we believe that the ECB will tighten monetary policy from time to time and will not chase the Fed or the Bank of England at all.

Trading plan for the week of July 25 – 29:

1) During the 24-hour period, the pair continues to trade near its 20-year lows. Almost all elements still support the long-term expansion of the US currency. Traders failed to overcome the Ichimoku cloud. Therefore, the upward movement and purchases of the euro currency are still irrelevant. It is required to wait, at least, for consolidation above the Senkou Span B line, and then after that, to consider long positions.

2) The sales of the euro/dollar pair are still more relevant currently. The price has adjusted to the key line, but until this level is overcome, the negative trend stays the same, and the rebound from this line can be utilized as a sell signal with a target of 0.9582 (161.8 percent Fibonacci) (161.8 percent Fibonacci).Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - levels that are targets when starting purchases or sales. Take Profit levels can be set near them.

Ichimoku indicators(standard settings), Bollinger Bands(standard settings), MACD(5, 34, 5). (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each group of traders.

Indicator 2 on the COT charts represents the net position size for the "Non-commercial" group.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.